Cross Timbers Royalty Stock: Bullish 8.8%-Yielder Went Up 120% in 2022

CRT Stock Pays Monthly Distributions

In the current economic climate, with decades-high inflation and rising interest rates weighing down stocks, it’s tough to find equities that are worth investing in. And with the odds of a recession shaping up, it looks like 2023 could be another difficult year. That said, energy stocks are expected to remain overweight. They could be the top-performing stocks on the market this year.

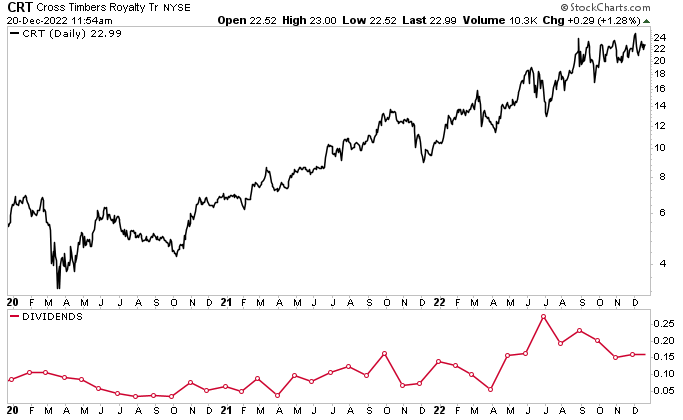

Investors who want to take advantage of the energy industry’s tailwinds might want to consider Cross Timbers Royalty Trust (NYSE:CRT). Cross Timbers Royalty stock isn’t an overlooked energy stock that’s poised to rebound. It was one of the best-performing energy stocks of 2022, up by about 130%.

I’ve been following CRT stock for a while now. It has more than doubled since I wrote about it in July 2021, gone up by about 25% since I profiled it in July 2022, and risen by about 20% since I wrote about it in October 2022.

Not only has Cross Timbers Royalty stock been on a tear in terms of share price, but its dividend yield surged in 2022 to 7.6%. Best of all, the company pays its distributions monthly.

Cross Timbers Royalty is an oil and natural gas exploration and production company that holds 90% of the net profit interests in certain royalty and overriding-royalty property interests in Texas, Oklahoma, and New Mexico. Because these 90% net-profit interests aren’t subject to production or development costs, the income from them generally only varies due to changes in sales volume or energy price. (Source: “About Us,” Cross Timbers Royalty Trust, last accessed December 30, 2022.)

The company also holds 75% of the net profit interests in certain working-interest properties in Texas and Oklahoma. These 75% net-profit interests are conveyed from underlying working interests in seven large, predominantly oil-producing properties. Cross Timbers Royalty Trust’s net profit income from these properties is calculated separately for each state and is reduced by production and development costs.

Most of the company’s net profit income comes from longstanding natural gas properties in the San Juan Basin of northwestern New Mexico.

Unlike some energy companies, Cross Timbers Royalty doesn’t plow capital into developing new wells. Instead, it pays out virtually all of its earnings to CRT stockholders.

Cross Timbers Royalty Trust’s Distributions Went Up 76% in 2022

Since Cross Timbers Royalty is in the energy industry, its monthly distribution fluctuates based on oil and gas supply, demand, sales, price, and development costs. It all depends on where we are in the economic cycle, and right now, the company is in a sweet spot.

In November 2022, Cross Timbers Royalty Trust sold 12,000 barrels of oil—at an average price of $84.47 per barrel—and 93.0 million cubic feet of natural gas—at an average price of $10.74 per 1,000 cubic feet. Cross Timbers Royalty stock’s November distribution (paid in December) was $0.16 per unit. (Source: “Cash Distributions,” Cross Timbers Royalty Trust,” last accessed December 30, 2022.)

In December, the company sold 14,000 barrels of oil— at an average price of $84.61 per barrel—and 101.0 million cubic feet of gas—at an average price of $10.44 per 1,000 cubic feet. That month, Cross Timbers Royalty announced a distribution (to be paid in January 2023) of $0.15 per unit. (Source: “Cross Timbers Royalty Trust Declares December Cash Distribution,” Cross Timbers Royalty Trust, December 19, 2022.)

As you can see in the below table, Cross Timbers Royalty stock’s dividends have varied wildly, going from $5.15 in 2008 to $0.77 in 2020, then rising again. In 2022, CRT stock’s dividends went up by 76% over the 2021 payout and up by 153% over the 2020 payout.

| Year | Dividends/Share |

| 2022 | $1.95 |

| 2021 | $1.11 |

| 2020 | $0.77 |

| 2019 | $0.87 |

| 2018 | $1.42 |

| 2017 | $1.00 |

| 2016 | $1.06 |

| 2015 | $1.35 |

| 2014 | $2.65 |

| 2013 | $2.31 |

| 2012 | $2.48 |

| 2011 | $2.99 |

| 2010 | $2.78 |

| 2009 | $1.88 |

| 2008 | $5.15 |

(Source: “Cash Distributions,” Cross Timbers Royalty Trust,” op. cit.)

In terms of share price, at the end of 2022, CRT stock was up by about:

- 11% over the previous three months

- 38% over the previous six months

- 128% year-over-year

Chart courtesy of StockCharts.com

The Lowdown on Cross Timbers Royalty Stock

What’s not to love about Cross Timbers Royalty Trust right now?

The energy sector was one of the best places to be in 2022, and that trend is expected to continue in 2023. This bodes well for CRT stock’s price and monthly distributions. That combination should be welcome news to even the most discerning dividend hog.