Is MGM Growth Properties LLC’s 7% Yield Immune to COVID-19?

Can MGM Growth Properties LLC’s Distribution Survive COVID-19?

This past February, the casino industry had just reported another round of record revenues and earnings. Then COVID-19 changed everything.

The whole business model relies on bringing people together for gambling, entertainment, and conventions. But thanks to rolling government shutdowns, casino operators no longer have enough cash flow to pay employees and shareholders. That has resulted in a number of high-profile dividend cuts, most notably from Las Vegas Sands Corp. (NYSE:LVS) and Wynn Resorts, Limited (NASDAQ:WYNN).

Which brings me to today’s company: MGM Growth Properties LLC (NYSE:MGP). The casino landlord comes with an upfront yield of almost seven percent. And for income-hungry investors, this high payout seems worth taking a gamble on.

But can MGM’s payout possibly survive COVID-19? Let’s take a look.

To begin with, the casino industry will take quite some time to recover.

While casinos plan to reopen, they will operate at 50% capacity with social-distancing protocols and certain facilities, like pools and buffets, closed. But even with these measures in place, it’s unclear yet how many customers will feel comfortable flying to destinations, sharing dice with strangers, or dancing in a nightclub.

As a result, few expect casinos will bleed money for the time being. Analysts project that Las Vegas Sands and Wynn Resorts, for instance, will see revenues for full-year 2020 drop 61% and 65%, respectively, from 2019 levels.

But MGM Growth Properties LLC seems relatively immune to the industry’s turmoil.

That’s because MGM rents its properties to casino operators. It doesn’t actually run the facilities itself. As a result, tenants still have to make payments to MGM regardless of how their businesses perform.

And so far, anyway, tenants have continued to pay their rent. Adjusted fund flows from operations for the three months ended June 30 topped $0.56 per unit. That compares to $0.59 per unit during the same period a year ago.

This dip in profitability might not impress some readers. But given the current state of the casino business, this number’s absolutely remarkable.

More importantly, ongoing cash flows leave management in a good position to continue paying unitholders.

Based on the partnership’s current distribution, MGM Growth Properties LLC’s payout ratio comes in at only 86%. As I like to see businesses pay out no more than 90% of their income as dividends, MGM fits well within my comfort zone.

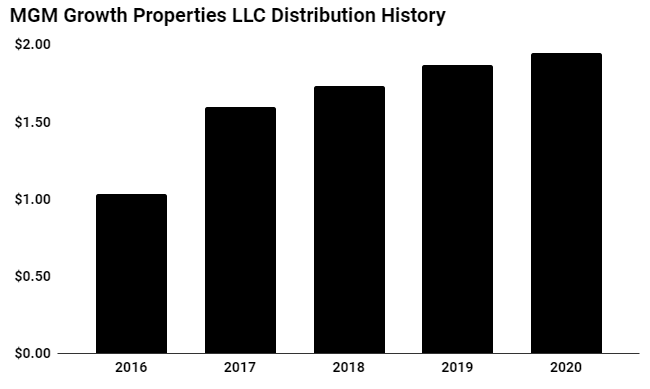

Source: Yahoo! Finance

Management seems optimistic about the partnership’s business prospects, too.

During the second quarter, executives announced their intentions to expand the company’s stock buyback program by up to $700.0 million. More incredibly, CEO James Stewart increased the partnership’s payout, which represented MGM’s 11th distribution bump in four years. (Source: “MGM GROWTH PROPERTIES REPORTS SECOND QUARTER FINANCIAL RESULTS,” MGM Growth Properties LLC, August 4, 2020.)

I would prefer to see a little more fiscal restraint given the current state of the casino business. Nevertheless, management would not have boosted the distribution if they expected a wave of tenant defaults in the coming months. The initiatives announced in MGM’s recent financial results suggest that executives have an enormous amount of confidence in the future of the business.

That bodes well for MGM unitholders. This distribution looks reasonably COVID-proof.