How Rising Interest Rates Will Affect Dividend Stocks

Impact of Interest Rates On Dividend Stocks

Income investors have two major goals: to generate a steady income and preserve the capital invested into a company. With interest rates near record lows and gradually increasing, the impact will be felt by dividend stocks in both negative and positive ways. Throughout this article, I will go through the different scenarios caused by the impact of rising interest rates on dividend stocks.

Not all dividend stocks are the same, and there are different categories, such as high-yielding stocks, dividend payers with a steady payment, and dividend-growth stocks. Each one of these categories will be impacted in a different way as interest rates continue to increase.

An important aspect to consider as an income investor is the dividend-paying stock’s sector of operations. This is because some companies will benefit more from an increase in interest rates, while there are others that will suffer in a rising interest rate environment.

The direction of interest rates is in the hands of the U.S. Federal Reserve. Its decision is based on a few factors, such as the economy’s past performance of the economy and how well it can handle a future change in interest rates. If the trend is higher, there will be a greater probability of seeing an increase.

Another reason to enact a hike in interest rates would be to battle against inflation, the rise in the prices of goods and services. Inflation will occur in a growing economy and, as a result, employment wages should also be on the rise, while the unemployment rate should decrease.

When there is confidence that the economy is growing and the future outlook is bright, expect the Fed to increase interest rates. This has been the case recently, with interest rate hikes in December of both 2015 and 2016. That said, the current interest rate is still sitting near a record low of 0.75% and really has no direction to go except higher.

This year, there could be three more interest rate hikes, as hinted at the Fed’s December 2016 meeting. This is why it would be important to know the impact of interest rates on dividend stocks. (Source: “Fed sees three interest rate rises in 2017,” Financial Times, December 14, 2016.)

How Do Dividend Stocks Perform When Interest Rates Rise?

There are three important factors that should be considered when looking at the relationship between interest rates and dividend stocks: the type of dividend stocks (high-yield, dividend growth, etc.), the sector, and the financial stability of the company.

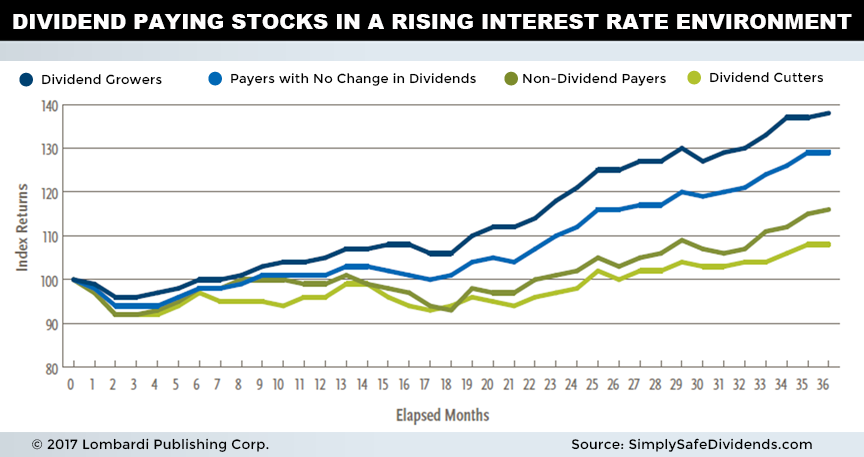

I will be going through all three factors, first starting with how different dividend stocks perform in a rising interest environment. Below is a chart regarding how different types of dividend stocks perform, which I will explain further.

1. Dividend Stocks

Dividend Growth

This would include companies from many different sectors. Dividend-growth stocks are often the preferred pick for income investors between various dividend-paying companies, since they outperform other types of dividend stocks.

Dividend growth is a great option because, historically, the companies are solid and generate consistent earnings growth, increasing their dividend over time. The companies’ profits are typically predictable recurring revenue, and are protected against inflation.

A dividend-growth stock usually has a lower yield, with the yield on the average cost of shares only going higher over time for as long as the shares are owned. In other words, patience is required. Also, dividend-growth stocks tend to go unnoticed by investors due to their track record, so the share price will one day see itself bid up.

Dividend-Paying Companies with a Steady Payout

These companies will perform well in a rising rate environment because their top brass want to reward income and growth investors alike. Part of the earnings are used to pay a dividend, with the rest of the earnings being reinvested into the business.

