Compass Minerals International, Inc.: This “Trophy Asset” Yields 4.2%

One “Trophy Asset” to Own Forever

Regular readers know that we love “trophy assets”–high-quality properties that are impossible to replace.

These include wonderful businesses like The Coca-Cola Co (NYSE:KO), the Empire State Building in New York City, and Freeport-McMoRan Inc’s (NYSE:FCX) monster Grasberg copper mine. Most of the time, you have to pay a premium to buy these assets. But once in a while, you can pick up “trophies” at fire sale prices.

Case in point: Compass Minerals International, Inc. (NYSE:CMP). The salt and potash miner has a number of traits I look for in a wonderful business: it has some of the best properties on the planet, is managed by a proven leadership team, and pays out a generous dividend to boot. And thanks to the general doom and gloom surrounding the commodity sector right now, investors can pick up this stock at a once-in-a-lifetime bargain.

The Business

Kansas City-based Compass Minerals is a relatively small operation, with $1.1 billion in annual sales and less than $2.3 billion in market capitalization.

It makes money from two businesses, salt, and fertilizer. And most of its production comes from the Sifto Mine in Ontario, Canada, the biggest rock salt mine in the world.

Needless to say, this sleepy company is the last name you’d ever expect to hear around the cocktail party circuit. Few people even know this firm exists. Fewer still want to hear a “riveting” conversation on rock salt mining. But for investors who know what they’re looking at, the Sifto Mine represents a true trophy asset.

The property produces around eight-million tons of rock salt each year, for starters, most of which gets sold for highway deicing. The company owns all of the land and surface rights around the property. Compass’s lease on the mineral rights extends out to 2022, with an option to renew until 2043. At today’s output, management estimates the mine will stay in operation for another 90 years. (Source: “Compass Minerals 2016 Annual Report,” Compass Minerials Investor Relations, last accessed December 19, 2017.)

Also Read:

Mining Stocks: Surprising place to Finding Top Dividend Stocks

Moreover, the salt seams at Sifto measure in at 100 feet thick. By comparison, most competitors make do with seams only a fraction of that size. This allows Compass to exploit more efficient mining techniques, removing more salt on every inch advanced at the mine. In other words, the company can haul salt out of the ground for a fraction of the cost rivals pay.

If the Sifto mine was located in Texas or central Nevada, no one would really care. These places don’t get a lot of snowfall. Rock salt sells for a low price in relation to its weight, so it doesn’t make sense to ship it far.

A good salt mine needs to be near to customers. And Goderich, Ontario might be the perfect spot. It’s located on the eastern shore of Lake Huron, with access to a nearby port. It’s also placed right smack dab in the middle of the Great Lakes region, which is full of snowy markets that need highway salt every winter — Ontario, Michigan, Wisconsin, New York, and such.

In addition to Sifto, Compass owns a number of other properties including:

- The Winsford mine in northwest England has a thinner salt stream, but still represents the largest rock salt mine in the U.K.

- A mechanical evaporation plant in Amherst, Nova Scotia, Canada. The facility produces almost 50% of the table salt used in homes and food production across Canada.

- The underground salt mine in Cote Blanche, Louisiana produces nearly 15% of America’s highway deicing salt. Thanks to a favorable location on the Mississippi River, Compass can supply most market in the Midwest. (Source: “Locations,” Compass Minerals International, Inc., last accessed December 13, 2017.)

Compass also has a lucrative business in sulfate of potash (SOP) production, a key fertilizer ingredient. Worldwide, geologists have only located three naturally occurring brines for mining this mineral. Compass owns one of these in Utah, and because the company doesn’t rely on more expensive methods to produce SOP, its costs come in a 40% to 50% lower than those of rivals.

For shareholders, such a collection of trophy assets has produced solid returns. Over the past decade, Compass has generated 20%+ returns on invested capital. And because these assets would be difficult to replace, I expect those returns to continue for the next decade or more.

The Management

When you invest in a commodity business, management can be the biggest driver of shareholder returns.

