Permianville Royalty Trust Stock: 16.6%-Yielder Declared 2nd Special Dividend of 2023

Current Oil Market Bodes Well for PVL Stock

I last wrote about Permianville Royalty Trust (NYSE:PVL) in July, noting that the time was ripe for royalty trust stocks like PVL. My opinion on Permianville Royalty Trust stock hasn’t changed since then.

There was a time when Organization of the Petroleum Exporting Countries (OPEC) members, particularly Saudi Arabia, controlled the world’s oil supply and prices. But record-high U.S. oil production has begun to challenge OPEC Plus (OPEC+) as its members have desperately cut their own production to boost crude oil prices.

The repeated production cuts by OPEC+ since 2022 have been a blessing for U.S. producers, with North American producers easily making up for OPEC’s production cuts.

And really, OPEC’s desperate production cuts have been fun to watch. In November 2014, OPEC surprised the world when it announced that its members weren’t going to reduce their output. (Source: “Saudi Arabia: We’ll Never Cut Oil Production,” CNN, December 22, 2014.)

OPEC wanted oil prices to fall in the hopes that non-OPEC members, like U.S. shale producers, wouldn’t be able to remain profitable and would shut down. At the time, Saudi Arabia blamed the falling oil prices on speculators, not weak demand and record-high global supplies.

Certain of his country’s ability to control the world’s oil prices, the Saudi oil minister at the time, Ali al-Naimi, said if non-OPEC countries wanted to cut production, they could go ahead, but Saudi Arabia was never going to cut production. “[That] position we will hold forever, not [just] 2015,” said al-Naimi. (Source: Ibid.)

Less than two years later, the cash-strapped OPEC decided that “never” was too long. Since November 2016, Saudi Arabia has implemented many oil production cuts—to no avail. Record-high U.S. production and stockpiles of crude oil continue to undermine the production cuts.

As for Ali al-Naimi, he left his post as Saudi Arabia’s minister of petroleum and mineral resources in 2016.

Now, high U.S. oil production, a bullish outlook for oil prices in 2024, impressive U.S. economic growth, fears of a recession fading, and lower inflation bode well for PVL stock over the long run.

Permianville Royalty Trust is a Delaware statutory trust (DST) that owns the right to receive 80% of the net profits from the sale of oil and natural gas from conventional properties in Texas, Louisiana, and New Mexico—as well as from “unconventional” assets in the Permian and Haynesville basins. (Source: “Overview,” Permianville Royalty Trust, last accessed December 5, 2023.)

Conventional oil and gas are extracted through vertical well bores, whereas unconventional resources are extracted through horizontal well bores.

Permianville Royalty Trust is straight up about its monthly dividends, noting that their amounts fluctuate depending on production volume, oil and gas prices, the amount and timing of capital expenditures, and administrative expenses.

Management Declared 2 Special Distributions in 2023

As a monthly dividend provider, Permianville Royalty Trust releases its financial results every month. As might be expected from an energy company, its results can fluctuate wildly.

The table and chart below illustrate that Permianville Royalty Trust stock’s dividend can change from year to year and month to month. Due to the COVID-19 pandemic, the company suspended its payout from July 2020 through July 2021. Not a big surprise; the pandemic gutted much of the energy sector for a stretch.

In October 2023, it recorded oil cash receipts of $2.4 million (with realized wellhead prices of $73.07 per barrel), up from just $100,000 in September.

The trust’s natural gas receipts in October were $500,000 (with realized wellhead prices of $2.02 per thousand cubic feet), which was consistent with the receipts in September. (Source: “Permianville Royalty Trust Announces Monthly Cash Distribution,” Permianville Royalty Trust, October 16, 2023.)

This resulted in monthly dividends of $0.006 per unit, for an inflation-thumping yield of 16.58%.

In November, the trust recorded oil and gas cash receipts of $2.8 million (with realized wellhead prices of $78.95 per barrel), but because of higher expenses, it had a shortfall of about $1.2 million. The shortfall was an anomaly that was related to several big exploration and production projects. (Source: “Permianville Royalty Trust Announces Monthly Operational Update,” Permianville Royalty Trust, November 17, 2023.)

