The Coca-Cola Co Dividend 2017: KO Stock Yield, Dates, Splits, Prediction, and Everything You Need to Know

Why Income Investors Should Not Ignore KO Stock

The Coca-Cola Co (NYSE:KO) is a very unique company when it comes to paying out a dividend. Coca-Cola has been operating its business for more than 100 years. The business model is very easy to understand: supplying beverages to consumers around the world. And with its cash flow, Coca-Cola stock serves as a steady dividend payer.

Now, a lot of times, investors are looking for the next new investment that will provide a steady stream of income. These investors often look for companies that are underowned and/or unknown by the market. This is a good idea if the investment proves successful over the long term.

However, there could be a reason why investors are staying away from such investments. And sometimes the best investments are those business that are known worldwide and have a long track record of rewarding their shareholders.

In truth, there is no secret formula that is required for a stock to provide a steady income stream. And KO stock is proof of this.

What Makes KO Stock a Special Dividend-Paying Stock?

Coca-Cola has increased its dividend for the past 55 years. This would include times of oil booms, high inflation periods, interest rate increases and decreases, recessions, economic booms, and more.

Another unique and interesting aspect of KO stock is that it is known as a “dividend king,” because it has increased its dividend for at least the past 50 years.

Coca-Cola is also one of the 52 companies on the S&P 500 Dividend Aristocrats Index. All businesses on this index are Fortune 500 companies that have raised their dividend for at least the past 25 years.

Below is more details on how KO stock is unique among dividend stocks, including its stock split history, forecasted earnings, and dividend policy.

- The Coca-Cola Co Stock Dividend Data

- When is The Coca-Cola Co’s Ex-Dividend Date?

- The Coca-Cola Co Dividend Growth History

- The Coca-Cola Co. Dividend Reinvestment Plan

- The Coca-Cola Co’s Current Dividend Policy

- Stock Split History

- Will The Coca-Cola Co Split Its Shares in 2017?

- Forecasted Earnings Per Share

- KO Stock Predictions 2017

#1. The Coca-Cola Co Stock Dividend Data

KO stock pays out a dividend on a quarterly basis, with payments traditionally being in April, July, October, and December. This info can be used as a guideline for future expected dividend payments.

| Dividend Yield | Annual Dividend Payment | Payout Ratio | Years of Dividend Growth | First Dividend Paid Out |

| 3.47% | $1.48 | 79% | 55 Years | 1920 |

The dividend yield represents the percentage return solely on the cash payment that would be received.

The payout ratio is in a percentage form and represents the percentage of the dividend that is paid from annual earnings.

The years of growth are exactly what they sound like: the number of consecutive years in which the dividend has gone up.

#2. When is The Coca-Cola Co’s Ex-Dividend Date?

Coca-Cola’s board of directors will declare the dividend a few weeks before the actual payment date. The declaration date is set to determine the cutoff deadline for eligible shareholders and what the actual payment date will be.

Below is more information regarding important dates for the dividend.

| Declaration Date | Ex-Dividend Date | Record Date | Payment Date | Payment Amount |

| February 16/2017 | March 13/2017 | March 15/2017 | April 3/2017 | $0.37 |

The ex-dividend date for KO stock’s first 2017 dividend payment–and the date you have to own the shares before–is March 13. If the shares were purchased on March 13 or later, then no dividend would be received.

The record date is the date that the company records all eligible shareholders that will receive the dividend payment.

The payment date is when the cash payment would be received.

The rest of the dividend for the year has not been declared by Coca-Cola just yet.

#3. The Coca-Cola Co Dividend Growth History

There are not many companies that increase their dividend on a consistent basis. And the companies that do so regularly do it for two reasons: to reward shareholders and because they can.

Businesses increase their dividends because there is recurring revenue that sees growth as time passes. Management seeks to give shareholders a piece of the growing profits, showing the market and investors that the company is shareholder-friendly. These same people ensure that the dividend is being paid from earnings and that the remainder is being used for growing the business.

Management teams that run companies that are constant dividend growers have strong financial discipline. This is because they must ensure to hold on to money to use for the dividend.

When there is a potential investment, such as an acquisition, or a need for improvement, those in the company have to ask themselves a couple of questions before a decision is made: how quickly will the investment generate positive cash flow? Will the investment create more cash flow to continue to pay shareholders? How will investors benefit from such a move? How would the investment affect the dividend?

For investors, a constant dividend grower should remove the stigma of the dividend being cut or eliminated. It does not remove it entirely, because there is always a small percentage of change occurring, since no one can predict the future. However, the company will still work to keep shareholders happy. Also, as long as the dividend can continue to grow, the yield on the average cost of shares will increase.

