Dorian LPG Ltd’s Incredible 61.4%-Yield Dividend Is Safe & Reliable

LPG Stock’s Price & Dividend Are Up in 2022

Some ultra-high-yield dividend stocks are too good to be true. The higher the yield, the riskier the investment. When it comes to the trend being your friend though, there are few better ultra-high-yield dividend stocks right now than Dorian LPG Ltd (NYSE:LPG).

Dorian LPG is a liquefied petroleum gas shipping company that owns 21 modern very large gas carriers (VLGCs) and charters in two VLGCs. Its owned fleet has an average age of 7.8 years. (Source: “Investor Presentation: February 2022,” Dorian LPG Ltd, last accessed May 31, 2022.)

Demand for liquefied petroleum gas will fluctuate, but recently, spot liquefied petroleum gas rates have been surging due to a scarcity of tonnage, with many shipping companies repositioning their vessels to the more profitable U.S.–Far East trade route.

Even when the imbalance subsides, demand for liquefied petroleum gas is expected to remain robust. In 2021, the market hit $128.4 billion. It’s projected to reach $164.4 billion by 2027, expanding at a compound annual growth rate of 3.8%. (Source: “Global Liquefied Petroleum Gas (LPG) Market Report 2022,” GlobeNewswire, May 3, 2022.)

When it comes to the liquefied petroleum gas sector, there are seasonal fluctuations, with the shipping market strongest in the spring and summer. As a result, the demand for Dorian LPG Ltd’s vessels is often higher in the second and third quarters.

It wasn’t that long ago (February) that I last wrote about Dorian LPG stock. At the time, it was trading up by 10% year-to-date and paid quarterly dividends of $1.00 per share, for an ultra-high yield of 15.9%.

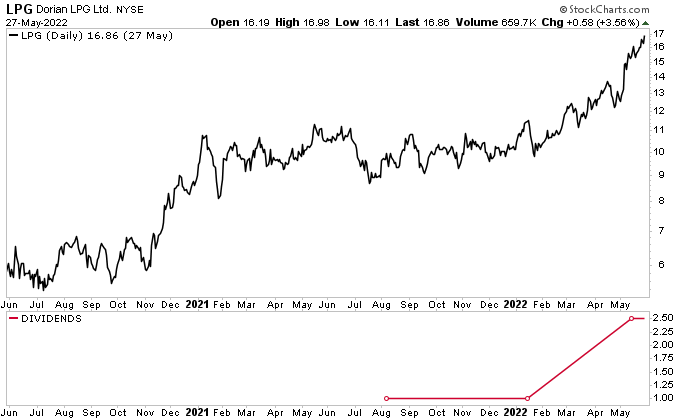

A lot has changed for Dorian LPG Ltd since then, for the better. Thanks to the company’s continued healthy financial results, LPG stock has advanced by an additional 30%. As of this writing, Dorian LPG stock is up by:

- 32% over the last month

- 45% over the last six months

- 69% over the last six months

- 66% year-to-date

- 61% year-over-year

Chart courtesy of StockCharts.com

For income hogs, it gets even better. On May 4, Dorian LPG’s board declared an irregular/special cash dividend of $2.50 per share. That represents a 150% increase over the $1.00 per share it paid out in the previous quarter. (Source: “Dorian LPG Ltd. Declares Cash Dividend of $2.50 per share,” Dorian LPG Ltd, May 4, 2022.)

When the company made that announcement, its dividend yield was an eyewatering 76%. Optimistic shareholders have sent LPG stock considerably higher since then, which has brought the yield down slightly to a still-incredible 61.4%.

Some might ask if that kind of dividend is safe. It most certainly is: the payout ratio is just 55.6%.

Dorian LPG Ltd Reported Solid Q4 Results

For the fourth quarter of fiscal 2022 ended March 31, Dorian LPG reported revenue of $79.6 million. Its time charter equivalent per operating day rate in the fourth quarter was $43,372 per vessel, compared to $33,508 in the third quarter. (Source: “Dorian LPG Ltd. Announces Fourth Quarter and Full Fiscal Year 2022 Financial Results,” Dorian LPG Ltd, May 26, 2022.)

The company’s net income in the fourth quarter was $35.4 million, or $0.88 earnings per share. Its adjusted net income was $24.7 million, or $0.62 in adjusted diluted earnings per share.

For fiscal 2022, Dorian LPG Ltd reported revenue of $274.2 million. Its time charter equivalent per operating day rate for the fiscal year was $34,669, down by 12.5% from $39,606 in fiscal 2021. The company’s net income in fiscal 2022 was $71.9 million, or $1.78 per share. Its adjusted net income in the fiscal year was $53.6 million, or $1.33 per share.

In fiscal 2022, the company declared and paid two irregular dividends totaling $80.5 million. It also repurchased more than $20.4 million worth of its own common stock.

John Hadjipateras, Dorian LPG Ltd’s chairman, president, and CEO, commented, “Supported by good market conditions and access to attractive capital, we generated solid results for the quarter and are pleased to pay an additional $2.50 per share dividend, bringing our total returns of capital to shareholders to over $400 million since our IPO.” (Source: Ibid.)

The Lowdown on Dorian LPG Stock

Dorian LPG Ltd is a leading liquefied petroleum gas shipping company with a massive fleet.

Thanks to the ongoing high demand for liquefied petroleum gas, the company should continue to reward LPG stockholders with share-price gains and growing, ultra-high-yield dividends. This dynamic will ebb and flow as economic conditions change, but for now, the outlook for this dividend stock is exceptional.