Outlook for 8.1%-Yield Spok Stock Bullish on Strong 2023 Results

Spok Stock Recently Hit Record High & Is Set for More Gains

Spok Holdings Inc (NASDAQ:SPOK) is an excellent high-yield health-care stock that seems to slip under the radar. I don’t often hear investors talk about how great the company is, but they should be talking about it.

Spok continues to report tremendous financial results, and management has said one of the company’s goals is to return capital to its shareholders.

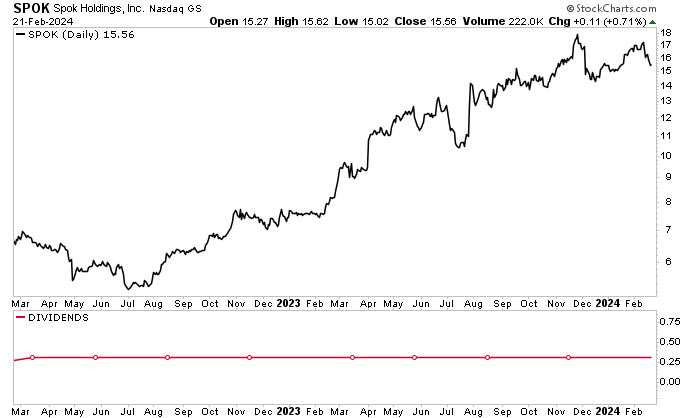

I’ve been following Spok Holdings Inc for a while now. On November 27, 2023, the stock hit a new record high of $18.05, for a gain of about 130% over its price at the time I first profiled it in Income Investors in April 2022.

Since it hit that high of $18.05, Spok stock has given up some well-deserved ground to profit-taking, but it’s still trading up by 23.2% over the last six months and 91.0% year-over-year (as of this writing).

Thanks to Spok Holdings Inc’s strong guidance and rock-solid balance sheet, the outlook for Spok stock is robust. By all accounts, the stock should continue its record-setting ways in 2024.

Chart courtesy of StockCharts.com

About Spok Holdings Inc

What exactly does Spok Holdings do?

The overlooked health-care powerhouse is all about an antiquated technology: pagers. Through its subsidiary Spok Inc., the company provides health-care communications services to hospitals in the U.S., Canada, Europe, Australia, and the Middle East. (Source: “Spok Reports Fourth Quarter and Full Year 2023 Results,” Spok Holdings Inc, February 21, 2024.)

The company’s products, which include “Spok Care Connect,” enable faster collaboration between health-care team members.

Spok is the largest paging carrier in the U.S., with approximately 785,000 pagers in service at more than 2,200 hospitals. (Source: “Investor Presentation: October 2023,” Spok Holdings Inc, last accessed February 21, 2024.)

The company’s solutions send more than 100 million messages each month. (Source: Spok Holdings Inc, February 21, 2024, op. cit.)

Why are pagers such an important tool at hospitals?

They may seem outdated, but that’s part of their charm. Pagers are the safest, most reliable way for doctors and other hospital staff to communicate.

Pagers are more secure than cell phones. With mobile phones, it’s easy to accidentally send confidential information, which could be compromised or stolen. With pagers, users only send numeric messages or basic text messages, so it’s unlikely that confidential information will get in the wrong hands.

Moreover, pagers only need to be charged once every week or two, which is much less often than cell phones need to be charged.

Spok Holdings Inc has longstanding customer relationships with the best hospitals in the country, including seven of U.S. News & World Report’s top 10 children’s hospitals and 20 of its top 22 adult hospitals. (Source: “Investor Presentation: October 2023,” Spok Holdings Inc, op. cit.)

The company’s long-term contracts (24 years, on average) provide Spok Holdings Inc with a reliable revenue stream. More than 80% of the company’s revenues—particularly its maintenance revenues and wireless paging revenues—are reoccurring. Of its $134.5 million in revenues in 2022, $112.6 million were reoccurring.

Software Bookings Climbed 22%+ in 2023

For the fourth quarter of 2023, Spok announced that its total revenues inched up by 2.1% year-over-year to $33.95 million. Its total wireless revenues went up by 0.4% year-over-year to $19.09 million, while its software revenues went up by 4.4% year-over-year to $14.86 million. (Source: Spok Holdings Inc, February 21, 2024, op. cit.)

The company generated fourth-quarter net income of $3.4 million, or $0.17 per share, and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $6.5 million.

Spok Holdings Inc’s full-year 2023 revenues went up by 3.3% to $139.03 million. This was the first time in the company’s history that it reported annual total revenue growth.

Its full-year wireless revenues grew by 0.5% to $75.97 million, while its full-year software revenues climbed by 7.0% to $63.06 million.

Spok’s full-year net income was $15.67 million, or $0.77 per share. Its full-year adjusted EBITDA went up by 102.8% to $30.34 million. Its full-year software bookings went up by more than 22% to a record-high $30.11 million.

The company ended 2023 with cash and cash equivalents of $32.0 million, as well as no debt.

Guidance for 2024

Based on Spok Holdings Inc’s 2023 business performance, which included a number of financial and operational milestones, the company provided strong guidance for revenues and adjusted EBITDA for 2024.

At the midpoint of its guidance range for 2024, management believes the company is on track to again increase its consolidated revenues, with slight declines in its wireless revenues being more than offset by growth in its software revenues.

Management also projects that, at the midpoint of its 2024 guidance, the company’s adjusted EBITDA will be consistent with last year’s adjusted EBITDA.

Spok Stock Returned $25.6 Million to Shareholders in 2023

In its October 2023 investor presentation, Spok noted that its strategic goal is to “run the business profitably and generate cash.” (Source: “Investor Presentation: October 2023,” Spok Holdings Inc, op. cit.)

Management also said, “Returning capital to shareholders is our goal as well as our legacy.”

On that front, the company has been true to its word. Spok stock has returned almost $670.0 million to its shareholders via dividends and share buybacks since 2004. This included $25.0 million in 2022 and an estimated $25.6 million in 2023.

In the first quarter of 2024, the company’s board declared a regular dividend of $0.3125 per share, payable on March 29 to stockholders of record as of March 15. (Source: Spok Holdings Inc, February 21, 2024, op. cit.)

That dividend level translates to a yield of 8.1% (as of this writing).

The Lowdown on SPOK Holdings Inc

Spok stock is an outstanding stock that should be on the radar of every dividend hog.

Spok Holdings Inc has a large foothold in the health information services industry, it continues to report wonderful financial results (including a solid balance sheet), and it has provided impressive guidance for 2024.

This helps explain why Spok stock has been trading near record-high levels and continues to pay reliable, high-yield dividends. Moreover, the company has a low payout ratio of 68.68%, which gives management the financial room to maintain or raise the stock’s distribution.