Monthly Income: Nail Down Apple Hospitality REIT’s Safe 6.4% Dividend Yield Today

Today’s chart highlights one of the most attractive situations you can find: a high dividend yield that comes as a result of a drop in price. As regular readers know, I scour the market for these situations all the time.

Now, we have to be careful, of course. After all, there’s usually a very good reason behind a particular stock’s decline. Typically, there is trouble surrounding the company’s fundamental performance or operating environment.

However, there are rare times when a stock’s pullback is largely unjustified. This makes the dividend yield being offered just too good to pass up. I like to call these stocks “limited-time high-yielders” (LTHY) because the juicy yields on them probably won’t last forever.

Sooner or later, the market will catch on and bid them up. Thus, it’s important to do your research on them as quickly as possible.

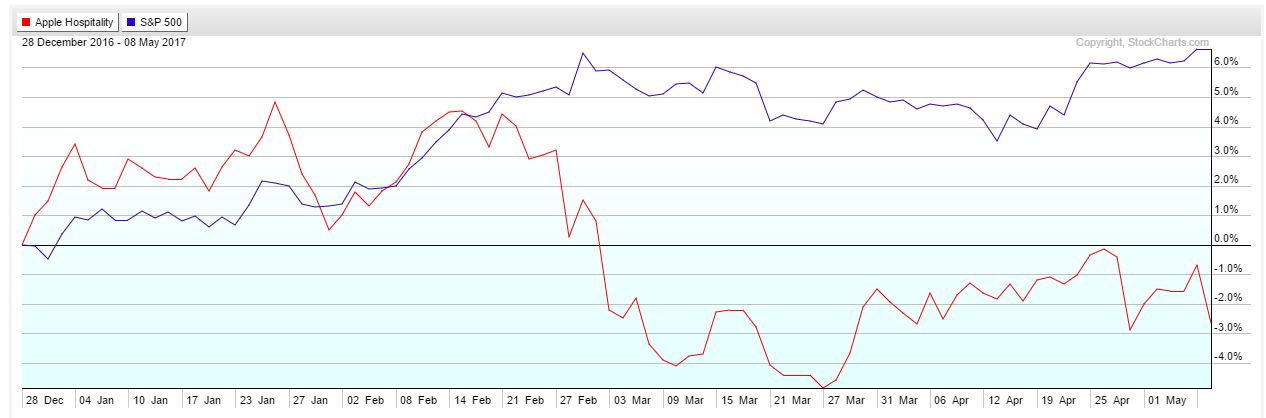

This week’s LTHY is hotel company Apple Hospitality REIT Inc (NYSE:APLE). It is down more than five percent over the past three months and boasts a safe dividend yield of about 6.5%.

It is also a monthly dividend stock.

Let’s take a closer look.

Apple of My Eye

For investors who aren’t familiar with Apple Hospitality, it is a real estate investment trust (REIT) that focuses primarily on the hotel sector. Specifically, it invests in income-producing upscale hotels, and then passes on the cash flow to shareholders through healthy dividends.

All of Apple’s hotels operate under the well-known Marriott International Inc (NASDAQ:MAR) or Hilton Worldwide Holdings Inc (NYSE:HLT) brands. In total, the company owns about 235 hotels, with an aggregate of more than 30,000 rooms. The entire portfolio spans throughout 33 states across the country.

Thus, Apple Hospitality is very well diversified, both in terms of branding (Marriott and Hilton) and geographic location.

When it comes to relying on dividends for income, we always want to invest in companies that have some type of built-in diversification. Why? Well, diversification helps a company “smooth” out their dividend distributions in case one area of the business isn’t doing so well.

woodleywonderworks/Flickr

It’s also worth noting that Apple Hospitality doesn’t technically operate its hotels. Instead, the hotels are run under separate contracts by other hotel management companies. This gives Apple the ability to simply focus on what it does best: grow the portfolio by investing in more hotels.

Thus, management’s investment objectives are simple: 1) focus only on the upscale sector of the hotel industry, 2) ensure diversification across different geographic regions, 3) utilize experienced hotel management companies, and 4) reinvest in current hotels to maintain their competitive advantage.

So how well is management performing on those goals? Well, according to Apple’s first-quarter (Q1) results last week, very nicely.

Sweetening Apple

In Q1, Apple Hospitality posted earnings per share of $0.39, meeting the average analyst consensus. Meanwhile, revenue soared 30.5% to $292.9 million, which topped Wall Street’s estimate by $2.0 million.

What is even more impressive?

The company’s comparable revenue per available room (RevPAR) increased by 1.4%. RevPAR is a key metric in the hotel business because it gauges two key things: how well a company fills its rooms and how much it is able to charge. Therefore, we always want to see RevPAR increasing.

Apple’s Q1 RevPAR growth went up despite a whopping 16% decline in its Los Angeles market. This is the power of diversification at work. Apple was able to squeak out a RevPAR gain because it doesn’t put all of its eggs in one geographic basket. Particularly strong performance in the company’s Phoenix, San Diego, and Seattle markets helped offset the decline in Los Angeles.

“We are pleased with our results for the first quarter, which highlight the benefits of our broad geographic diversification,” said President and CEO Justin Knight. (Source: “Apple Hospitality REIT Reports Results of Operations for First Quarter 2017,” Apple Hospitality REIT, May 4, 2017.)

Also Read:

The 7 Top Monthly Dividend Stocks for 2017

REIT ETF List: Earn Regular Income from These Real Estate ETFs

Passing the Cash

But of course, there is something far more important than RevPAR. In fact, it is the most important metric for any business: cash flow. After all, it is from a company’s cash flow that dividends are paid out to shareholders.

Here, things also look good for Apple Hospitality.

In 2011, for example, Apple’s operating cash flow clocked in at just $123.0 million. And in 2016, operating cash flow was a whopping $332.0 million. That represents average annual growth of 28.2%.

Management used the strong cash generation to declare a regular monthly cash dividend of $0.10 per share in April. That translates to $1.20 per year.

Given the company’s solid diversification and financial position, I don’t expect that distribution to be cut anytime soon.

“We continue to believe that our large, geographically diversified, upscale portfolio of Marriott and Hilton branded hotels and our strong, flexible balance sheet position us well as we continue throughout the year,” Knight said. (Source: Ibid.)

High Dividend Yield at a Good Price

That brings us back to Apple Hospitality’s stock price, which has clearly underperformed over the past 90 days:

What is the main cause for concern? Well, the investment community is worried about the negative impact of higher interest rates on Apple’s borrowing costs and the stock’s relatively plump dividend yield.

Still, I believe Apple’s 6.4% dividend yield more than makes up for the interest rate risk. After all, that yield is much higher than the real estate industry average (5.3%), as well as the S&P 500 (2.1%).

Considering how diversified Apple is, both in terms of brand and location, I can only see that spread narrowing over time.

The Bottom Line on Apple Hospitality

And there you have it: several reasons why I think Apple Hospitality REIT Inc is a monthly dividend stock worth considering.

As always, don’t view this article as a formal recommendation. You need to put more hours of research into the idea. After all, Apple Hospitality uses a fair bit of leverage to finance its hotel properties. You need to make sure you are comfortable with this.

As a “watchlist” idea, though, Apple Hospitality should definitely be on every income investor’s radar.