The past 55 years of dividend hikes proves this applies to Coca-Cola, with 2017 marking the 97th year that KO stock has paid a dividend. Even though there have been many administrative changes over the company’s history, management has retained the same perspective on the business and investors.

Below is a look at the past few years of dividend payments from The Coca-Cola Co. The average dividend hike over this period is 7.72%, which outpaces the rate of inflation.

| Ex-Dividend Date | Dividend Payment | Percentage | Declaration Date | Record Date | Payment Date |

| Mar. 13, 2017 | $0.37 | 5.7% | Feb. 16, 2017 | Mar. 15, 2017 | Apr. 03, 2017 |

| Nov. 29, 2016 | $0.35 | N/A | Oct. 20, 2016 | Dec. 01, 2016 | Dec. 15, 2016 |

| Sept. 13, 2016 | $0.35 | N/A | Jul. 21, 2016 | Sept. 15, 2016 | Oct. 03,2016 |

| Jun. 13, 2016 | $0.35 | N/A | Apr. 28, 2016 | Jun. 15, 2016 | Jul. 01, 2016 |

| Mar. 11, 2016 | $0.35 | 6.1% | Feb. 18, 2016 | Mar. 15, 2016 | Apr. 01, 2016 |

| Nov. 27, 2015 | $0.33 | N/A | Oct. 15, 2015 | Dec. 01, 2015 | Dec. 15, 2015 |

| Sept. 11, 2015 | $0.33 | N/A | Jul. 16, 2015 | Sept. 15, 2015 | Oct. 01, 2015 |

| Jun. 11, 2015 | $0.33 | N/A | Apr. 30, 2015 | Jun. 15, 2015 | Jul. 01, 2015 |

| Mar. 12, 2015 | $0.33 | 8.2% | Feb. 19, 2015 | Mar. 16, 2015 | Apr. 01, 2015 |

| Nov. 26, 2014 | $0.31 | N/A | Oct. 16, 2014 | Dec. 01, 2014 | Dec, 15, 2014 |

| Sept. 11, 2014 | $0.31 | N/A | Jul. 15, 2014 | Sept. 15, 2014 | Oct. 01, 2014 |

| Jun. 12, 2014 | $0.31 | N/A | Apr. 24, 2014 | Jun. 14, 2014 | Jul. 1, 2014 |

| Mar. 12, 2014 | $0.31 | 8.9% | Feb. 20, 2014 | Mar. 14, 2014 | Apr. 01, 2014 |

| Nov. 27, 2013 | $0.28 | N/A | Oct. 17, 2013 | Dec. 2, 2013 | Dec. 16, 2013 |

#4. The Coca-Cola Co. Dividend Reinvestment Plan

KO stock offers its investors the option of receiving the dividend payment in cash or in the form of additional shares via a dividend reinvestment program (DRIP). These programs give a lot of flexibility when it comes to choices and benefits.

In terms of flexibility, the whole dividend payment does not have to be used to purchase more shares. For instance, you can use half the payment to purchase shares and receive the other half as cash. The ratio of the split is up to you.

Here are the benefits of being enrolled in a DRIP:

- There is no commission cost associated with purchasing more shares. The savings will add up over time, leaving more money to invest in the stock.

- It is not possible to buy fractional shares of a company that trades on the trading exchanges. For instance, you cannot buy half or one-third of a share. However, being enrolled in the DRIP makes it possible to purchase fractional shares.

- There is a compounding benefit which generates excess returns. Let’s say an investor owns 100 shares of KO stock and each time the dividend is received, one share is purchased. With the dividend being paid quarterly, that means they would own 104 shares at the end of the year. The dividend would be based on this number, and as time continues to pass, more shares would be accumulated and a larger payout would be received.

- Daily volatility is very important to consider but is often forgotten. This is the average price movement that is seen from the stock itself. Stocks that offer a DRIP tend to have lower volatility than those that do not, since using the dividend to purchase more shares is considered a long-term strategy. Those that are enrolled in the DRIP tend to be buy-and-hold investors.

