PAA Stock: Earn a High Dividend Yield of 8.52%

PAA Stock is a Solid Dividend Paying Company

Today we’ll look at a company that offers a high dividend yield of 8.52%: Plains All American Pipeline, L.P. (NYSE:PAA). A master limited partnership in the oil pipeline industry, PAAP is engaged the transportation, storage, terminaling, fractionation, and marketing of crude oil and natural gas—all without doing any actual drilling itself. This is good news for investors, as drilling companies carry a lot of risk.

PAA stock is notable for its high dividend yield. There is no guarantee that a stock will go on to trade at a higher price, which is what makes stocks that already have a high yield so appealing. As long as there is solid cash flow from regular business operations, the dividend should continue to be paid out.

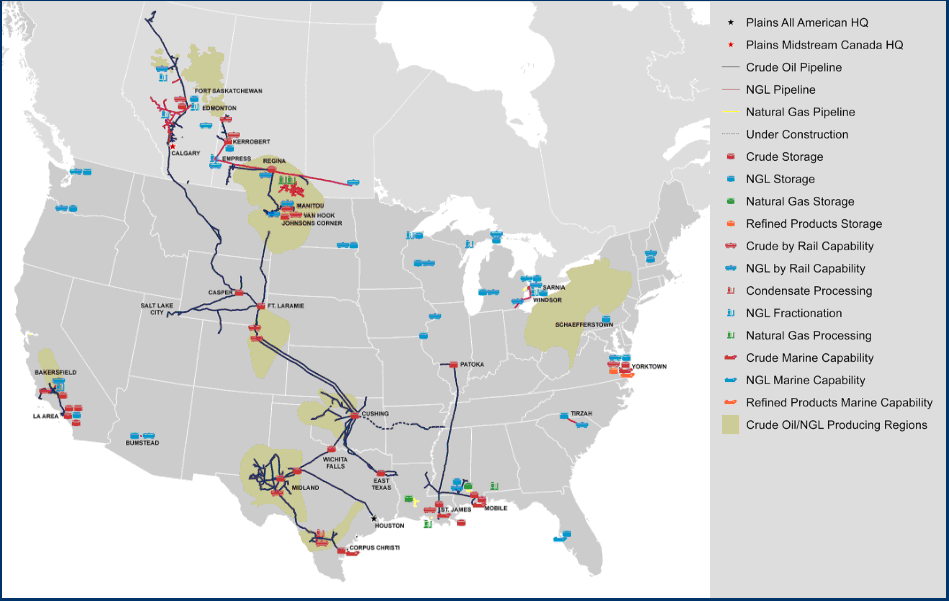

As of December 2015, the company owned more than 2,900 trucks and trailers, over 10,000 railway carts, more than 19,000 miles of crude oil systems, 135 million barrels of storage capacity, and 142 transport and storage barges. PAAP operates in both the U.S. and Canada, as detailed in the map of its assets below:

(Source: “View our Assets,.” Plains All American Pipeline, L.P., last accessed July 7, 2017.)

How the company functions is very simple. Oil companies will drill for oil, then they will approach PAAP to transport it to either an end user or a storage facility; the latter provides additional revenue until it leaves its destination. Reasons for storing oil include supply exceeding demand or the drilling company waiting for oil price to increase so it can earn more per barrel.

But PAAP has it better, because no matter the price of oil, there will always be demand for its services. The company’s business model is also protected from inflation. Transporting oil from one location to another will cost more over time, effecting business margins; PAAP passes these added costs on to the end user. And since this tends to happen at the same rate or higher than that of inflation, investors needn’t worry about seeing margin compression.

For further evidence, take a look at the reported earnings for 2016 and the forecasted earnings for the next few years:

| Year | Annual Earnings Per Share | Type of Earnings |

| 2016 | $0.43 | Actual |

| 2017 | $1.68 | Estimated |

| 2018 | $1.91 | Estimated |

| 2019 | $2.09 | Estimated |

Earnings for 2017 are estimated to be almost four times those of 2016, then growing nearly 10% the following years. In other words, earnings are projected to be above inflation, which is normally in the three percent range.

How and Why is There Such a High Dividend Yield?

The dividend is split up throughout the year, being paid out every three months. In this case, the dividend yield is 8.52%, or $8,520 per year based on a $100,000 initial investment, with $2,130 of that paid every three months.

A high-dividend investment has long-term benefits. Let’s say the dividend’s payout doesn’t change from the above. So, if the shares were held for five years, you would receive 34.08% ($34,080) from that initial $100,000. And this does not even factor in stock price gains, which would bring the number even higher.

Remember, at the end of the day, a company does not have to pay out a dividend; it chooses to. And the dividend is high because the flow of revenue has held steady. Also, this move attracts more of a buy-and-hold investor mentality, which reduces the volatility in the stock, since fewer people will get in and out and on a daily basis.

Also Read:

MLP Stock List: Earn Reliable Income from These Energy Partnerships

The Best Pipeline Stocks for Retirement Income

Attractive Valuation

The best investments are not necessarily the ones offering a high dividend yield and the lowest price. Rather, they are the ones featuring growth and which are trading at a cheap valuation in comparison to others in the same industry. The reason why this is the best method to determine an investment decision is that it ignores the stock price, market size, and dividend yield of a stock.

The price-to-earnings (P/E) ratio is the best barometer when it comes to valuation. PAA stock has a ratio of 30 times, compared to the industry average of 54 times. This advantageous ratio for PAAP is due to its growing earnings, which gradually support a higher trading price.

Final Thoughts About PAA Stock

With the markets hitting new highs on an almost weekly basis, it can be difficult to invest new capital. But with PAA stock, this is not a concern thanks to its cheap valuation, solid business, and reliable income.

Need even more reason to consider Plains All American Pipeline stock? Well, savings and money market accounts are currently offering near-zero-percent returns. This is just another way to benefit from PAA stock’s high dividend yield.