This Ignored Dividend Stock Has Increased Payments 986%

1 Dividend Stock to Own Forever

As I’ve said over and over, one of the good things about dividend stocks is that they’re predictable.

Take Automatic Data Processing (NASDAQ:ADP), for example. In a column last month, my colleague Jing Pan predicted the company, which manages the payrolls for one in six Americans, would boost its distribution by the end of the year.

I’m happy to report he nailed that call. A few weeks after we published the article, ADP raised its quarterly dividend by 10.5%.

Now I’d loved to say we have special forecasting power at Income Investors. Some kind of complex model that allows us to see these moves in advance. But honestly, any Joe Sixpack could see this one from a mile away.

ADP has hiked its dividend every November for more than 40 years. And with its business growing at a steady clip, management wanted to keep that tradition alive.

The only real question: how much would executives raise the payout?

And while I always like a raise, you only start to appreciate the power of compound growth when you string these dividend hikes together.

Also Read:

3 Top Dividend Stocks to Own Forever

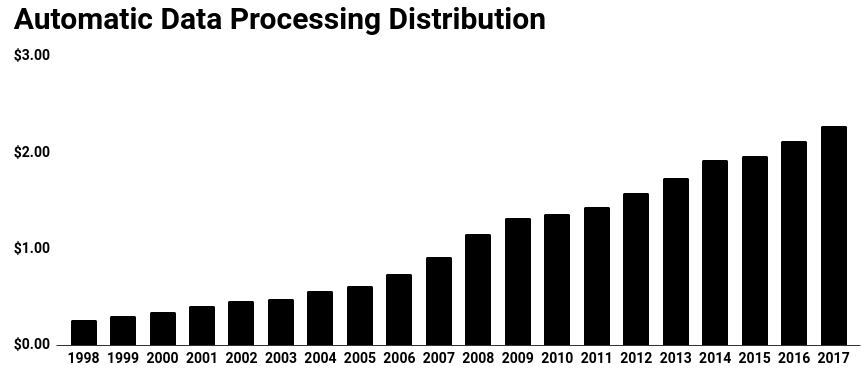

In 1998, ADP paid out a quarterly dividend of 5.8 cents each. At the time, that came out to an annual yield of 1.4%. Over the next two decades, management boosted the payout at a 13% compounded annual clip.

That growth rate numbers might not knock your socks off, especially in the days of cryptocurrencies. But thanks to those small bumps each year, the distribution has grown 986%. What’s more, shares, which split two-for-one in 1998, have increased more than fivefold.

I think of capital gains like the gravy on your potatoes. My primary goal is to generate a reliable source of income, and I consider a growing share price to be a nice bonus.

But as long as sales and earnings keep growing, I fully expect shares to rise more or less in lockstep over the long haul.

How will shares do over the next year? Who knows. For that reason, I focus on my predictable dividends. But over long enough periods of time, investors eventually reward consistent distributions hikes with a higher stock price.

Now, some folks might ignore ADP because of its meager 2.2% yield. But focusing on the current payout alone misses the point.

To me, you can look at dividend stocks in two ways. Some deliver big payouts right out of the gate, but only grow their dividends slowly going forward. Others dividends start out small, but increase at a much faster clip.

If you just want a fat yield today, look elsewhere. But if you’re willing to trade a short-term profits for steady, predictable growth, ADP will likely reward that patience.

Source: Corporate Filings

Obviously, management can’t pull future dividend hikes out of thin air. The company, however, has plenty of growth runway to support its rising payout.

Last month, ADP acquired digital payment processing system Global Cash Card Inc. With the deal, the business gains a big presence in the pay card space, allowing it to serve younger employees and the growing “gig economy” workforce.

Moreover, executives can simply raise prices. Employers loath switching payment processors, given the time and hassle involved. This allows ADP to increase fees, prices, and service charges each year, without the fear of customers revolting.

Of course, you can’t call any stock a sure thing. If the economy tanks, demand for payroll services will inevitability take a hit. But if you’re prepared to stomach a bad year or two, shares will predictably throw off growing dividends for decades to come.