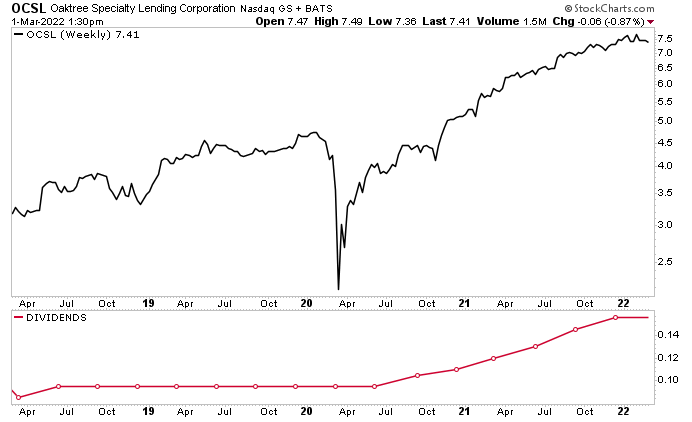

Oaktree Specialty Lending Corp: 8.6%-Yielder Raises Payout for 7 Straight Quarters

OCSL Stock Trading at Record Levels

At 7.5%, U.S. inflation is at its highest level in 40 years. For blue-chip investors who were happy with a 3.5% dividend yield, the eyewatering inflation has led them to change their investing strategies. To find above-average yields, investors will need to focus on ultra-high-dividend stocks. Shares of a business development company (BDC) like Oaktree Specialty Lending Corp (NASDAQ:OCSL) might fit the bill.

A BDC is essentially a private equity firm that provides loans and credit to businesses. Unlike a private equity firm, a BDC is publicly traded. This gives investors access to companies that make boatloads of money from loans and other investments. Moreover, BDCs provide buy-and-hold investors with frothy dividends and significant capital gains.

Even though interest rates are on the rise, they’re still near historic lows. That means BDCs can still access capital cheaply and lend it to cash-strapped businesses that have been hammered by the COVID-19 pandemic.

Oaktree Specialty Lending is a leading global investment management firm that provides loans and credit to upper-middle-market companies with enterprise values between $100.0 and $750.0 million. (Source: “Investor Presentation: First Quarter 2022,” Oaktree Specialty Lending Corp, last accessed March 3, 2022.)

The BDC does this through senior secured debt, asset-backed loans, unsecured/mezzanine loans, bonds, and preferred and/or common equity.

It has assets under management of $166.0 billion in contrarian, value-oriented, risk-controlled investments in a variety of asset classes. Currently, Oaktree Specialty Lending Corp’s portfolio is made up of 140 companies with an 8.7% weighted average yield on debt investments, with 91.6% of that debt portfolio comprising floating-rate investments.

The top 10 industries in its portfolio are:

- Application Software: 16.2%

- Pharmaceuticals: 5.4%

- Biotech: 4.5%

- Data Processing and Outsourced Services: 4.4%

- Personal Products: 4.1%

- Industrial Machinery: 3.4%

- Health-Care Services: 3.1%

- Internet and Direct Marketing: 2.7%

- Aerospace and Defense: 2.7%

- Specialized Finance: 2.6%

Oaktree Specialty Lending Corp Kicks Off 2022 With Another Great Quarter

For the first quarter of fiscal 2022 (ended December 31, 2021), Oaktree Specialty Lending Corp reported total investment income of $64.9 million, or $0.36 per share. That’s compared to $63.8 million, or $0.35 per share, in the fourth quarter. (Source: “Oaktree Specialty Lending Corporation Announces First Fiscal Quarter 2022 Financial Results and Declares Increased Distribution of $0.16 Per Share,” Oaktree Specialty Lending Corp, February 3, 2022.)

The company’s adjusted total investment income was $62.1 million, or $0.34 per share, in the first quarter of fiscal 2022, versus $58.2 million, or $0.32 per share, in the fourth quarter of fiscal 2021. Management attributed the increase to higher interest income resulting from a larger investment portfolio.

Oaktree Specialty Lending Corp reported first-quarter net investment income of $32.3 million, or $0.18 per share, compared to $33.0 million, or $0.18 per share, in the fourth quarter of 2021. The slight decrease was a result of higher incentive fees and interest expenses.

The company’s adjusted net investment income in the first fiscal quarter was $32.1 million, or $0.17 per share, compared to $29.1 million, or $0.16 per share, in the previous quarter.

As of December 31, 2021, Oaktree Specialty Lending Corp’s net asset value (NAV) was $7.34 per share, up by 0.8% from $7.28 on September 30, 2021.

Also during the quarter, the BDC originated $299.9 million worth of new investment commitments and received $235.0 million in proceeds from prepayments, exits, other paydowns, and sales. Of these new investment commitments, 73% were first-lien loans, 26% were second-lien loans, and one percent were equity investments. The weighted average yield on new debt investments was 8.1%.

Armen Panossian, the company’s CEO and CIO, said, “OCSL delivered another strong quarter with adjusted net investment income of $0.17 per share, up 7% from the prior quarter. Credit quality remains high with no non-accruals, and NAV grew by 1% sequentially to $7.34 per share.” (Source: Ibid.)

Oaktree Specialty Lending Stock’s Dividend Rises for 7th Consecutive Quarter

Based on Oaktree Specialty Lending Corp’s “continued exceptional performance,” its board increased OCSL stock’s dividend for the seventh consecutive quarter to $0.16 per share, for a yield of 8.6%.

The company’s payout ratio is a paltry 45.1%, which is far below the 90% threshold I’m comfortable with. This provides Oaktree Specialty Lending with more than enough financial wiggle room to not just continue paying ultra-high-yield dividends, but to continue increasing the payouts.

Oaktree Specialty Lending stock’s next distribution is payable on March 31 to shareholders of record as of March 15.

Consistently strong financial results haven’t just been helping juice Oaktree’s dividends, they’ve been (as one would hope) helping fuel stock market gains. As of this writing, OCSL stock is up by 30% year-over-year.

While Oaktree Specialty Lending Corp stock is down by 0.4% in 2022, that’s far better than the S&P 500, which is down by 9.5%; the Dow Jones Industrial Average, which is down by 8.5%; and the Nasdaq, which is down by 13.5%.

Chart courtesy of StockCharts.com

The Lowdown on Oaktree Specialty Lending Corp

Oaktree Specialty Lending Corp is a fabulous BDC with a conservative balance sheet, strong liquidity, and a diverse portfolio. With a focus on larger companies and the majority of its portfolio involving first-lien loans, the company is more resilient than other BDCs, especially during economic downturns.

All told, Oaktree Specialty Lending is off to a solid start to its fiscal year. The BDC is well positioned to take advantage of increasing interest rates and continue delivering attractive risk-adjusted returns to Oaktree Specialty Lending stockholders.