11.4%-Yield Dorian LPG Stock Near Record Highs, Has 40% Upside

Why LPG Stock Is Set to Keep Rising

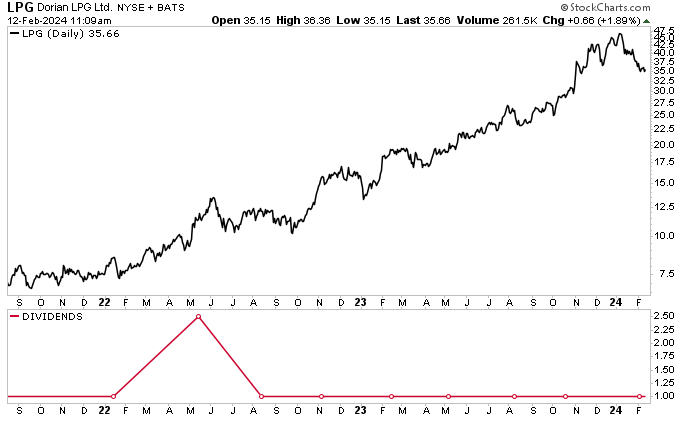

Dorian LPG Ltd (NYSE:LPG) is a great shipping stock that destroyed the stock market in 2022, climbing by 108% that year. The momentum carried into 2023, with Dorian LPG stock rallying by an additional 171%.

I’ve been keeping an eye on LPG stock for the last few years, and it continues to impress me. As of this writing, the stock is up by 175% since I wrote about it in Income Investors in February 2022 and up by 95% since I wrote about it in January 2023.

Dorian LPG stock entered 2024 on a bullish note, hitting a record high of $48.24 on January 5. It has since given up some ground to well-deserved profit-taking, but thanks to industry tailwinds, the outlook for the stock is pretty robust.

LPG stock may still be trading near record-high levels, but Wall Street analysts think it has more room to run. They’ve provided a high 12-month share-price target for Dorian LPG Ltd in the range of $42.00 to $50.00, which points to potential gains of approximately 23% to 40%.

Why is Wall Street so bullish on Dorian LPG stock?

Dorian LPG is a liquefied petroleum gas shipping company that’s a leading owner and operator of 25 modern very large gas carriers (VLGCs). Its fleet has a total carrying capacity of about 2.1 million cubic meters (CBM). (Source: “Company Summary,” Dorian LPG Ltd, last accessed February 12, 2024.)

The average age of Dorian LPG Ltd’s fleet is 8.0 years, which is well below the average age of the global fleet of 10.3 years. (Source: “Investor Presentation: November 2023,” Dorian LPG Ltd, last accessed February 12, 2024.)

Dorian LPG Ltd has many long-term contracts, including with some of the energy industry’s biggest names, such as BP plc (NYSE:BP), Chevron Corp (NYSE:CVX), Exxon Mobil Corp (NYSE:XOM), Phillips 66 (NYSE:PSX), and Shell PLC (NYSE:SHEL). (Source: “Company Summary,” Dorian LPG Ltd, op. cit.)

While the price of LPG stock may be down by about 16% since the start of 2024 (as of this writing), from a fundamental perspective, the outlook for Dorian LPG Ltd is robust.

That’s thanks to a significant spike in time charter equivalent (TCE) rates from their lows at the beginning of the year. The reason? Recent attacks on vessels in the Red Sea have lengthened shipping routes, which has increased shipping times and freight rates.

The risk of attack in the Red Sea has led ships to divert to longer routes around the tip of Africa. This has put upward pressure on freight rates because of higher fuel costs and the reduced availability of vessels. (Source: “Red Sea Attacks Increase Shipping Times and Freight rates,” U.S. Energy Information Administration, February 1, 2024.)

A VLGC, like those in Dorian LPG Ltd’s fleet, consumes about $30,000 to $35,000 worth of fuel per day, so longer routes mean higher costs. Moreover, despite the longer routes, shipping companies need to maintain the same delivery schedules, which has resulted in fewer vessels being available at any given time.

Q3 Net Income Jumped 94%, TCE Rates Rose 44.7%

The aforementioned industry tailwinds and higher tanker rates have been a boon for Dorian LPG.

For the third quarter of its fiscal 2024 (ended December 31, 2023), the company announced that its revenues increased by 57.8% year-over-year to $163.1 million. (Source: “Dorian LPG Ltd. Announces Third Quarter Fiscal Year 2024 Financial Results,” Dorian LPG Ltd, February 1, 2024.)

The company’s third-quarter net income went up by 94.9% year-over-year to $100.0 million, or $2.47 per share. Its adjusted net income climbed by an impressive 103.8% to $106.0 million, or $2.62 per share.

The all-important TCE rate per operating day for Dorian LPG’s fleet went up by 44.7% year-over-year to $76,337 in the quarter. The big increase in TCE rates was fueled by higher spot prices and moderately lower bunker prices. The company’s vessel operating expenses increased slightly in the quarter but were still relatively low, at $9,936 per day.

Commenting on the results, John C. Hadjipateras, Dorian LPG Ltd’s chairman, president, and CEO, said, “We are reporting strong financial results, reflecting an extremely favorable market and great teamwork…we believe in the long-term fundamentals in the [liquefied petroleum gas] market and the potential for ammonia transportation.” (Source: Ibid.)

Dorian LPG Stock’s 10th Quarterly Dividend

Dorian LPG Ltd hasn’t been paying dividends for very long (its first distribution was in mid-2021), but the company’s shareholders have been able to rely on those payments.

In January, the company declared its 10th irregular dividend, at $1.00 per share, totaling $40.6 million. This brought LPG stock’s cumulative dividends to more than $463.0 million. It also translates to a yield of 11.4% (as of this writing).

Dorian LPG stock’s high-yield dividend is safe: the company’s payout ratio is just 53.05%, which is well below the 90% threshold I’m willing to stomach. That payout ratio gives Dorian LPG Ltd more than enough financial wiggle room to maintain or raise its dividend level (if it so chooses).

Chart courtesy of StockCharts.com

The Lowdown on Dorian LPG Ltd

You almost have to find a reason to dislike Dorian LPG right now. The company continues to be a fabulous liquefied petroleum gas shipping company that reports superb financial results, including significantly higher TCE rates.

As mentioned earlier, LPG stock hit a record high in early January, and while it has pulled back from that level since then, Wall Street analysts expect Dorian LPG stock to hit fresh highs over the coming quarters.

The solid fundamentals in the liquefied petroleum gas freight market, including lengthened shipping routes and increased freight rates, suggest that the current momentum in the sector will continue for the foreseeable future.