NextEra Energy Partners (NYSE:NEP): Landowners Earning Up to $4,900 Per Month

Ranchers Earn $10,000 Per Turbine Per Year

The Childers family struggled to work their farm in Nolan County, Texas for generations, until a landman knocked on the door a few years ago.

The local utility company thought their dusty fields would make the perfect place for a new wind farm. Today, the Childers earn thousands of dollars in monthly royalty checks from the six turbines on their land.

“The new infrastructure was mostly welcomed for its potential to help desperate farmers at the mercy of droughts and floods, and the boom-and-bust cycles of the oil industry.” reports The Guardian. “A rancher can expect to receive about $10,000 per turbine per year; potentially twice that figure for a newer, more powerful machine.” (Source: “‘The wild west of wind’: Republicans push Texas as unlikely green energy leader,” The Guardian, February 20, 2017.)

Earn Green Royalty Checks (Even If You Don’t Own Land)

Thousands of regular folks have hit it big in America’s green energy boom.

Over the past few years, utilities have installed millions of wind turbines and solar panels. Property owners can earn ongoing royalties by leasing out their land, on top of initial payments that can top six figures.

But unless you own vast tracts of real estate, it’s tough for most people to cash in on the country’s clean power bonanza. Or at least, it use to be. One little known partnership allows small investors to get in on the country’s energy boom… while earning a tidy income to boot.

I’m talking, of course, about NextEra Energy Partners, LP (NYSE:NEP). This partnership buys green power projects, collects payments from utilities, and passes on the income to owners. And while it doesn’t have the sex appeal of a stock like Tesla Inc (NASDAQ:TSLA), I have good reason to love this business.

Images by John ‘K’/Flickr

It’s stable, for one. You make money when the sun shines and you make money when the wind blows. Mother Nature doesn’t care about terrorist attacks or stock market crashes. Sure, your income can vary with the weather. Over time, though, these profits tend to even out.

And once you have a wind turbine built, you don’t need to spend a lot of money on maintenance. Ongoing costs come in at just a fraction of sales. Once up and running, you have a passive stream of income that can last for decades.

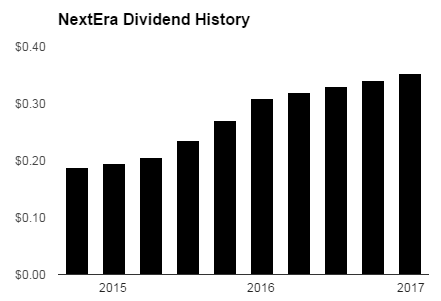

Better still, most of these profits gets passed on to owners. In fact, over the last few years, NextEra’s payout has nearly doubled. Today, owners earn a quarterly distribution of $0.37 per unit, which comes out to an annual yield of 4.3%.

You can expect this payout to keep growing. The partnership continues to buy up high-quality assets to pad its bottom line. This should allow management to hike the distribution at a mid-teen annual clip through 2022. (Source: “Earnings Conference Call: Fourth Quarter and Full Year 2016,” Nextera Energy Partners LP, January 27, 2017.)

Source: Yahoo! Finance

Let’s run these numbers out a couple of years. Assuming executives raise the distribution in-line with estimates, owners will collect an annual payout of about $3.00 by 2022. Based on the partnership’s current unit price, that represents a yield on cost of 8.7%.

Of course, clean power is no sure thing. If you want to see how risky green energy projects can get, check out the high profile bankruptcy of Sunedison Inc (OTCMKTS:SUNEQ). New facilities can be high-stake gambles, with developers putting billions on the line. Investors can get wiped out by delays and cost overruns.

That said, most of the risk gets front-loaded into the development, construction, and early operation of a new project. NextEra, in contrast, tends to focus on the less glamorous job of actually running these facilities. By buying up assets already producing power, management passes most of the risk to others.

This Clean Energy Stock Gushes Income

Few people want to stick a noisy wind turbine on their property. For smart investors, though, the dull thrum, thrum, thrum of those rotating blades sounds like a cash register. With each spin of the generator, property owners earn lucrative royalty checks.

If you don’t own big tracts of land, NextEra represents the next best way to cash in. This collection of wind and solar projects should keep cranking out income for decades to come. And while those fields of turbines might look ugly to some, they look like money to me.

Also Read:

3 Clean Energy Stocks Yielding Up to 8.5%