As a result of November’s shortfall, PVL stock won’t pay a monthly distribution in December. PVL unitholders won’t receive another monthly dividend until the company’s net profit shortfall is eliminated. If history is any indicator, Permianville Royalty Trust’s shortfall should be easily covered by net profits in early 2024.

Dividend hogs might not like the fact that the trust skipped a monthly distribution, but with a variable dividend schedule based on production and earnings, the company won’t overextend itself and get into financial trouble. Moreover, it’s quite uncommon for Permianville Royalty to skip a monthly distribution.

Then there’s the other end of the dividend spectrum: special dividends.

In September, management announced a special distribution of $0.06967 per unit. That special dividend represents net proceeds allocable to PVL unitholders from the $6.4-million sale of certain oil and natural gas properties in the Permian Basin. (Source: “Permianville Royalty Trust Announces Special Cash Distribution of Net Proceeds From Permian Basin Divestiture,” Permianville Royalty Trust, September 20, 2023.)

In November, Permianville Royalty Trust announced a special distribution of $0.07725 per unit. That payout represented the majority of the remaining net proceeds from the sale of oil and natural gas properties in the Permian Basin.

| Year | Annualized Dividend Per Unit |

| 2023 Year-to-Date | $0.36967 |

| 2022 | $0.4415 |

| 2021 | $0.1195 |

| 2020 | $0.13423 |

| 2019 | $0.306462 |

| 2018 | $0.4185809 |

| 2017 | $1.35826 |

| 2016 | $0.241953 |

(Source: “Cash Distributions,” Permianville Royalty Trust, last accessed December 6, 2023.)

Permianville Royalty Trust Stock Is Resilient

When it comes to energy stocks, their share prices rise and fall with oil and gas prices. That’s not a big surprise.

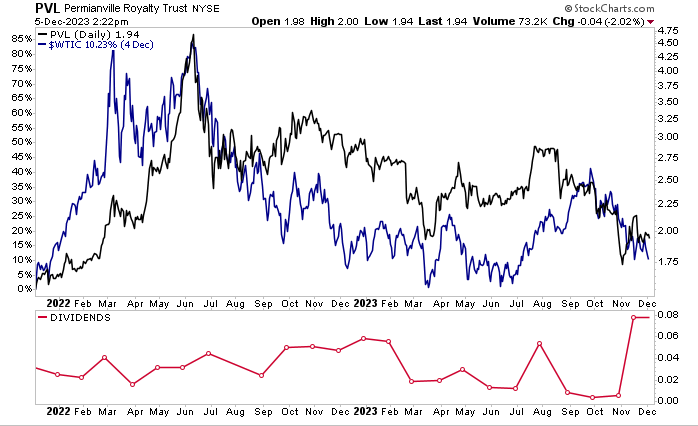

As of this writing, the price of crude oil (the blue line in the below chart) is $73.00 per barrel, down from its June 2022 high of $120.00 per barrel.

Meanwhile, the price of PVL stock (the black line in the chart) is currently about $1.95 per unit, down from its June 2022 high of $4.70. Over the last month, however, Permianville Royalty Trust units are up by about seven percent.

For technical traders, PVL units’ price is in an interesting spot, with $1.95 being its support level. Permianville Royalty Trust stock’s resistance level is $2.50 per unit.

Chart courtesy of StockCharts.com

The Lowdown on Permianville Royalty Trust Units

Permianville Royalty Trust owns stakes in hundreds of oil and natural gas wells across Texas, Louisiana, and New Mexico. For the most part, the trust has been a reliable cash cow that provides investors with ultra-high-yield monthly dividends.

Admittedly, royalty trusts might not be for every investor; their above-average payouts come with above-average risk. PVL stock’s dividends swing up and down with energy prices, and they’ll decline as the company’s wells run dry. But for investors who understand the benefits and risks of royalty trusts, Permianville Royalty Trust stock can provide an attractive income stream.