The product you’re selling, by definition, is indistinguishable from competitors. How executives allocate capital often makes the difference between a dud investment and a grand slam home run.

Around our research office, we’ve always admired the management team at Compass Minerals. Current and past executives have found a good balance between growing operations and paying dividends to shareholders. Over the past few decades, every dollar reinvested back into the business has created at least $1.00 or more of market value.

Take the current project to reduce costs at the Sifto mine, for example. Management could’ve chosen instead to make a number of flashy, ego-boosting acquisitions. This growth, however, tends to come with a steep price tag. Though it will never put an executive on the cover of Forbes, improving existing operations provides a far better return on investment.

Where management has chosen the acquisition route, they’ve deployed shareholder capital wisely. It looks like management paid a fair price for plant nutrients distributor Produquímica. Other purchases have enhanced the strengths of existing assets, supporting the company’s salt and fertilizer businesses.

Moreover, we like management’s compensation scheme. Long-term payouts depend upon returns on invested capital and total shareholder returns (including dividends and buybacks) versus the Russell 3000 index over a three-year period. This metric incentivizes executives to only pursue high return projects, or pay out remaining profits to shareholders.

This might sound like a small point. Afterall, don’t all management teams work for the benefit of their shareholders? Well if you believe that, I have a line about bridges in Brooklyn.

In reality, most managers don’t care about investor returns. Executives usually have an incentive to grow the business as big as they can. Running a larger empire often comes with a bigger paycheck. Managers will often choose to grow the company, even if new projects offer poor returns for investors.

But by linking pay to investor returns, Compass has aligned the interests of management and shareholders. Executives generally won’t pursue ego-boosting side projects because it will eat into their paychecks. Instead, they’re more likely to just pay owners big, generous dividends, and over time, this can make an enormous difference in your returns.

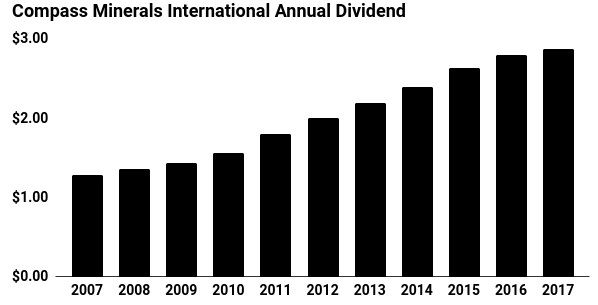

For shareholders, the combination of several trophy assets and a top-tier management team has created a great income stream. Compass has increased its dividend almost every year since starting payments in 2004. Today, the stock pays a quarterly distribution of $0.72 per share, which comes out to an annual yield of 4.2%.

Source: “Compass Minerals International, Inc.,” Google Finance, last accessed December 19, 2017.

The Risks

Compass Minerals comes with three big risks: operations, mild winters, and lower commodity prices.

As with any complex industrial process, Compass comes with operational risk. We saw that earlier this year, where a partial ceiling collapse at the Sifto mine reduced production for six weeks. Thankfully, the accident didn’t injure any workers. The news, however, temporarily hammered shares, reminding investors even a stodgy business can come with surprises.

I consider the other two risks more mundane. Highway deicing accounts for most of the Compass’s sales, so revenues have a strong link to weather. As such, a warm winter can clip profits. Over the long haul, though, the number of good and bad years tends to even out, though I suppose “good” and “bad” depends on your perspective

Furthermore, investors tend to dump shares of all miners during periods of low commodity prices–even trophy assets like Compass. And as long as the materials sector stays out of favor, I expect this company’s shares to stay in the doghouse. For traders looking for quick money profits, that could be a problem. But for investors looking to lock in a reliable dividend, that shouldn’t be an issue.

Eventually, I expect “Mr. Market” to recognize the true value of this business.

The Bottom Line on Compass Minerals

In other words, the doom and gloom surrounding the commodity sector have created a great opportunity to buy this great business on the cheap. It’s a trophy asset–one of the biggest and most desirable sets of properties on the planet. And when you go around buying the “beachfront properties” of the investment world, you’ll do pretty well over the long haul.