Ellington Residential Mortgage REIT: Alternative Bank With Safe 9.2% Dividend

Ellington Residential Mortgage Stock Is a Top Income Stock

Thanks to barely-there interest rates, the Federal Reserve has successfully sucked the income from fixed-income investments. Sure, investors like America’s big banks, but their dividends leave a little to be desired. For example, Wells Fargo & Co (NYSE:WFC) provides an annual dividend of 1.2%.

But a group of firms I like to call “Alternative Banks” provide significantly higher dividends. One such company is Ellington Residential Mortgage REIT (NYSE:EARN).

Ellington Residential Mortgage REIT is, as its name suggests, a real estate investment trust (REIT) that specializes in buying, investing in, and managing residential mortgage- and real estate-related assets. The company’s primary focus is residential-backed securities for which both the principal and interest payments are guaranteed by the U.S Government or a U.S. Government-sponsored enterprise.

And the REIT is good at what it does—if its history of strong financial results is anything to go by.

During the third quarter, Ellington Residential Mortgage generated net income of $8.1 million, or $0.66 per share. Its year-to-date net income was $12.7 million, or $1.03 per share. Core earnings came in at $4.8 million, or $0.39 per share. (Source: “Third Quarter 2020

Earnings Conference Call,” Ellington Residential Mortgage REIT, November 5, 2020.)

At the end of the third quarter, Ellington Residential Mortgage stock was trading around $11.00 per share but it had a book value of $13.17 per share, which included the third-quarter dividend of $0.28 per share.

EARN Stock Could Resume Dividend Hikes

For income hogs, you can’t get much better than Ellington Residential Mortgage stock’s 9.2% dividend yield, which translates into a quarterly dividend rate of $0.28 per share. The company has a payout ratio of just 61.9%.

Ellington Residential Mortgage REIT can afford to pay out such a high dividend because it’s structured as a REIT. For federal income tax purposes, it’s legally obligated to distribute at least 90% of its income to shareholders on an annual basis.

Last December, it declared a dividend for the fourth quarter of 2020 of $0.28 per share.

While Ellington Residential Mortgage’s dividend experienced a number of cuts leading up to the COVID-19 crisis, it was not alone. But EARN stock has performed better than most during the coronavirus pandemic. In fact, it maintained its dividend payout throughout 2020, a year when many mortgage REITS slashed their dividends. (Source: “Dividend Information,” Ellington Residential Mortgage REIT, last accessed February 11, 2021.)

Because its third-quarter financial results were better than expected, and the company’s outlook remains solid, chances are good that Ellington Residential Mortgage will resume raising its dividend payout over the coming months.

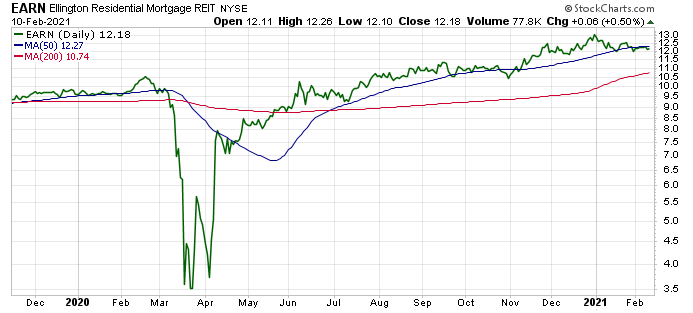

Ellington Residential Mortgage Stock Erases All COVID-19 Losses

In addition to having a safe 9.2% dividend, EARN stock has erased all of its losses associated with the coronavirus-fueled sell-off last March. Ellington Residential Mortgage stock is actually up 15.6% from its February 2020 highs and up 6.2% year-over-year.

Chart courtesy of StockCharts.com

That’s a much better bang for your investing buck than Wells Fargo stock, which is down 30.4% year-over-year. That’s not an isolated instance. JPMorgan Chase & Co. (NYSE:JPM) provides a 2.5% dividend and its share price is up just 1.1% year-over-year. Then there’s Bank of America Corp (NYSE:BAC): its dividend yield is 2.2% and its share price is down 5.6% year-over-year.

This isn’t to bash American banks; they’re some of the safest investments around. But investors looking for higher dividends could do a lot better with EARN stock.

The Lowdown on Ellington Residential Mortgage REIT

Ellington Residential Mortgage REIT is a lucrative way for investors to grab a stable, high dividend yield and solid capital appreciation.

Thanks to the company’s legal structure as a REIT, most of its earnings get paid out to investors. In fact, Ellington Residential Mortgage stock pays out some of the highest upfront yields around. Yes, big banks are a great investment, but those who don’t mind doing a little homework can earn more from alternative banks like Ellington Residential Mortgage.