Could Apple Stock Issue a 25% Special Dividend?

“Trigger Event” Bullish for Apple Stock

Today’s chart highlights the coming Donald Trump “trigger event” for Apple Inc. (NASDAQ:AAPL).

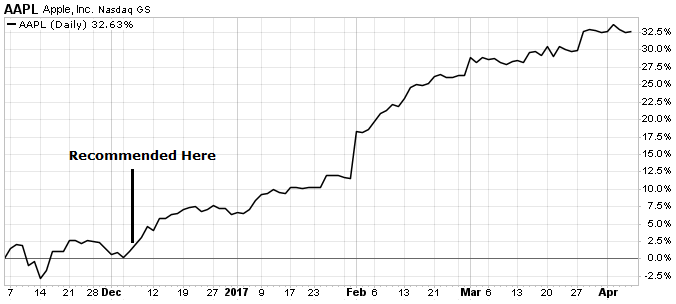

In December, we told Income Investors subscribers to start buying cash-rich tech stocks. Readers have already earned double-digit profits, though we see more upside ahead.

The reason? President Trump has proposed a tax holiday allowing businesses to repatriate foreign cash holdings. If approved, the measure could save corporations billions in levies and spark the biggest wave of dividends in history.

And Apple shareholders might make out like bandits. Last quarter, the company reported $246.0 billion in cash on its balance sheet. Executives, though, have stashed $230.0 billion of this total overseas. Bringing this money stateside would trigger a big tax event, which is why management has parked these funds abroad. (Source: “Form 10-Q,” Apple Inc., December 31, 2016.)

That could change. Under Trump’s proposed plan, Apple could repatriate that cash at a low 10% tax rate. Based on some back-of-the-envelope numbers, that would lower the company’s IRS bill by $50.0 billion.

Most of that money will likely get passed on to shareholders. In the event Apple repatriates all of its overseas cash at once, management could pay out a big one-time dividend. Chief Executive Officer Tim Cook has enough foreign reserves to fork over a 25% special distribution.

More likely, executives would dish out the money in drips and drabs. Management could up stock buybacks or triple the regular dividend. This would bring the yield on Apple stock to a jaw-dropping six percent.

Regardless, traders see something big coming down the pipe. Since December, shares have surged 32%. Analysts have raised their target prices, factoring in the possibility of a holiday.

Other stocks could win, too. Tech giants like Microsoft Corporation (NASDAQ:MSFT), Cisco Systems, Inc. (NASDAQ:CSCO), and International Business Machines Corp. (NYSE:IBM) also have huge cash piles overseas. These shares have popped on tax cut rumors.

Source: StockCharts.com

Of course, you can’t call this thesis a slam dunk. Any holiday will need the green light from Congress. And after the failure of Trump’s healthcare bill, we can no longer call tax cuts a sure thing.

That tells me that you haven’t missed the boat. The market likely hasn’t priced in all of the upside from tax reform. Any bookie would have given you long odds on passing a healthcare bill. Most Republicans, though, can agree on tax cuts.

Bottom line: watch Capital City closely. As more details get leaked from Washington, cash hoarders like Apple should tick higher. This “trigger event” could top the list of dividend stories in 2017.