Sunoco Stock: Bullish High-Yielder Makes Transformational $7.3B Acquisition

Why SUN Stock Is Near Record Levels & Has Massive Upside

A lot of investors shy away from high-yield and ultra-high-yield dividend stocks because they think they’re risky.

There are a fair number of underperforming stocks that sport high dividend yields because their share prices are lagging. But then there are companies like Sunoco LP (NYSE:SUN), the largest fuel distributor in North America.

The Dallas, Texas-based company has been reporting tremendous financial results, has raised its guidance, has increased its inflation-crushing dividend, and has been busy on the acquisition and asset sales front.

Sunoco distributes more than 8.0 billion gallons of motor fuel to approximately 10,000 convenience stores, independent dealers, commercial customers, and distributors in more than 40 states and territories. (Source: “Sunoco LP Announces Third Quarter 2023 Financial and Operating Results,” Sunoco LP, November 1, 2023.)

Moreover, it owns 42 refined product terminals and about 950 real estate assets. Those real estate assets generate stable rental income. (Source: “Investor Presentation: December 2023,” Sunoco LP, last accessed January 23, 2024.)

Sunoco Expands Midstream Business With NuStar Acquisition

On January 22, Sunoco announced plans to acquire NuStar Energy L.P. (NYSE:NS) for $7.3 billion in an all-equity transaction. (Source: “Sunoco LP to Acquire NuStar Energy L.P. in Transaction Valued at $7.3 Billion,” Sunoco LP, January 22, 2024.)

Sunoco was already a great energy company before announcing its acquisition of the fuel storage and pipeline operator, but with NuStar under the Sunoco banner, it’s getting a lot stronger.

We profile a lot of energy companies here at Income Investors, and we know that the ones we highlight are the best of the bunch. That’s why many of them get snapped up by other companies. This includes NuStar Energy L.P., which we just profiled on December 5, 2023.

The deal, which has been approved by both companies’ boards, will give Sunoco access to NuStar’s transportation and storage facilities, including a portfolio of about 9,500 miles of pipeline and 63 oil terminal and storage facilities that distribute and store crude oil, refined products, renewable fuels, ammonia, and specialty liquids. NuStar has operations in the U.S. and Mexico.

Sunoco LP said it expects that the acquisition will result in cost savings of $150.0 million by the third year after the deal closes, which is expected to be in the second quarter of 2024.

Analysts at JPMorgan Chase & Co (NYSE:JPM) said Sunoco’s transaction “does represent a transformative shift in strategy, in our view, to a more diversified and vertically integrated midstream company.” (Source: “Sunoco to Buy NuStar Energy in US$7.3-Billion Deal as It Expands Midstream Business,” The Globe And Mail, January 22, 2024.)

Other Recent Acquisitions & Sell-Offs

The highly fragmented energy industry provides Sunoco LP with a reliable supply of opportunities. Over the years, it has acquired several companies, including Susser Holdings Company, Aloha Petroleum, Ltd., Emerge Energy Services LP, Brenco Marketing Corporation, American Midstream Partners LP, and Superior Plus Energy Services.

In May 2023, Sunoco completed its $110.0-million acquisition of 16 refined product terminals located across the East Coast and Midwest from Zenith Energy Ltd. (Source: “Sunoco LP Announces First Quarter 2023 Financial and Operating Results,” Sunoco LP, May 2, 2023.)

Sunoco kicked off 2024 announcing a definitive agreement to sell 204 convenience stores in West Texas, New Mexico, and Oklahoma to 7-Eleven, Inc. for approximately $1.0 billion. (Source: “Sunoco LP Announces Sale of West Texas Assets, Acquisition of European Liquid Fuels Terminals, and Reaffirms 2024 Adjusted EBITDA Guidance Range,” Sunoco LP, January 11, 2024.)

Sunoco also announced its intention to acquire liquid fuel terminals in Amsterdam, Netherlands and Bantry Bay, Ireland from Zenith Energy.

The Amsterdam terminal is at the Port of Amsterdam, which is an international hub for the global energy market and is part of the largest refined product trading port in Europe. The Bantry Bay terminal is the largest independent bulk liquid storage terminal in Ireland, and it provides storage for Ireland’s strategic oil reserve.

This transaction is expected to close in the first quarter of 2024, subject to customary conditions.