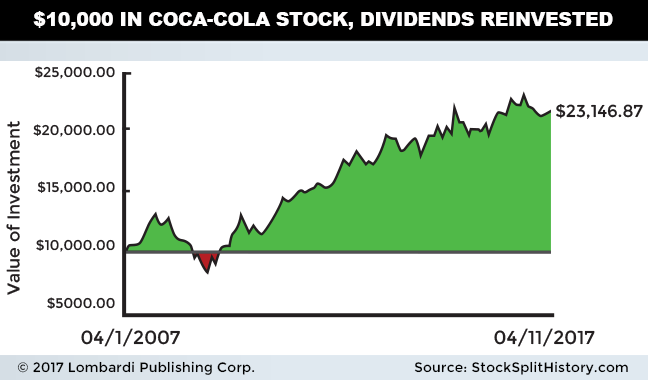

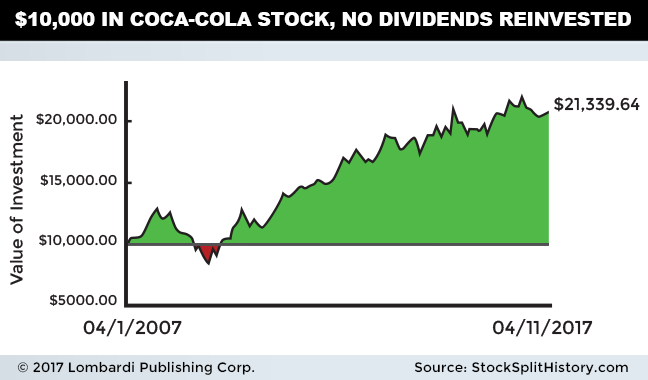

Below are two charts detailing how returns differ for KO stock with and without enrollment in the DRIP. Both charts depict the same 10-year period with an initial investment of $10,000.

The first chart below is the returns with the dividend being reinvested in KO stock.

The total return from being enrolled in the DRIP is 131.47%, with an annual return of 8.75%. Over this period, the $10,000 has grown to $23,146.87.

Below is the second graph, showing the return with the dividend received as a cash payment.

The total return in this case is 113.45% and the annual return is 7.78%. The total value of the investment is $21,339.64.

The difference in total return is 18.02% and $1,807.23 in total dollar value. Using this same example, if $100,000 was initially invested, the difference between the two investment strategies would amount to $18,072.30. The difference in total return is all thanks to the dividend being reinvested and the compounding effect.

As the returns show, this is a long-term investment strategy. The more time that is spent in a stock, the higher the returns when purchasing more shares with the dividend.

#5. The Coca-Cola Co’s Current Dividend Policy

A dividend policy is simply a set of rules that a company has set for itself. The policy is used to determine the amount of the dividend payment, the percentage of earnings to pay out as a dividend, the payment frequency, and how often the policy itself is renewed.

Coca-Cola’s dividend policy is reviewed annually every February. The trend has been to announce a dividend hike, with KO stock having seen a dividend increase every year for the past 55 years. With the current growth in earnings, it seems that this trend can and will continue.

The current dividend is $0.37, representing a payout ratio of 79%. This ratio is calculated by taking the dividend payment and dividing it by the company’s annual earnings. The three-year average of the payout ratio is 71%. Even though the current ratio if higher than its average, there is no need to panic. Why? Because current earnings do support the dividend payment.

#6. Stock Split History

First off, a stock split does not change the market value of the company. It does, however, affect the number of outstanding shares and the stock price.

This is the way a stock split would occur: first, the company would release an announcement that the shares will be split. This is typically done during an earnings call, though sometimes the business may simply issue a press release.

Stock splits have a set ratio, which is set by the company. The most common stock split ratio is two-for-one, which doubles the number of outstanding shares and cuts the stock price in half.

For example, if an investor owns 100 shares of a company trading at $20.00, a two-for-one stock split would result in the investor owning 200 shares and the share price changing to $10.00. The investment would remain at $2,000, change or no change.

So why would a company go through all this trouble? Well, for a couple of reasons.

For one, it makes shares of the company more affordable.

Coca-Cola has had a total of 11 stock splits in its history. If you bought one share at the time of the initial public offering (IPO) or before the first stock split, you would have 9,218 shares today. And with the shares trading at $42.60, this would amount to $392,686.80 (9,218 shares x $42.60).

If KO stock never had a stock split, the value of one share would instead be $392,686.80. This would be unaffordable for most and the company would be ignored. Needless to say, $42.60 is a lot more appealing.

Second, stock splits broaden the investor base of the company, attracting traders and, more importantly, long-term investors.

Third, the volume of shares traded on an average day increases. This shrinks the bid-ask spread, the difference between the bid price and ask price, which is great for investors looking to get in or out of the company.

Besides a two-for-one split, Coca-Cola has also used a three-for-one stock split. In this case, simply divide the stock price by three and multiply the number of shares by three.

