Ellington Residential Mortgage REIT: 8.7%-Yielding Stock Raises Dividend

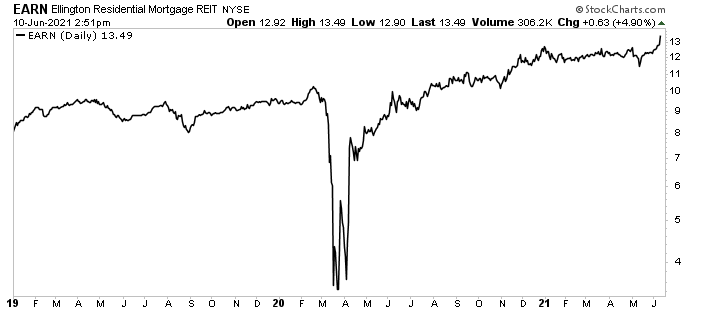

EARN Stock Is in Record Territory

Despite rising long-term interest rates, a steepening yield curve, and increased interest-rate volatility, Ellington Residential Mortgage REIT (NYSE:EARN) has performed well since the start of 2021.

As of this writing, Ellington Residential Mortgage stock is up:

- 10% over the last three months

- 16% over the last six months

- 41% year-over-year

- Five percent year-to-date

Those are pretty strong gains when you take into consideration how the real estate sector, particularly the mortgage real estate investment trust (mREIT) industry, fared during the COVID-19 stock market crash in March 2020.

During that hectic period, Ellington Residential Mortgage REIT saw its share price crater by roughly 65%. It quickly recovered, though. By July 2020, EARN stock had erased all of its pandemic-related losses.

Ellington Residential Mortgage stock has since gone on to record levels. In fact, it recently hit an all-time high of $13.49. As you’ll soon see, there’s a good reason why EARN stock hit that new record high.

Chart courtesy of StockCharts.com

Despite these large stock-market gains, Ellington Residential Mortgage stock continues to pay a high dividend of 8.7%, or $1.12 per share on an annual basis. Truth be told, investors expect Ellington Residential Mortgage REIT to pay a high dividend. It legally has to.

Ellington Residential Mortgage specializes in buying, investing in, and managing residential mortgage and real-estate-related assets.

The company’s primary focus is on residential-backed securities for which both the principal and interest payments are guaranteed by the U.S Government or a U.S. Government-sponsored enterprise.

Instead of owning real estate, Ellington Residential Mortgage REIT owns the debt based on specific properties and uses the spread between borrowing and lending to make money—which it then passes onto investors.

Structured as a REIT, Ellington Residential Mortgage is legally obligated to distribute at least 90% of its income to shareholders on an annual basis. That’s why its dividend yield is so high.

When I wrote about EARN stock back in February, I noted that the company had cut its quarterly dividend a number of times between 2015 and 2019, most recently in the first quarter of 2019, from $0.34 to $0.28. (Source: “Dividend Information,” Ellington Residential Mortgage REIT, last accessed June 17, 2021.)

On the plus side, Ellington Residential Mortgage stock held its dividend payout at $0.28 throughout the pandemic, which is more than I can say for a number of mREITs. And because the company had been reporting better-than-expected financial results, I predicted that Ellington Residential Mortgage would probably begin raising its dividends over the coming months.

And it did just that.

On June 9, the company’s board of trustees declared a second-quarter 2021 dividend of $0.30 per share, a seven-percent increase over the first-quarter dividend. (Source: “Ellington Residential Mortgage REIT Increases Common Dividend,” Ellington Residential Mortgage REIT, June 9, 2021.)

Admittedly, the company has a history of cutting its dividends, so the big question is: “Is the current dividend hike safe, and will the company announce more increases?”

After years of cutting its dividends, chances are good that the company will now continue to raise it. On the surface, it certainly wouldn’t look good for Ellington Residential Mortgage to raise its dividend for just one quarter, only to cut it again.

Judging by the company’s financial results, it seems that management knows what it’s doing.

During the first quarter, Ellington Residential Mortgage’s book value was stable, and its core earnings were solid. The company’s first-quarter book value per share was $13.22, compared to $13.48 in the fourth quarter of 2020. Its core earnings were $3.8 million, or $0.31 per share. (Source: “Ellington Residential Mortgage REIT Reports First Quarter 2021 Results,” Ellington Residential Mortgage REIT, May 3, 2021.)

The outlook is bright for this dividend stock. According to management, mortgage repayment speeds remain strong, but the company is seeing signs that the prepayment wave is slowing. That’s actually great for Ellington Residential Mortgage, since borrowers paying their mortgages quicker than expected means interest won’t accrue as much.

CEO Laurence Penn noted that the rapidly shifting market plays to the company’s strengths, “where asset selection and risk management will continue to drive performance.” Penn added that the company continues to “deploy a dynamic and adaptive hedging strategy to protect book value.” (Source: Ibid.)

That’s why Ellington Residential Mortgage was able to finally resume increasing its dividend. And with a payout ratio of just 37.5, it’s fair to say that its dividend payout is safe. Not only that, the company has more than enough room to continue increasing its dividends. That’s probably what investors are hoping for, and it might explain the big jump in EARN stock’s share price on June 10, one day after the company announced the increase.

The Lowdown on Ellington Residential Mortgage REIT

Ellington Residential Mortgage REIT is an excellent way for investors to secure a high-yield dividend.

With the real estate market heating up and mortgage prepayments slowing down, the outlook for Ellington Residential Mortgage stock is optimistic. This points to increased dividend payouts and the company’s share price in record territory.