9.4%-Yielding Oaktree Specialty Lending Corp Hikes Dividend 26%

Why OCSL Stock Is Worth Considering

Annual inflation is at its highest level in roughly 40 years, sending the stock market considerably lower. As of this writing, the S&P 500 is deep in correction territory and the Nasdaq is in bear-market territory. This means investors are turning more and more to dividend stocks.

Currently, the average dividend yield for S&P 500-listed companies is just 1.4%. That’s nowhere near the current inflation rate, and is 30% lower than the Federal Reserve’s long-term inflationary target of two percent. There are, however, ultra-high-yield dividend stocks that outpace inflation. That said, it’s never a good idea to simply chase a stock for its dividends. Generally, the higher the dividend yield, the riskier the stock.

That said, there are many ultra-high-yield dividend stocks with attractive risk/reward profiles. One is Oaktree Specialty Lending Corp (NASDAQ:OCSL), a business development company (BDC) that dividend hogs might want to put on their radar.

Oaktree Specialty Lending provides capital to companies that have limited access to public or syndicated capital markets. (Source: “Investor Presentation,” Oaktree Specialty Lending Corp, last accessed June 13, 2022.)

Interest rates are on the rise, but they’re still near historic lows, which means BDCs like Oaktree Specialty Lending can still access capital cheaply and help cash-strapped businesses. Moreover, because interest rates are rising, Oaktree Specialty Lending can make more revenue.

Oaktree Specialty Lending Corp provides companies with first- and second-lien loans, unsecured loans, mezzanine loans, and joint ventures. It currently has $164.0 billion in assets under management, with the majority of those assets in credit strategies. And that dollar figure continues to grow.

The company’s historical assets under management are as follows:

- March 2022: $164.0 million

- 2015: $114.0 million

- 2010: $84.0 million

- 2005: $30.0 million

- 2000: $18.0 million

- 1995: $5.0 million

Oaktree Specialty Lending Corp typically invests in companies with resilient business models and strong fundamentals. The firm’s portfolio is made up of 146 companies with an 8.8% weighted average yield on debt investments. Almost 90% of the portfolio is composed of floating-rate debt investments.

The top 10 industries in Oaktree Specialty Lending Corp’s portfolio (and their percentage of the portfolio) are:

- Software: 15.9%

- IT Services: 6.8%

- Pharmaceuticals: 5.1%

- Health-Care Services: 4.5%

- Biotech: 4.5%

- Specialty Retail: 4.0%

- Chemicals: 3.8%

- Financial Services: 3.7%

- Health-Care Technology: 2.8%

- Aerospace and Defense: 2.7%

Oaktree Specialty Lending Corp’s strategic joint ventures (7.1% of its portfolio) are income-enhancing vehicles that primarily invest in senior secured loans of middle-market companies and other corporate debt securities. The equity ownership makeup of those joint ventures is 87.5% for Oaktree Specialty Lending and 12.5% for its partner. The voting control of the joint ventures is 50% for Oaktree and 50% for its partner.

Oaktree Specialty Lending Corp Kicks Off 2022 With Wonderful Q1 Results

For the second quarter of fiscal 2022 (ended March 31), Oaktree Specialty Lending reported total investment income of $64.0 million, or $0.35 per share. That’s compared to $64.9 million, or $0.36 per share, in the first quarter of 2022. (Source: “Oaktree Specialty Lending Corporation Announces Second Fiscal Quarter 2022 Financial Results and Declares Increased Distribution of $0.165 Per Share,” Oaktree Specialty Lending Corp, May 5, 2022.)

The company’s adjusted total investment income in the second fiscal quarter was $60.3 million, or $0.33 per share, versus $62.1 million, or $0.34 per share, in the first fiscal quarter.

Oaktree Specialty Lending Corp reported net investment income of $40.1 million, or $0.22 per share, for the 2022 second quarter, compared to $32.3 million, or $0.18 per share, in the first quarter. The company’s adjusted net investment income in the second quarter of 2022 was $32.3 million, or $0.18 per share. In the first quarter, its adjusted net investment income was $31.2 million, or $0.17 per share.

As of March 31, Oaktree Specialty Lending Corp’s net asset value (NAV) per share was down by 1.1% over the previous quarter, from $7.34 to $7.26. The decrease was primarily driven by unrealized losses related to credit spread widening, which was partially offset by undistributed net investment income.

