General Electric Company Slashes Quarterly Dividend 50%

GE Slashes Quarterly Dividend

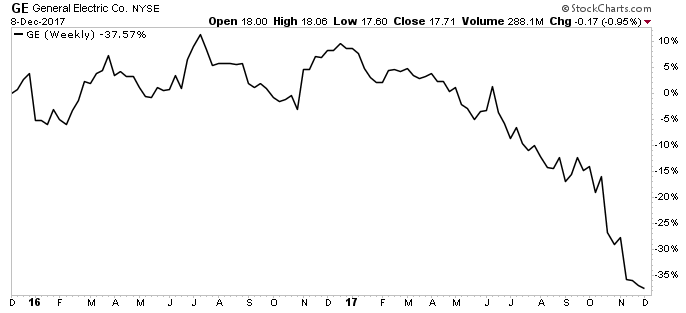

Today’s chart highlights the dangers of chasing big payouts.

Traders usually dump high-yielding stocks for a reason: they often represent struggling companies that will likely slash their distributions.

Take General Electric Company (NYSE:GE), for instance. After a steep drop through the year, General Electric’s stock dividend yield approached nearly five percent. But with profits in decline, that oversized distribution became increasingly unsustainable.

That situation came to ahead in GE’s quarterly dividend announcement Friday, where management slashed the payout to shareholders by 50%. General Electric’s dividend payment day has been scheduled for January 25, 2018. The distribution will be sent to shareholders of record at the close of business on December 27, 2017, bringing General Electric’s ex-dividend date to December 26, 2017. (Source: “GE Board of Directors Authorizes Regular Quarterly Dividend,” General Electric Company, December 8, 2017.)

Investors should’ve spotted a problem in General Electric’s high payout ratio, for starters. Management paid out nearly $0.90 in dividends for every dollar generated in profits. This left the business in a cash crunch, with little funds left over to sustain or grow the business.

Also Read:

General Electric Company: Why GE Stock is a Dividend Juggernaut

Moreover, declining profits put any yield on borrowed time. GE’s power unit has grappled with weak demand and increasing competition for lucrative service agreements. The company’s sprawling spread management’s attention thin, allowing smaller, nimbler competitors to eat up market share.

And if investors missed these warning signs, the stock price chart provided clear evidence something was amiss. Wall Street usually bids up the price of companies offering good, safe dividends. With shares plunging to a 52-week low, it’s clear the smart money wanted out.

Source: StockCharts.com

For GE, a smaller dividend puts the company on a firmer financial footing. The company’s payout ratio will drop to a more sustainable 44%. The move will also free up more cash flow for management to implement their turnaround.

For investors, this episode serves as a good lesson in the danger of chasing yield.