Below is more information on KO stock’s share split history. Note that the “Shares Today” column refers to if you purchased a single share on the day of the IPO.

| Stock Split | Record Date | Shares Today |

| N/A | September 5, 1919 | 1 |

| 1-for-1 | April 25, 1927 | 2 |

| 4-for-1 | November 15, 1935 | 8 |

| 3-for-1 | January 22, 1960 | 24 |

| 2-for-1 | January 22,1965 | 48 |

| 2-for-1 | May 13, 1968 | 96 |

| 2-for-1 | May 9, 1977 | 192 |

| 3-for-1 | June 16, 1986 | 576 |

| 2-for-1 | May 1, 1990 | 1,152 |

| 2-for-1 | May 1, 1992 | 2,304 |

| 2-for-1 | May 1, 1996 | 4,608 |

| 2-for-1 | July 27, 2012 | 9,216 |

The one unique event in the above chart is the stock dividend that occurred in 1927. Coca-Cola issued its shareholders one share for each one that was already owned by investors. This resulted in the share price decreasing by 50%, having the same effect as a stock split would have.

This was more for accounting purposes and, again, had no effect on the overall value of the shares.

#7. Will The Coca-Cola Co Split Its Shares in 2017?

Past stock splits are a great indicator to determine if another split will occur in 2017.

The last three splits occurred between the prices of $78.00 to $85.00. The 52-week range for KO stock has $39.00 to $47.00.

Based on the current trading price and on the company’s history, I don’t believe a stock split will occur this year.

Still, there is always the small possibility of seeing a stock split in 2017, where the price of KO stock to shoot up. The stock would then have to be reevaluated to determine if a split would occur.

A stock split could still occur in 2017, if the administration decided to just ignore the past and just split the shares on a whim. However, I would say there is a very little chance of this occurring.

The number-one reason investors deploy capital into a stock is to grow their money. In the case of KO stock, the return would be both dividend income and capital gain. However, this would require earnings growth, which supports the dividend payment and the stock price increasing.

The previously mentioned earnings trend also gives insight regarding how volatile the earnings are in different economic environments—something else to keep in mind.

Future earnings should be considered as well. In this case, go by the opinions of analysts. Many analysts put out an earnings forecasts for companies they follow very closely, as well as those in the same sector.

Below is a table outing the actual past earnings and the forecasted earnings.

| Type of Earnings | Year | Annual Earnings |

| Actual | 2016 | $1.91 |

| Estimated | 2017 | $1.87 |

| Estimated | 2018 | $1.95 |

| Estimated | 2019 | $2.08 |

| Estimated | 2020 | $2.19 |

The trend of estimated earnings over the next few years is moving higher. This supports both the dividend and the share price moving up.

As you can see, earnings are expected to decrease in 2017 in comparison in 2016, though earnings growth will occur in the following years. This is nothing to be concerned about, because it is one only year. More importantly, earnings will grow over the long term.

So why are analysts bullish on KO stock?

For one, Coca-Cola operates in the consumer staples sector, which means its products sell in both good and bad economic times. This means there is no real big change in the company’s earnings.

Another reason for the positive outlook on KO stock is because of the company’s steady margins. This is thanks to inflation on the cost side of the margins, which is passed to consumers. This keeps the earnings protected from inflation.

The business’ overall margins are also improving due to the company reducing its overall headcount. It has also installed more efficient equipment. Looking forward, analysts believe that commodity pricing will be in a more favorable environment for Coca-Cola.

Further, the expectation is that the overall volume of products sold will increase. With margins expected to rise as well, this will help boost both gross and net income.

Analysts also like KO stock because of its geographic mix. Since Coca-Cola reports its earnings and revenue in the U.S. dollar, generating profits in many different currencies should help offset any unfavorable impact from foreign currency exchange. This could generate a capital gain based on a foreign exchange transaction.

#9. KO Stock Predictions 2017

Coca-Cola could do a couple of things to reward shareholders and the business as well, thanks to the approximately $22.0 billion in its bank account. (Source: “Coca-Cola Co.” MarketWatch, last accessed April 12, 2017.)

For instance, shareholders could receive a special dividend. This is an extra dividend paid in addition to the regular quarterly dividend payment.

Another strong possibility is seeing share repurchases. This is a tax-efficient method of returning money to shareholders. Unlike a dividend, there is no cash received; rather, there is an increase in ownership of the company owned.

In this case, if Coca-Cola repurchased shares, the immediate result would be fewer shares available on the trading exchanges. This would mean every share already owned by shareholders would be worth a larger percentage of the company. This also has an effect on the overall net worth of investors. And best of all, you wouldn’t have to pay taxes on the shares until they’re sold.

An acquisition is another possibility, be it a small company with big potential or even a competitor. Since Coca-Cola operates around the world, there are many competitors that only operate in a couple of countries. This could result in adding more revenue to the top line of the financial statements and increase the share price over time.