Where I’m Finding 10%+ Dividend Yields

This Dividend Yield Tops 10%

If you want to earn big dividend yields, you have to go where others fear to tread.

Investors have already grabbed the obvious ideas. But if you’re willing to pick through the market discount bin, you can sometimes find a bargain.

Case in point: natural gas shipper Golar LNG Partners LP (NASDAQ:GMLP). Energy executives look so depressed that their wives are hiding the hunting rifles. But, with a payout approaching 10.1%, yield hogs should take note.

This distribution looks reasonably safe, for starters. Golar owns ships that carry and store liquefied natural gas (LNG). Customers tend to commit to long-term contracts, which results in steady cash flow.

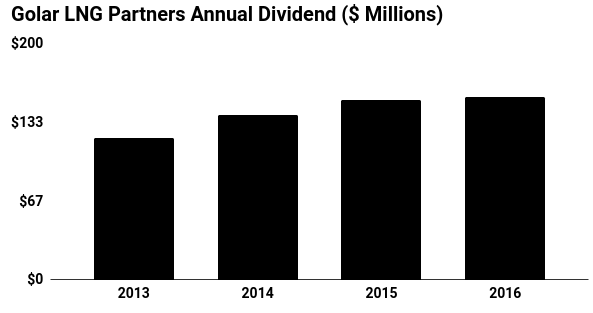

This has created a bond-like income stream for owners. Since Golar started mailing out distributions in 2011, management has never cut the payout. And over that period, these checks have grown more or less in line with profits.

Also Read:

Why Golar LNG Partners is a Top Pick: A Dividend Yield of 10.6%

Here’s what the numbers look like: last year, Golar generated $261.2 million in free cash flow. During that time, management paid out $154.7 million in distributions. This comes out to a payout ratio a smidgen under 60%.

Generally, I like to see businesses pay out less than 75% of profits as dividends. This ensures a little breathing room if profits dip for a year or two. So, in the case of Golar, the payout ratio sits well within my comfort zone.

In fact, that distribution could keep growing. As I wrote about this previously, analysts project U.S. LNG exports to surge over the next few years. That will require more pipelines, more energy terminals, and more storage tanks.

Booming exports will also require more LNG tankers. Golar has added a number of ships to its fleet. And thanks to a growing shortage of shipping capacity, management has also raised prices on contract renewals.

Such a boom has really padded the company’s bottom line. In 2017, analysts project free cash flow to rise to $316.0 million. This leaves management with a number of options, including paying off debt, expanding existing operations, and/or increasing the distribution.

I suspect management will choose a combination of all three. But even if executives opt to skip the distribution hike, investors will still enjoy a 10.1% yield. Moreover, owners will be left with a bigger, healthier business.

(Source: “Golar LNG Limited (USA),” Google Finance, last accessed January 2, 2018.)

My only concern? Debt. Golar has taken on a big debt load to fund its expansion. If those liabilities continue to grow, owners will have to revisit their investment thesis.

That said, the company gushes ample cash flow. And thanks to a visible income stream, owners don’t have too much to worry about. Yield hogs should ignore the turmoil in the energy sector and give this 10.1% dividend yield a second look.