4.5%-Yielding Iron Mountain Stock Up by 9.5% in 2023

IRM Stock Rewards Shareholders With Dividends & Price Appreciation

The broader stock market is up by more than eight percent since the start of 2023, and many investors have declared that stocks have bottomed. Some financial researchers, however, say the S&P 500 still has a lot of room to fall. Inflation is stubbornly high, at 6.5%, and the scorching January jobs report suggests that the Federal Reserve still has some work to do to bring inflation down—which means additional interest rate hikes.

Where does that leave stock investors, especially dividend hogs?

Stocks that have experienced strong gains since the start of 2023 could be ripe for profit-taking or even a pullback if the economy remains hot. On the other hand, some stocks have been performing well for years (in terms of share price) and have also been paying reliable, high-yield dividends. That doesn’t mean their share prices are going to keep rising, but there’s no reason to be bearish on companies that continue to report wonderful financial results.

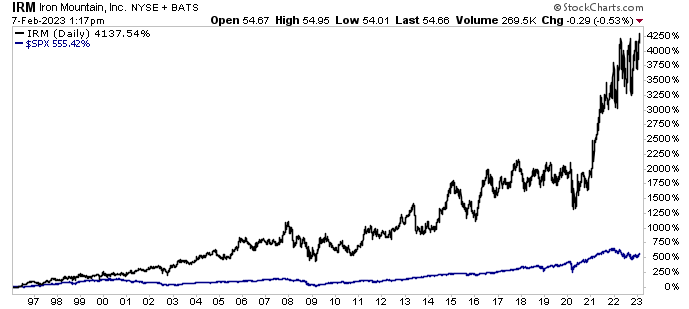

For instance, shares of Iron Mountain Inc (NYSE:IRM) pay high-yield dividends and have been on a great run since the company went public in early 1996. Since then, with dividends reinvested, Iron Mountain stock has posted total returns of 4,137%. For the same time frame, the S&P 500 posted returns of 555.4%

More recently, IRM stock has continued to outpace the broader market. As of this writing, Iron Mountain stock is up by:

- 9.5% since the start of 2023

- 10.5% over the last three months

- 6.5% over the last six months

- 26.5% over the last year

IRM stock hit an all-time high of $57.21 on February 2, but it still has room to run. Analysts have provided a 12-month share-price target of $62.00 to $66.00, which points to gains in the range of approximately 15% to 22%.

Chart courtesy of StockCharts.com

About Iron Mountain Inc

Iron Mountain is the global leader in storage, asset lifecycle management, and information management services. The Boston, Massachusetts-based company protects billions of valuable assets, including critical business information, highly sensitive data, and cultural and historical artifacts. The company has 225,000 customers worldwide, including 95% of the Fortune 1000, and a customer retention rate of 98%. (Source: “Corporate Overview, Iron Mountain Inc, last accessed February 9, 2023.)

Iron Mountain’s real estate network includes 1,380 facilities in 63 countries across 95 million square feet (730 million cubic feet of physical volume). That’s the equivalent of 1,650 NFL football fields. (Source: “Investor Event & Site Tour,” Iron Mountain Inc, September 20, 2022.)

While Iron Mountain has been reporting record quarterly financials, it has set its sights on even bigger financial growth. In September 2022, it revealed “Project Matterhorn,” a five-year plan that includes investing 16% of the company’s revenue (about $4.0 billion) to capture a larger share of its global addressable market.

By building on its key strengths, Iron Mountain Inc is targeting:

- A revenue compound annual growth rate (CAGR) of about 10% to about $7.3 billion in 2026

- An adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) CAGR of about 10% to about $2.5 billion in 2026

- An adjusted funds from operations (AFFO) CAGR of about eight percent to about $1.5 billion in 2026

- About $150.0 million in one-time costs per year for the 2023–2025 period

Record Q3 AFFO & Adjusted EBITDA

As I mentioned last December, for the third quarter ended September 30, 2022, Iron Mountain reported total revenues of $1.3 billion, a 13.9% increase over the $1.1 billion it reported for the same period of 2021. Excluding the impact of foreign currency exchange, the company’s total revenues went up by 18.2% year-over-year. (Source: “Iron Mountain Reports Third Quarter Results,” Iron Mountain Inc, November 3, 2022.)

The company’s net income climbed by 183% year-over-year in the third quarter of 2022 to $192.9 million, or $0.66 per share. That’s compared to $68.1 million, or $0.23 per share, in the third quarter of 2021. Iron Mountain Inc’s adjusted EBITDA went up by 16.5% year-over-year in the third quarter to a record $469.4 million.

Iron Mountain Inc’s funds from operations (FFO) went up by 5.6% year-over-year in the third quarter to $0.76 per share. Its AFFO rallied by 9.3% year-over-year in the quarter to a record $288.0 million, or $0.98 per share.

In the first nine months of 2022, Iron Mountain Inc’s income was $436.5 million, or $1.49 per share. That’s compared to $391.3 million, or $1.34 per share, in the first nine months of 2021. Its normalized FFO grew in the first nine months of 2022 by 7.2% year-over-year to $2.17 per share. The company’s AFFO increased in the same period by 10.5% year-over-year to $823.1 million, or $2.82 per share.

The Lowdown on Iron Mountain Stock

Iron Mountain Inc has an excellent stock for both income and growth. The company has a solid balance sheet, it reported record adjusted EBITDA and AFFO for the third quarter of 2022, and it continues to expand its international operations.

Management expects the company’s financial growth trajectory to continue. They estimate that Iron Mountain Inc’s total 2022 revenue climbed by up to 17%, its adjusted EBITDA advanced by up to 13%, and its AFFO per share grew by up to 10%. We’ll find out how well Iron Mountain really did in 2022 when the company reports its full-year results on February 23.

Regardless, IRM stock is worth watching.