Procter & Gamble Co: 1 “Forever Asset” for the Next 100 Years

One Stock to Own Forever

In recent posts on Income Investors, I’ve told you all about my favorite group of income stocks for earning safe, high yields. These businesses have rewarded shareholders not just for years or decades, but for generations. In a few cases, these firms have paid out dividends for over 100 years.

Such compounded returns can really add up over time. It’s not uncommon to find long-term shareholders earning yields of 75%, 150%, or even 275% on their original investments. And while this group of stocks doesn’t get a lot of airtime on TV, most have crushed the broader market returns.

I like to call this group of stocks my “forever assets.” These firms sell products and services that have stood the test of time. For that reason, some shareholders have locked in income streams that have lasted decades. Many of these companies pay out dividends that are so secure, shares can get passed down from generation to generation.

Case in point: Procter & Gamble Co (NYSE:PG). The consumer product giant is one of the largest companies in America, with a dividend track record that survived the Great Depression.

I’ve had my eyes on this business for a number of years. With the consumer staples sector out of favor on Wall Street (everyone now wants to strike it rich quick on cryptocurrencies or tech stocks), its shares now look reasonably priced.

The Business

Procter & Gamble can trace its roots back to a handshake between two men in 1837: William Procter and James Gamble.

As partners, the brothers-in-law built a successful soap and candle business in the frontier town of Cincinnati. The company prospered during the Civil War after securing contracts to supply cleaning supplies to the Union army. These orders built the company’s reputation nationwide as soldiers returned home with their P&G products. (Source: “Heritage,” Procter & Gamble Co last accessed May 17, 2018.)

Over the following decades, management expanded the company into new businesses like shampoo, cooking supplies, and laundry detergent.

Today, P&G owns a sprawling consumer product empire that generates over $65.0 billion in annual sales. The company has built or acquired dozens of top brands, including “Bounty” paper towels, “Crest” toothpaste, “Gillette” razors, and “Tide” laundry detergent. (Source: “Our Brands,” Procter & Gamble Co, last accessed May 17, 2018.)

No doubt, you probably have a handful of the company’s products in your house right now. The portfolio of leading businesses has created a cash cow dividend stock and forever asset.

P&G proves that you can earn big returns from companies that “sell the basics.” Over the past four decades, shares have delivered a compounded total return of nearly 10% per year, representing one of the best stock performances over that period.

If you had invested $10,000 into PG stock at the start of 1980, your position would be worth more than $336,000 today (and would be paying you more than $12,000 in annual dividends).

In the last 40 years of technology, we’ve gone from audio cassettes to mobile streaming. Yet one of the best stocks to own makes pretty much the same products today as it did 80 years ago. Of course, you can credit some of that success to P&G’s savvy management team.

The company’s real secret, though, comes from earning unspectacular returns over a spectacular amount of time. Lots of stocks shoot the lights out for a few years, earning double-digit returns for a short while. PG stock, in contrast, has sustained those profits for decades. That kind of compounding can turn an ordinary investment into something extraordinary.

P&G benefits from its multi-decade investment in building a portfolio of leading brands. The company’s multi-billion-dollar advertising and marketing budget distinguishes its products on store shelves and allows the company to command premium prices. Consumers will pay more for a container of Tide than for one of the generic detergents.

Further, as the value of a brand increases, P&G can put greater demands on retailers, securing the best placements in stores.

This often results in a virtuous profit cycle. Better store placement results in better sales, better sales allow for a bigger marketing budget, and a bigger budget results in a stronger brand. For any new competitor looking to break into the business, it’s a difficult cycle to start themselves.

Procter & Gamble Co’s Top Brands

| Brand | U.S. Market Share | P&G Share vs. #2 Competitor |

| Gillette | 66% | 5.0x |

| Cascade | 64% | 3.0x |

| Always | 54% | 3.0x |

| Dawn | 50% | 2.5x |

| Tampax | 49% | 2.5x |

| Bounty | 44% | 5.5x |

(Source: “Morgan Stanley Global Consumer & Retail Conference Presentation,” Procter & Gamble Co, November 15, 2017.)

Lastly, P&G’s raw size results in enormous economies of scale. Size also gives the company tremendous bargaining power with its suppliers, allowing it to keep costs low. As a result, P&G can earn higher margins even if it’s charging the same prices as its competitors.

When evaluating the strength of a business, I sometimes ask myself, “How hard would it be for me to build a competing business from scratch?”

In the case of most companies, it’s actually not all that hard. If you and I could cough up a few hundred thousand dollars (relative peanuts in the business world), we could break into a lot of industries fairly quickly.

But in the case of P&G, it would cost billions of dollars to replicate the company’s operations and supply chain. And even if we could somehow find that kind of dough, it would be almost impossible to replicate the company’s multi-generational relationship with customers. That’s the hallmark of a wonderful business.

For proof, you only need to look at P&G’s financial results. Over the past 10 years, the company has generated returns on invested capital (including goodwill) of more than 12% annually.

