7.9% Income Streams… Hiding In Plain Sight

Wall Street’s Secret Payouts

Most people associate Los Angeles with Hollywood and the stars that live there. But for those in the energy patch, the city constitutes a working oil field.

You can find secret oil wells all over the metropolis. Drillers conceal some inside plain office blocks, or next to schools and shopping malls. And by taking a drive around town, you can find thousands of these facilities hiding right in plain sight.

The same thing happens in the financial business. I call them “Wall Street’s Secret Payouts,” sometimes with payments as high as 7%, 12%, even 15%. You usually don’t see these yields posted in the mainstream press, however, and people look right past them.

How can this happen?

Most news and investment websites don’t publish the total yield stocks offer. To calculate a firm’s annual distribution, news agencies usually take the most recent dividend and multiply it times the payment frequency. They then divide this number by the stock price to compute the yield.

Also Read:

The Stock Market’s Secret Source of Big, Safe Yields

The problem? This number gets thrown off when companies pay out irregular or special dividends. You might see a stock’s yield listed under two percent, but the real distribution could be much bigger.

Take Main Street Capital Corporation (NYSE:MAIN), for example.

The firm pays a monthly dividend of $0.19 per share. Based on some grade five math, that comes out to an annual yield of six percent.

You’ll find that number reported on most investment sites. In fact, many Income Investors readers would look into this name based on that mid-single digit yield alone. Thing is, Main Street’s real distribution looks even better when you look into it further.

In addition to a lucrative monthly dividend, management also pays out two special distributions each year. These payouts vary depending on investment returns. In most cases, though, they can represent distributions two to three times larger than the normal dividend.

If you factor in these special payments, Main Street’s trailing yield jumps to 7.9%. In other words, nearly one-third larger than what most people see on popular investment sites like MSN, TheStreet.com, or Yahoo! Finance.

These discrepancies can sometimes come out much larger.

Consider RLI Corp. (NYSE:RLI), another one of Wall Street’s secret payouts. The specialty insurance company has delivered underwriting profits for over 25 years. This has allowed the business to pay out more than 170 consecutive quarterly dividend payments, in addition to posting 40 straight years of distribution hikes.

At first glance, RLI only yields 1.3%. You’ll see that figure posted on your broker’s website and all of the popular news outlets. The payout looks okay, but most people would skip right over it.

But if you dig a little deeper, you’ll find management rewards shareholders with a special distribution at the end of each year. In most cases, these payments can be 10 times larger than the standard payout. And when you include these in your calculation, the total yield jumps to 4.1%.

This glitch even crops up with blue-chip stocks.

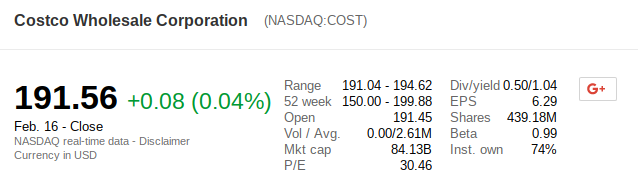

Take a look at the screenshot for Costco Wholesale Corporation (NASDAQ:COST) from Google Finance below. As you can see in the top right-hand side, it shows a dividend yield of just over one percent.

Source: Google Finance

This number doesn’t really reflect how much money Costco returns to shareholders. Every few years, management likes to pay out excess cash to owners. In some cases, these special distributions are 10 to 20 times larger than the regular dividend.

Last summer, for example, Costco announced a $3.1 billion special dividend to shareholders, which came out to $7.00 per share. In other words, investors received more cash from this single payout than they would have otherwise earned over three and a half years. If you include this payment in Costco’s trailing yield, the total payout on shares jumps to 4.6%. (Source: Costco to pay special dividend of $7, increases quarterly dividend by 5 cents, MarketWatch.com, April 25, 2017.)

You can find a lot more hidden high yielders like the ones I’ve mentioned. And if you’re willing to do some extra digging, they can become a lucrative source of income. Like the oil wells of Los Angeles, Wall Street’s Secret Payout are hiding right there in plain sight.