The 5 Best Retirement Stock Opportunities for 2017

Retirement Stocks to Watch in 2017

Owning the right dividend stocks with a great profile has proven to be a successful venture when working towards retirement. That’s why today’s article is focused on my favorite dividend growth stocks, many of which also enjoy high yields.

A dividend growth stock is one that pays a growing income and generates a lot of cash flow, even after expenses such as wages and rent. The excess income is often put towards shareholders, giving investors the opportunity for income, as well as to participate in the company’s future growth prospects.

A stock’s dividend growth is based on its payment history. Besides showing if the company has a precedent for being shareholder-friendly, dividend hikes are more likely if they have happened before.

Not all dividend growth stocks fit into the same category because the frequency of changes to the dividend differs between businesses. For instance, some companies will increase the dividend every few years, while others do so annually.

Before getting into my favorite dividend growth retirement stocks, here are the benefits of holding such stocks in your portfolio.

Three Ways Dividend Growth Stocks Help You Achieve Your Retirement Goals

1. Maintain a Steady Stream of Income

A dividend stock does not have to continuously pay out. There is always the possibility of the dividend being cut or eliminated outright. But companies that grow their dividends at a steady rate don’t have this concern.

Also keep in mind a company’s discipline, ensuring enough money remains for the dividend. This is in regards to making major business decisions, such as deploying capital into a new investment.

When it comes to dividend growth stocks, more time spent in the investment means a higher average yield on the purchase price, in addition to the steady growth.

2. Inflation Protection

A major concern for any retirement portfolio is the affect of inflation on your plans, retirement or otherwise. Protecting your portfolio from inflation from the start is a major benefit.

For example, let’s say your goal is to retire in 15 years and you have determined where you want to settle down. Even though you took the time to research the financial details, this info will be irrelevant in 15 years., because the cost of living will be higher then than it is today.

Now, let’s take a look at how dividend growth investing can help against inflation. Using the above example, let’s say you bought a dividend paying-stock which kept its payout at the same rate. This would mean that there would be no protection against inflation.

On the other hand, with a dividend growth stock, there would be an increase in the payment. This would result in more money being earned and greater protection.

3. Dividend Growers Outperform the Market

Investors are always looking for long-term investments that perform strongly. But sometimes, it’s a simple strategy that is best, such as dividend growth stocks.

Not only do dividend growth stocks outperform other similar stocks, but the the S&P 500 Index as well. This is the broadest index, containing 500 of the largest U.S. companies, which is why it is used as a benchmark.

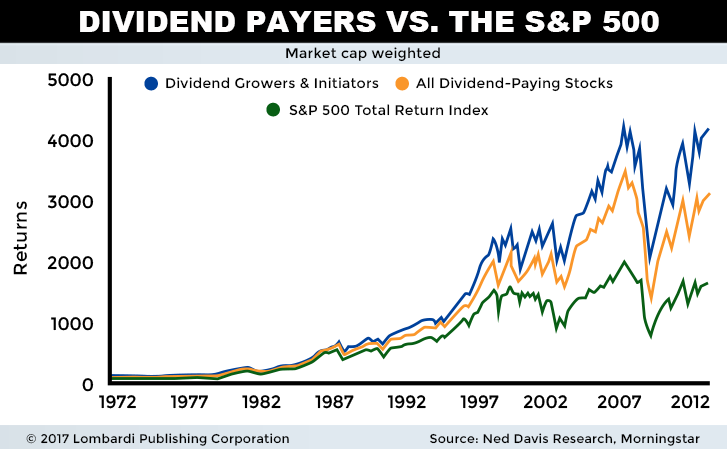

Below is a chart reflecting the returns of dividend growth stocks, all dividend stocks, and the S&P 500 over 40 years.

As you can see, the returns from dividend growth stocks are more than double those of the S&P 500. A major reason for the outperformance is that companies that pay a dividend are less volatile than those that don’t. This is because the income from a quality dividend-paying company will still be paid in a down market.

Dividend growth stocks have outperformed all dividend-paying stocks as well because the income received over time increased. Therefore, based on the initial purchase price, the average yield only goes up, and with it the return.

Now, let’s take a look at my favorite dividend growth stocks that could help you achieve your retirement goals.

List of the Best Retirement Stock Opportunities for 2017

| Company | Ticker | Price | Yield | Consecutive Growth (Years) |

| Target Corporation | TGT | $55.85 | 4.3% | 49 |

| AT&T Inc. | T | $39.63 | 4.95% | 32 |

| PepsiCo, Inc. | PEP | $113.28 | 2.66% | 44 |

| AFLAC Incorporated | AFL | $74.88 | 2.3% | 34 |

| Tesoro Logistics LP | TLLP | $54.86 | 6.85% | 6 |

1. Target Corporation

Target Corporation (NYSE:TGT) is one of the largest retailers in the U.S. The items that line every Target location’s shelves include both consumer staples and discretionary products.

