Dorchester Minerals Stock: 11%-Yielder Hit Another Record High

Why DMLP Stock’s Price Is Up 36% Year-Over-Year

Bullish sentiment has helped propel crude oil prices by nearly 15% since the start of 2024. A price of $90.00 per barrel is now within reach.

The future demand for oil is uncertain, but ongoing geopolitical tensions, a weakening U.S. dollar, and extended production cuts by the Organization of the Petroleum Exporting Countries Plus (OPEC+) have helped fuel higher oil prices.

The price of Brent crude oil, which comes from oil fields in the North Sea, is holding around $87.00 per barrel. Meanwhile, West Texas Intermediate (WTI) crude oil, which comes from U.S. oil fields, is trading around $82.00 per barrel.

That bodes well for Dorchester Minerals LP (NASDAQ:DMLP), an oil and natural gas exploration and production company I’ve been following for a while.

When I first wrote about the company in October 2021, Dorchester Minerals stock was trading at $18.95. On March 26, 2024, DMLP stock hit a new all-time record intraday high of $34.00, for a gain of approximately 58%.

The Dallas-Texas-based company owns royalty properties (aka interests) in about 593 counties and parishes in 28 states. This diversity gives it exposure to virtually every oil and gas-producing basin in the U.S. (Source: “Form 10-K: Dorchester Minerals, L.P.,” United States Securities and Exchange Commission, December 31, 2023.)

This allows the partnership to take advantage of multiple commodity prices and development cycles.

Dorchester Minerals’ independent engineering consultant estimated that its total proved oil and gas reserves amounted to 83.3 billion cubic feet of natural gas equivalent at the end of 2023. (Source: “Dorchester Minerals, L.P. Announces 2023 Results,” Dorchester Minerals LP, February 22, 2024.)

Of that total, 82% was attributable to the partnership’s royalty properties and 18% was attributable to its net profits interest. Natural gas accounted for 40% of the reserves.

Thanks to high crude oil prices, strong demand for U.S. natural gas, inflation coming down, interest rates expected to decline, and chances of a recession being virtually nil, the outlook for Dorchester Minerals LP is robust.

Dorchester Minerals Stock’s Dividends & Share Price on the Rise

For 2023, Dorchester Minerals reported operating revenues of $163.8 million and net income per share of $114.1 million, or $2.85 per share. (Source: Ibid.)

This allowed the company to declare a distribution of $1.007874 for February 2024. (Source: “Distribution History,” Dorchester Minerals LP, last accessed March 26, 2024.)

As an energy exploration and production company, Dorchester Minerals pays quarterly distributions that fluctuate based on oil and gas prices, which are, in turn, based on supply and demand.

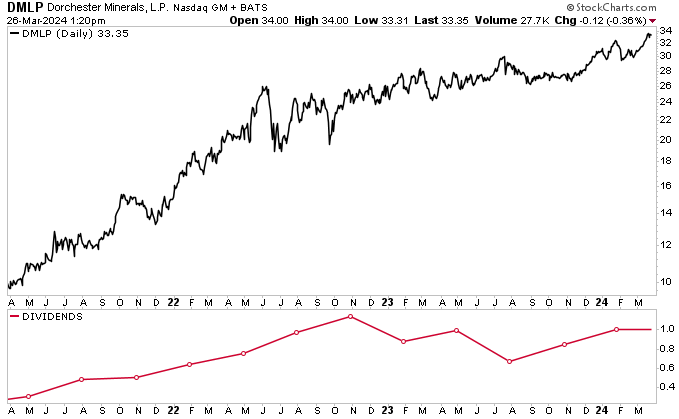

As you can see from the red line in the below chart, DMLP stock’s dividends have fluctuated quite widely over the years. In 2021 and 2022, the partnership raised its payout every quarter. From the beginning of 2021 to the end of 2022, Dorchester Minerals stock’s quarterly payout increased by 368.5% from $0.24226 to $1.135019 per unit.

Nothing goes up forever, though. In February 2023, Dorchester Minerals LP paid a quarterly distribution of $0.884339 per unit, followed by $0.989656 in May and $0.676818 in August of that year.

Since then, however, DMLP stock’s payouts have been going up—to $0.84512 in November 2023 and to the aforementioned $1.007874 per share in February 2024. Dorchester Minerals stock’s current quarterly distribution works out to an inflation-thumping yield of 10.52% (as of this writing).

Chart courtesy of StockCharts.com

As you can see in the black line in the above chart, Dorchester Minerals LP’s share price has been doing well since the COVID-19 pandemic. As of this writing, it’s up by 464% from its April 2020 low.

Again, DMLP stock hit a record intraday high of $34.00 on March 26. This put the stock up by 8.0% year-to-date and 36% year-over-year.

The Lowdown on Dorchester Minerals LP

Dorchester Minerals is a marvelous oil and gas exploration and production company that has been reporting consistently solid financial results and paying out reliable, high-yield distributions.

The outlook for Dorchester Minerals stock’s share price and distributions is bright. The North American oil and natural gas industry raked in record-high profits in 2022 and reported a banner 2023.

That momentum is expected to continue in 2024, which should result in another strong year for Dorchester Minerals LP and its shareholders.