Acquisitions Support Distribution Coverage & Growth

Acquisitions and taking on debt have a way of making investors nervous. That’s why Sunoco LP made a point of reaffirming its 2024 earnings before interest, taxes, depreciation, and amortization (EBITDA) guidance in the range of $975.0 million to $1.0 billion. (Source: Ibid.)

Acquisitions also have a tendency to lead shareholders to ask if they’ll cut into their distributions. Here again, Sunoco’s management has calmed the nerves of anxious income hogs.

When announcing the company’s acquisition of NuStar Energy L.P., Suncor’s management noted that, once completed, the deal will be immediately accretive, with a 10%+ accretion to distributable cash flow per limited partnership (LP) unit by the third year after the deal closes. (Source: Sunoco LP, January 22, 2024, op. cit.)

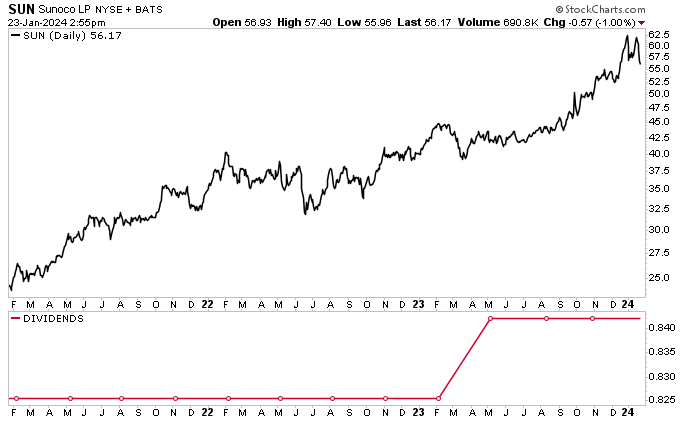

Before that announcement, Sunoco stock had paid stable dividends for more than 10 years. In fact, Sunoco hasn’t missed a distribution or reduced its payout level since the inception of its dividend in 2012. That time span, of course, includes the 2008 financial crisis and the 2020 pandemic. (Source: “Distribution History,” Sunoco LP, last accessed January 23, 2024.)

Thanks to the company’s robust distributable cash flow, it has been able to increase its payouts annually. In its early days, Sunoco even had a history of raising its payout quarterly. In fact, it did so almost every quarter from 2013 through 2016. It has only raised its dividend once since then.

In May 2023, the company paid a first-quarter distribution of $0.842 per unit. This represented a two-percent increase over the $0.8255 that Sunoco units paid out in February 2023.

The board has maintained the payout at $0.842 since then. As of this writing, SUN stock’s distribution works out to a dividend yield of 5.94%.

Sunoco Stock Could More Than Double

Sunoco LP’s distribution isn’t the only thing that’s been growing. Sunoco’s unit price has also been on the rise, up by 30% over the last six months and 32% year-over-year (as of this writing). SUN stock is also up by 43.5% since I last wrote about the company, which was back in July 2023.

It hit a new record high of $63.96 on December 28, 2023. Since then, it has given up some of that ground. As of this writing, Sunoco stock is trading at its 50-day moving average near $56.25.

Despite the big gains, sunnier days are ahead for SUN units, with Wall Street analysts expecting them to hit fresh highs over the coming months.

Of the analysts who’ve provided a 12-month unit-price target for Sunoco LP, their median estimate is $78.00 and their high estimate is $116.00. This points to potential gains from SUN stock of approximately 39% to 106%.

Chart courtesy of StockCharts.com

The Lowdown on Sunoco LP

With a market cap of $4.7 billion, Sunoco is an industry giant with a massive, growing footprint across the U.S. Through organic growth and acquisitions, the company has emerged as North America’s biggest independent fuel distributor and terminal operator. This has helped it expand its free cash flow with a long runway of high-quality investment opportunities.

Sunoco stock has a history of delivering superior returns to its unitholders. Since April 2017, when Sunoco LP announced a new strategic direction, it has reported total shareholder returns of 352% (as of this writing). Over the same time frame, the S&P 500 has provided returns of 105% and Alerian MLP ETF (NYSEARCA:AMLP), a midstream energy exchange-traded fund, has reported total shareholder returns of only 21.67%.