Arbor Realty Trust Inc: 7.8%-Yielder Raises Payout for 6 Straight Quarters

ABR Trust Stock Dishes Out Reliable, Growing Dividends

Stocks are at record levels, but they recently took a hit when news emerged that the Federal Reserve could begin raising its key lending rate over the next few months. That’s good news for passive income investors, but interest rates will still be near historic lows. This, coupled with soaring inflation, is hardly anything to get excited about.

Investors looking to kick the Fed and inflation to the curb might want to take a look at Arbor Realty Trust Inc (NYSE:ABR). It’s a real estate investment trust (REIT) that invests in a portfolio of structured finance assets in the multifamily, single-family, and commercial real estate markets. (Source: “Arbor Realty Trust Investor Presentation: November 2021,” Arbor Realty Trust Inc, last accessed January 7, 2022.)

The company also directly acquires real property and invests in real estate-related notes and certain mortgage-related securities.

Arbor Realty Trust Inc’s product lines include:

- Balance sheet loan origination

- Government-sponsored enterprise/agency loan origination

- Private-label loan origination

- Servicing of loans

- “SFR,” a proprietary single-family rental portfolio platform

As one would hope, this provides the REIT with strong revenue generation.

Third-Quarter Results

In the third quarter ended September 30, 2021, Arbor Realty Trust’s net income was $72.8 million, or $0.51 per diluted common share. In the quarter ended September 30, 2020, it was $82.0 million, or $0.72 per diluted common share. (Source: “Arbor Realty Trust Reports Third Quarter 2021 Results and Increases Quarterly Dividend to $0.36 per Share,” Arbor Realty Trust Inc, October 29, 2022.)

The REIT’s distributable earnings in the third quarter of 2021 were $75.7 million, or $0.47 per diluted common share, compared to $67.1 million, or $0.50 per diluted common share, in the quarter ended September 30, 2020.

As of September 30, 2021, Arbor Realty Trust Inc’s loan and investment portfolio’s unpaid principal balance (excluding loan loss reserves) was $9.2 billion with a weighted average current interest pay rate of 4.6%, compared to $7.4 billion and 4.9% as of June 30, 2021.

The average balance of the company’s loan and investment portfolio in the third quarter (excluding loan loss reserves) was $8.2 billion with a weighted average yield of 5.6%, compared to $6.6 billion and 5.9% in the second quarter of 2021.

Also in the third quarter of 2021, Arbor Realty Trust Inc:

- Grew its portfolio by 24%, or $1.8 billion

- Originated 118 loans totaling $2.5 billion, the vast majority of which were multifamily bridge loans

- Paid off and paid down 54 loans totaling $567.9 million

- Committed to fund a $17.6-million single-family rental build-to-rent loan

10 Straight Years & 6 Quarters of Dividend Growth

Thanks to its healthy cash flow, ABR stock has been able to provide income hogs with reliable, growing, high-yield dividends. In fact, Arbor Realty Trust stock raised its annual payout for the last 10 years, from $0.28 in 2012 to $1.38 in 2021. (Source: “Dividends,” Arbor Realty Trust Inc, last accessed January 7, 2022.)

Unlike many high-yield dividend stocks, which only raise their payouts once a year, Arbor Realty Trust has raised its quarterly dividends 21 times since 2012.

In October 2021, Arbor Realty Trust Inc’s board declared a quarterly dividend of $0.36 per share, for a yield of 7.8%. This represents the REIT’s sixth consecutive quarterly increase. Over that period, the payout has climbed by 20%.

Of particular note, Arbor Realty Trust maintains the lowest payout ratio in its industry, at just 56.3%. This bodes well for the possibility of ongoing dividend hikes.

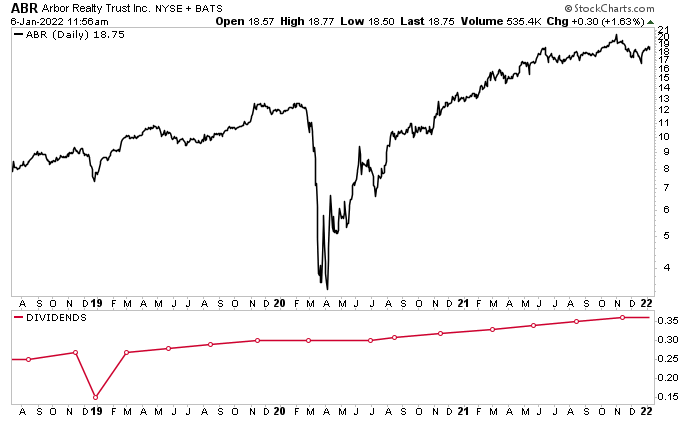

You may notice in the chart below (the red line) that ABR stock’s dividend dipped in January 2019. That’s never a good sign—except when it is. Arbor Realty Trust Inc paid a special dividend of $0.15 per share in January 2019. For the record, that was significantly higher than management’s call that the special dividend would probably be “in the range of $0.10 to $0.12 per share.”

Chart courtesy of StockCharts.com

Arbor Realty Trust Stock Provides Industry’s Leading Total Shareholder Returns

There’s more to Arbor Realty Trust stock than its frothy dividend. As shown in the above chart, Arbor Realty Trust Inc’s share price has been on a tear. Currently trading at $18.75, ABR stock is up by:

- 10% over the last six months

- 40% year-over-year

- 482% since bottoming in March 2020

- 45% from its pre-pandemic sell-off level

Wall Street is bullish on Arbor Realty Trust Inc. Of the analysts providing a 12-month share-price target, their average estimate is $22.33 and their high estimate is $24.00. That points to potential gains of 22% and 28%, respectively.

The Lowdown on Arbor Realty Trust Inc

Arbor Realty Trust stock is a great dividend stock for growth and income. Its share price has been climbing, and its dividend has increased every year since 2012.

As a mortgage REIT, Arbor Realty Trust Inc is legally required to pay out the vast majority of its profits to its shareholders. With interest rates on the rise, chances are good that the company will generate even more cash, which it will hopefully pass onto investors in the form of even higher dividends.