During the second quarter, the company originated $227.9 million of new investment commitments and received $180.1 million of proceeds from prepayments, exits, other paydowns, and sales. Of the new investment commitments, 72% were first-lien loans, 13% were subordinated debt investments, eight percent were equity investments, and seven percent were second-lien loans. The weighted average yield on the new debt investments was 8.7%.

Armen Panossian, Oaktree Specialty Lending Corp’s CEO and CIO, commented, “OCSL generated strong results in the second fiscal quarter. Our earnings were again solid, reflecting robust origination activity and successful exits of certain investments. Credit quality remains healthy with no non-accruals, a testament to our disciplined, risk-controlled investment approach.” (Source: Ibid.)

Oaktree Specialty Lending Stock’s Quarterly Dividend Hiked by 26%

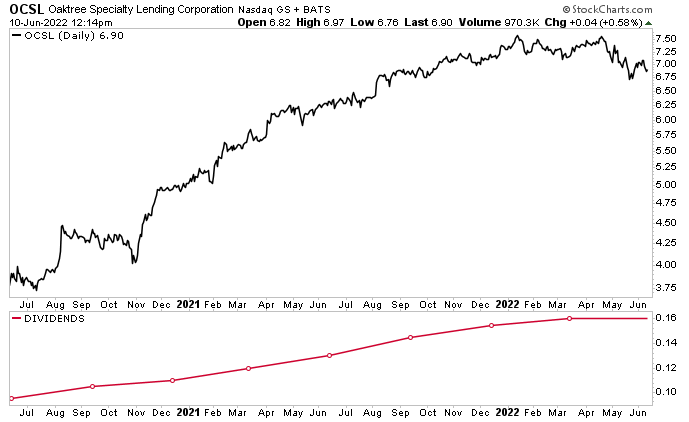

In May, Oaktree Specialty Lending’s board declared a quarterly distribution of $0.165 per share, a three percent increase from the prior quarter and a 26% increase year-over-year. This translates to a yield of 9.5%. The distribution is payable on June 30 to OCSL stockholders of record as of June 15. (Source: “Dividends,” Oaktree Specialty Lending Corp, last accessed June 13, 2022.)

This was the eighth consecutive quarter in which Oaktree Specialty Lending declared a raise to its quarterly dividend.

| Date Declared | Dividend Amount |

| May 5, 2022 | $0.165 |

| February 3, 2022 | $0.16 |

| November 16, 2021 | $0.155 |

| August 5, 2021 | $0.145 |

| May 6, 2021 | $0.13 |

| February 4, 2021 | $0.12 |

| November 19, 2020 | $0.11 |

| August 10, 2020 | $0.105 |

| May 7, 2020 | $0.095 |

(Source: Ibid.)

Oaktree Specialty Lending Corp’s consistently rising dividends certainly help weather the market volatility.

In terms of share price, Oaktree Specialty Lending stock has provided gains of 106% since the start of 2019, 52% since the start of 2020, 36% since the start of 2021, and 10% year-over-year. More recently, however, Oaktree Specialty Lending Corp’s share price has come under some pressure, but nothing compared to what’s been going on with the broader market.

As of this writing, OCSL stock is down by:

- 1.8% over the last month

- 3.9% over the last three months

- 4.5% over the last six months

- 5.9% year-to-date

Chart courtesy of StockCharts.com

Oaktree Specialty Lending stock’s outlook is positive, with analysts providing a 12-month price target of $8.50. That points to a gain of 23%.

That would be a solid gain, especially when you consider that Deutsch Bank AG (NYSE:DB) cut its baseline market forecast and said the S&P 500 could go to 3,000 if there’s a recession. That represents a 23.5% decline from the S&P 500’s current level and a 37.7% decline from its January 2022 high. (Source: “Here’s the Worst Case Scenario for Stocks, According to Goldman, Deutsche Bank and Bank Of America,” Forbes, May 19, 2022.)

Bank of America Corp (NYSE:BAC) sees the S&P 500 ending 2022 at 3,200, roughly an 18% drop from its current level and a 33.5% drop from its January 2022 high.

The Lowdown on Oaktree Specialty Lending Corp

Oaktree Specialty Lending Corp is an excellent BDC with a conservative balance sheet, strong cash position, and diverse portfolio.

Thanks to the company’s consistently great financial performance, its management declared an increase to OCSL stock’s dividend for the eighth consecutive quarter.