Consumer staples products account for the majority of Target’s revenue. These are the goods needed by consumers no matter how the economy is performing, such as food. In contrast, consumer discretionary products–luxury goods such as electronics and apparel–see growth in sales when the economy is booming and customers have more disposable income.

Selling both product types gives Target a balance in sales. This has benefited the company, with revenue on an upward trend and growing as time passes.

TGT stock should be considered as a retirement stock opportunity. The dividend has seen growth over the past 49 years. It also surpasses the three percent rate of inflation that is typically seen, which is why this investment requires patience; remember, the more time in the stock, the greater the return on the average purchase price.

2. AT&T Inc.

AT&T Inc. (NYSE:T) is a telecommunications company, and one of the largest in the U.S.

AT&T competes directly with only three other telecommunication companies: T-Mobile US Inc (NASDAQ:TMUS), Verizon Communications Inc. (NYSE:VZ), and Sprint Corp (NYSE:S). This oligopoly environment makes it hard for a new entry to take market share away from these four businesses, given the high barriers to entry.

Last year, AT&T began growing with the announcement of its intent to purchase Time Warner Inc (NYSE:TWX) for $85.4 billion. (Source: “AT&T to Acquire Time Warner,” AT&T Inc. October 22, 2016.)

This will diversify the business for AT&T and transition it into becoming a global media company. The purchase will also grow its existing market share via cross-selling various products with the new incoming customer base. This should result in generating higher margins, because running the business should cost less while revenue increases.

T stock’s dividend is on a current growth streak of 32 consecutive years. Its payout ratio–how much of the earnings are being paid out as a dividend–is 67%, which means $0.67 is paid out for every dollar of earnings. The rest is retained within the business.

3. PepsiCo, Inc.

PepsiCo, Inc.’s (NYSE:PEP) likely needs no introduction. with its global portfolio of brands including “Pepsi,” “Gatorade,” “Frito-Lay,” and “Quaker.”

As mentioned earlier, inflation is a big concern when it comes to achieving one’s retirement goals. This is a concern for PepsiCo as well, because inflation affects revenue, margins, and earnings. Luckily, inflation from the cosst of running the business is passed along to the end consumer via either increasing the price or charging the same amount for a smaller product.

Knowing this information is important before an investment is made because it could impact the dividend down the line. If margins are kept the same or improve, it only means there is a higher probability of seeing a dividend hike.

PEP stock pays its dividend on a quarterly basis and is reviewed annually in May. There have been 44 consecutive years of dividend hikes, and with PepsiCo’s strong earnings and margins, this streak shows no signs of stopping.

4. AFLAC Incorporated

AFLAC Incorporated (NYSE:AFL) is a U.S.-based insurance company that offers both individual and group insurance plans.

Comparing to its peers, AFL stock is trading at a cheap valuation. Its price-to-earnings (P/E) ratio of 11.7 times is below the industry average is 25.9 times. This means that for every dollar of earnings, AFL stock is paying out $11.70, as opposed to the industry average of $25.90.

Sometimes, a stock’s valuation is cheap because of a) weak earnings, b) poor management, or c) market ignorance. After digging deeper into AFLAC’s financials, I have concluded that the reason here is c). I say this because the return of equity and return on assets for the company are higher than others in the industry. Its margins are also higher, meaning the company is being run more efficiently than the competition.

Until the market become more aware of AFLAC, a quarterly dividend payment, currently in its 34th straight year of growth, can be earned.

5. Tesoro Logistics LP

Tesoro Logistics LP (NYSE:TLLP) became a public company in 2011. The company is involved in the transportation of oil and natural gas through its pipeline assets around the U.S.

Tesoro has been paying a dividend since it became a public company. The dividend is paid out on a quarterly basis, with increases occurring at the same frequency, marking 24 straight consecutive quarters.

The dividend can continue to grow for two reasons. One, pipelines are the preferred method of transporting energy around the country. This is because they are more efficient than other methods, such as trucks and railways. Pipelines are also cheaper, much more efficient, and, perhaps most importantly, safer. (Source: “Safety in the Transportation of Oil and Gas: Pipelines or Rail?,” Fraser Institute, last accessed April 28, 2017.)

Second, the company is know for its cash flow. This is because the capital required to run the business is low, consisting only of maintenance. Also, Tesoro’s margins are protected, because, like with PepsiCo, inflation is passed on to the end customer.