Hoegh LNG Partners LP: This Income Stream Yields 9.4%

This “Toll Bridge” Pays Out 9.4%

Today’s post highlights “toll bridges,” one of my favorite investing concepts.

Years ago, Warren Buffett praised the characteristics of this business type. He proposed that many great income investments have the attributes of a toll bridge: being unique, being hard to replicate, earning regular fees, and requiring little ongoing investment.

The oil patch provides many such opportunities. Companies that store and transport energy don’t make the most exciting investments, but they collect regular fee income. Across the industry, you can often find yields as high as 12%, 17%, and even 21%.

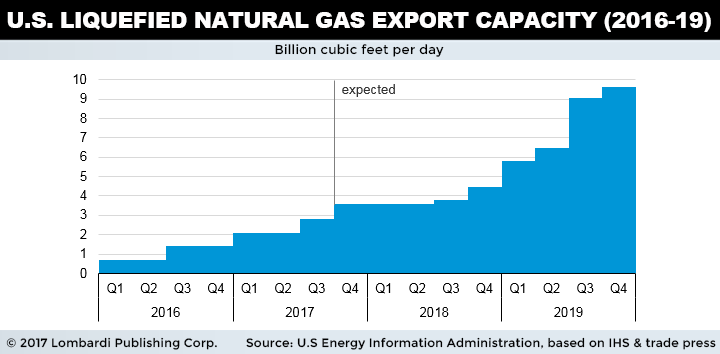

Hoegh LNG Partners LP (NYSE:HMLP) is one such example. The firm processes billions of cubic feet of natural gas each day. And with a yield approaching double digits, I expect this name to become a favorite among income investors over the next few years.

The partnership works like a classic toll bridge business.

Hoegh owns a fleet of floating storage and regasification units (FSRUs). These facilities convert liquefied natural gas (LNG), processing the commodity from a liquid to a gas—as the name implies.

Also Read:

Earn an 11.8% Yield From Top 7 LNG Dividend Stocks

If you want to move LNG from a tanker ship to a utility, you have to pay a firm like Hoegh. The partnership collects steady fee income on each cubic foot of natural gas processed. And, given that using onsite terminals can be an expensive and lengthy process, more countries have turned to these FSRUs as a more affordable alternative.

And business, it seems, is booming.

New drilling techniques have unlocked vast quantities of natural gas across North America. The glut has gotten so bad that prices have actually gone negative at some terminals.

Supplies remain constrained in the rest of the world. And because it’s such a clean0burning fuel, countries have started importing record amounts of LNG. To accommodate the boom, the industry needs more tankers, more storage facilities, and more FSRUs.

For investors, this has created a tidy income stream.

Today, Houegh pays a quarterly distribution of $0.48 per unit. This comes out to an annual yield of 9.4%.

That payout will likely grow. Over the coming years, executives plan to add more vessels to their fleet. And, given the shortage of LNG infrastructure, management will likely be able to raise toll income at or above the rate of inflation.

So can we call Hoegh a sure thing? Hardly.

Management has financed their business with a copious amount of debt. That could backfire if interest rates rise or profits dip.

That said, Houegh’s distribution is backed by an annuity-like business. The company signs long-term, fixed-rate agreements, and profits have almost no exposure to the ups and downs in commodity prices. Executives can literally circle the dates on the calendar decades in advance for when they’ll get paid.

The bottom line: we love toll-bridge businesses here at Income Investors. With their steady cash flows and entrenched market position, they make excellent dividend investments. And with a yield approaching 10%, income hunters should stick Hoegh on their watchlist.