You see businesses deliver numbers like that from time to time. Competition, though, tends to eat into those returns pretty quickly. Just look at the long list of once-profitable companies that have seen their profits erode, like Fitbit Inc (NYSE:FIT), BlackBerry Ltd (NYSE:BB), and GoPro Inc (NASDAQ:GPRO). P&G is one of the few great businesses that have sustained outsized margins for such a long period of time.

The Dividend

Needless to say, Procter & Gamble’s business isn’t terribly exciting. I don’t even think the CEO is all that excited about shampoo and detergent. But the company makes a ton of money—$15.3 billion in 2017—and has paid a dividend every year since 1890.

Let’s take a moment and appreciate that fact for a second—every year since 1890. Though the two World Wars, the Great Depression, the Cuban Missile Crisis, a presidential assassination, Vietnam, Watergate, gas lines, the rise of Japan, 9/11, the dotcom collapse, the housing bubble, and the financial crisis, P&G went about its business, making household products and paying out money to shareholders.

In fact, the last time this company did not pay a dividend, President William Henry Harrison sat in the White House, basketball had yet to be invented, and Idaho had just been admitted as the 43rd state in the Union.

That dividend will likely keep rolling in for years to come. Procter & Gamble’s business is arguably underleveraged, as it has minimal debt, below-average business risks, and ample free cash flow.

Today, management pays out $0.75 in distributions for every dollar generated in profits. That ratio sits at the upper end of my comfort zone, but I find the dividend rate well supported by P&G’s bond-like cash flow.

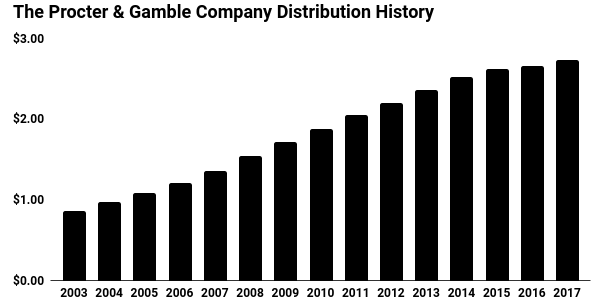

That payout will likely continue to grow, too. In April, P&G raised its quarterly payout for the 62nd consecutive year by four percent. (Source: “P&G Declares Dividend Increase,” Nasdaq, April 10, 2018.)

The bigger-than-expected bump signals that the company’s turnaround has gained traction and that management has more than enough cash to invest in the business for growth and to reward shareholders.

(Source: “Splits & Dividend History,” Procter & Gamble Co, last accessed May 11, 2018.)

Growing earnings should continue to fuel modest dividend hikes for years to come. We expect sales growth to average three to four percent over the next few years, driven by higher unit volumes and price increases. And thanks to a number of cost-cutting measures, more of those sales dollars should fall to the bottom line.

Overall, we expect a long-term dividend growth rate in the mid-single digits.

For shareholders, the combination of a large upfront payout and modest growth presents an interesting opportunity. Today, P&G shares pay a total shareholder yield (dividends plus buybacks) of five percent annually. If you assume a dividend growth rate in the four-to-five-percent range, that brings our total return potential into the low double-digits.

The Risks

The biggest risk for investors? Margins. Procter & Gamble has stumbled over the past few years, indicating that the company’s brand strength may have eroded. New products have failed to resonate with value-conscious households, as indicated by declining volumes and market share. P&G also spread its resources too thin, growing its portfolio to over 100 different brands at one point.

That said, I like some of the efforts that management has taken to address these challenges.

To boost margins, CEO David Taylor has introduced a $10.0-billion cost-saving program. This will be achieved through reduced overhead, lower material costs, more targeted ad spending, and squeezing efficiencies out of manufacturing operations.

And by culling the total number of brands in the company’s portfolio down to 65, executives can focus on the remaining categories where they have performed best.

P&G’s progress on this turnaround effort won’t knock your socks off, but analysts have liked the company’s recent results.

Last quarter, net sales rose 4.3% to $16.3 billion. Management credited that strong performance to their beauty business, namely its premium skincare brand “SK-II,” which reported a five-percent bump in organic sales. The company’s larger investment into core brands should lead to higher sales in upcoming quarters, too. (Source: “Procter & Gamble earnings top estimates, but market share losses send stock lower,” CNBC, April 19, 2018.)

The Bottom Line

Simply put, forever assets are a group of stocks so reliable that you can buy them today and hold them for the rest of your life. When you own stocks like these, you don’t have to worry about recessions, bear markets, stock market crashes, or what happens at the White House. If we can use history as a guide, these companies will just keep chugging along, making wonderful products for customers and paying out dividends for shareholders.

Procter & Gamble Co represents a textbook example. Selling the basics doesn’t get a lot of airtime on television, but it’s a profitable operation that pays out reliable dividends.

And with the shares temporarily out of favor on Wall Street, we have a chance to scoop up a great business at a bargain price. That’s a formula for building serious investment wealth over the long haul.