This Energy “Pick-and-Shovel” Play Yields 11.3%

Small-Cap Stock Pays a Big Yield

Today’s chart highlights my favorite way to spot great dividend stocks: “pick-and-shovel” businesses.

Rather than betting the farm searching for the next big strike, these firms provide tools and services to a commodity boom. They represent the safer (and often more profitable) way to invest in the natural resource industry.

Case in point: USA Compression Partners LP (NYSE:USAC). New technologies have unlocked vast quantities of natural gas across the country, resulting in booming profits for related energy service businesses. For investors looking to lock in a lucrative income stream, this little-followed partnership may be worth a second look.

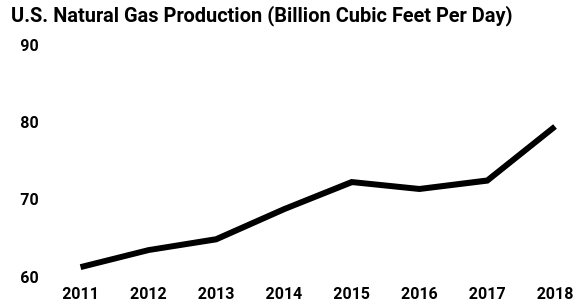

Shale drilling has turned America into the Saudi Arabia of natural gas, for starters.

U.S. natural gas output has averaged 79.6 billion cubic feet a day in 2018. That’s up by almost 10% from 2017’s record production. With drillers finding new ways to access shale deposits every year, analysts project that pace of growth to continue. (Source: “How Two Wells in Wyoming Explain the Natural-Gas Glut,” The Wall Street Journal, March 21, 2018.)

Infrastructure remains a big problem, though. Surging production has outstripped existing pipelines, terminals, and processing facilities. This is good news, however, for those with these assets already in place, who have exploited this situation to pass on juicy price hikes.

USAC has positioned itself smack-dab in the middle of this boom.

The partnership owns dozens of compression facilities across the Midwest and New England. As the name implies, this equipment compresses natural gas so it can be shipped in pipelines.

It’s a steady, profitable business. USAC signs up customers to long-term contracts, so the company knows exactly how much it will get paid well in advance. And with natural gas production surging across the country, demand for the partnership’s services continue to grow.

(Source: Ibid.)

Most of these profits should get passed onto owners.

Today, the partnership pays a quarterly distribution of $0.52 per unit. That comes out to an annual yield of 11.3%.

That payout will likely continue to increase. To accommodate booming production, management continues to invest in new compression facilities. That will likely translate into growing profits and, by rough extension, growing distributions.

In other words, this is one pick-and-shovel play worth investigating further.