Even though the company pays a steady dividend, there is always the possibility of seeing that dividend grow. However, this would only occur if the growth of the reinvestment is not as high as expected.

Non-Dividend Payers

Usually, non-dividend paying companies are ones that would be considered higher-growth companies. Rather than paying a dividend to shareholders, earnings that are generated are used to reinvest into the business.

The total return of the investment is solely on the capital appreciation of the stock price. As an income investor, this category of stocks would not meet your requirements. Even though there is no dividend being paid to shareholders presently, there is always a possibility in the future of seeing a dividend payment.

Dividend Cutters

A company’s management will cut the dividend for a few reasons, one of which is that the cut is part of a company’s new vision. This would mean restructuring the business by selling or writing down assets. This has an affect on cash flow, and the dividend is normally the first thing to be cut.

Another reason would be that the company may not be generating enough revenue to cover its operating costs. There is a possibility of using debt to cover the dividend payment over the short term, but a dividend cut remains more likely.

Many investors tend to stay away from these companies because, if there has been a dividend cut, there is always the possibility of another. For income investors, there will always be uncertainty regarding the dividend payment, which is why many “regular” investors just stay away.

2. Sectors

Companies in the utilities and pipeline sector are known as cash flow machines, so many income investors tend to flock to these investments. When it comes to the affect of interest rates in this sector, there is both good news and bad news.

First, the majority of the companies in this sector are known for having debt on their balance sheets, meaning the obligation of carrying the debt becomes larger. Even though this may sound negative, it is actually a positive, because utilities and pipelines tend to pass on interest rate cost increases to their customers.

This is great for shareholders because revenue is not only protected, but returned via a growing dividend. However, the growth of capital appreciation should not be expected at a high rate, as in a low interest rate environment.

That said, companies that operate in the real estate sector could see a negative affect from rising interest rates. Real estate companies are known for operating using debt, so the firms with larger debt loads could see trouble ahead. This sector is also best known for providing high-yielding dividend-paying stocks, which, with interest rates on the rise, is another negative.

The financial sector should be a big beneficiary of rising interest rates, given that a lot of its business is based on the current and future expectations of said rates. Within this sector, the net interest margins should improve, which should benefit the top and bottom lines of the balance sheet. Net interest margins are calculated based on the interest rate charged on a loan and the rate being paid out to a customer’s savings deposit.

Dividend-paying stocks that operate in the consumer discretionary segment of the market also stand to gain from interest rates increasing. These would be companies that sell products that are purchased by consumers when there is disposable income available and includes categories such as apparel, entertainment, and automobiles. This trend occurs because consumers feel more confident in the economy and are willing to spend more. At this time, consumer spending has been on an upward trend which, as the economy continues to grow, should continue. (Source “United States Consumer Spending,” Trading Economics, last accessed February 27, 2017.)

3. Financial Stability

A company that has a large debt burden will be negatively impacted by rising interest rates. Heavy debt could ultimately impact the overall business negatively, due to more capital allocated toward carrying and managing the debt obligations. This could result in asset sales, restructuring, or no further reinvesting into the business.

There is also the possibility of a dividend cut, resulting in investors staying away from the investment, and the share price declining in turn. This would result in income investors not meeting either of their goals, the previously mentioned steady income and preservation of capital.

To determine whether a company has too much debt, consider the debt-to-capital ratio of the company. This ratio takes a company’s total debt and divides it by its total capital. If the ratio is above or at 50%, it signals that the business is growing using debt and could be in trouble in a rising interest rate environment. However, if the ratio is below 50%, it simply means that the company is using debt to continue to grow strategically, with said debt remaining in control.

Final Thoughts on the Affects of Rising Interest Rates on Dividend Stocks

Being an income investor in the current investing environment is quite a unique experience. Over the past 30 years or so, interest rates have been coming down from their all-time highs.

Even though there have been two interest rate hikes, now is a great time to look at your investment portfolio and determine whether it will be impacted in a positive or negative way. If there is any possibility of a negative result, then consider making adjustments accordingly.

If you are just beginning to construct your investment portfolio, it could be the perfect time to educate yourself before deploying capital into an investment. Hopefully, your portfolio will benefit over the long term by being invested into the sectors that should see the most gains.

No matter the investor’s experience, their goal should be to own high-quality dividend-paying stocks that will provide a steady income and preserve the capital of the investment.