ZIM Integrated Shipping Stock Has Eyewatering 75% Yield & Low Payout Ratio

ZIM Stock Is One Dividend Stock to Watch

Despite concerns about a recession, shipping container rates remain strong, with marine container lines set to smash 2021’s record profits by a massive 73%. This comes on the heels of logistics and labor shortages that have been hobbling capacity amid high demand for imports. (Source: “Container Lines Are Set to Smash Year-Old Profit Record by 73%,” Bloomberg, August 9, 2022.)

The global container shipping industry’s net income for this year is forecast to be $256.0 billion. That’s up by $36.0 billion from an estimate in April. In 2021, the industry’s net income hit an all-time high of $148.0 billion.

Two years of economic hurdles have transformed a sector that transports roughly 80% of global merchandise into one of the post-pandemic period’s biggest economic successes. One company that continues to report great financial results and healthy earnings growth is ZIM Integrated Shipping Services Ltd (NYSE:ZIM).

For dividend hogs, ZIM Integrated Shipping stock’s annual payout stands at $27.10 per share, for a yield of 75%! That’s a crazy amount, and investors always need to be careful about chasing enormous dividends. No one would say you’re being overly cautious for taking a critical look at a company with a 75% yield, so let’s dive in.

About ZIM Integrated Shipping Services Ltd

ZIM Integrated Shipping is a global container shipping company with 149 vessels, serving more than 30,000 customers in more than 100 countries in more than 300 ports of call. (Source: “Investor Presentation: Q2 2022 Financial Results,” ZIM Integrated Shipping Services Ltd, August 17, 2022.)

From pharmaceuticals, to airplanes, to agriculture products, the company ships it all. ZIM Integrated Shipping also offers cargo handling, tariff management, schedule information, and other related services supported by offices and representatives around the world. (Source: “Services,” ZIM Integrated Shipping Services Ltd, last accessed September 7, 2022.)

In February 2021, ZIM Integrated Shipping said it had entered a long-term agreement to charter 10 container ships from Seaspan Corporation. Each of those ships have a capacity of 15,000 twenty-foot equipment units (TEU). (Source: “ZIM and Seaspan Announce Strategic Chartering Agreement for LNG-Fueled Vessels,” ZIM Integrated Shipping Services Ltd, February 12, 2021.)

More recently, on August 31, 2022, ZIM Integrated Shipping announced that it had signed a 10-year liquefied natural gas (LNG) sales and purchase agreement with Shell NA LNG, LLC. Valued at more than $1.0 billion, the agreement is for ZIM Integrated Shipping to supply Shell NA LNG with 10 LNG-fueled vessels, each with a capacity of 15,000 TEU. (Source: “ZIM Announces Large-Scale Long-Term LNG Bunkering Agreement With Shell,” ZIM Integrated Shipping Services Ltd, August 31, 2022.)

The 10 vessels, which are expected to enter service during the 2023–2024 period, will transport goods from China and South Korea to the U.S. East Coast and the Caribbean. This will be the world’s first LNG-fueled Very Large Container Ship (VLCS) fleet to operate on the Asia-North America shipping route.

Why Management Expects Full-Year Record Earnings & Profitability

Thanks to the ongoing supply chain crunch and high consumer demand, marine shipping rates are at a premium, and ZIM Integrated Shipping Services Ltd has been making money hand over first.

In 2019, the company’s operating cash flow was $370.6 million. In 2020, it soared to $880.8 million, but that’s nothing compared to the $5.9 billion it reported in 2021.

For the second quarter ended June 30, 2022, the company announced that its revenue jumped by 44% to $3.4 billion. ZIM Integrated Shipping’s second-quarter net income went up by 50% year-over-year to $1.3 billion, or $11.07 per share. Its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) advanced 57% year-over-year to $2.1 billion. Its operating cash flow in the second quarter climbed by 45% to $1.7 billion. (Source: “ZIM Reports Financial Results for the Second Quarter of 2022,” ZIM Integrated Shipping Services Ltd, August 17, 2022.)

During the quarter, ZIM Integrated Shipping Services Ltd’s average freight per TEU increased by 54% to $3,596. Its total cash position at the end of the second quarter increased to almost $4.0 billion.

Eli Glickman, ZIM Integrated Shipping Services Ltd’s president and CEO, noted, “We reported today strong Q2 results, including net profit of $1.34 billion, as well as our best ever first half-year results with standout margins, among the highest of our liner peers.” (Source: Ibid.)

He added, “During this period, we maintained our strong execution, agility and commitment to profitable growth as we continue to advance ZIM’s position as an innovative digital leader of seaborne transportation.”

For the first half of 2022, ZIM Integrated Shipping Services Ltd announced that its revenues climbed by 73% year-over-year to $7.2 billion and its adjusted EBITDA went up by 115% to $4.6 billion. Its net income in the first six months of 2022 advanced 50% year-over-year to $1.3 billion, or $25.26 per share. Its operating cash flow in that period increased by 72% to $3.4 billion.

That momentum is expected to continue.

Quarterly Dividends Increase to 30% of Net Income

ZIM Integrated Shipping Services Ltd noted that it has seen a gradual decline in its freight rates, including for transpacific trade. This is despite ongoing port congestion and high demand. Nevertheless, the company reaffirmed its full-year guidance, which includes another year of record earnings and profitability.

Glickman said the company focuses on identifying attractive growth opportunities and adjusting its fleet size in response to changing market conditions. ZIM Integrated Shipping Services Ltd’s strategy and ability to earn sustainable, long-term profits have allowed it to increase its quarterly dividend from 20% to 30% of the company’s quarterly net income. This will allow ZIM stockholders to benefit even more from the company’s outstanding results.

That’s just the baseline; ZIM Integrated Shipping stock could pay investors a dividend that’s up to 50% of the company’s annual earnings.

On that note, ZIM Integrated Shipping Services Ltd has declared a dividend of approximately $571.0 million, or $4.75 per share, which represents 30% of the company’s second-quarter net income and a 10% one-time cash-up from its first-quarter 2022 net income.

Share-Price Performance

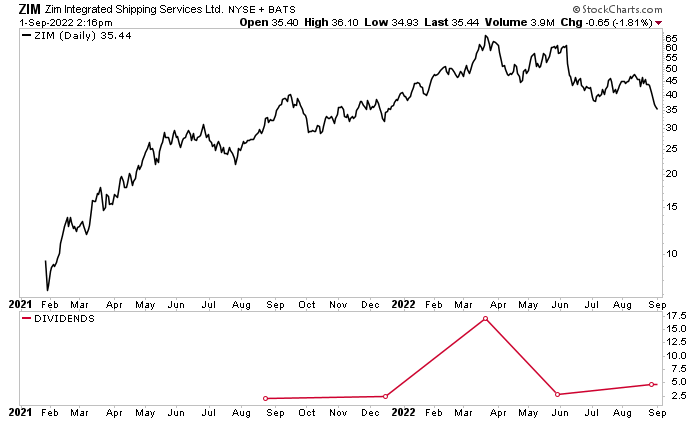

Despite all the great things going on at the company and reassurances that it will have another record year, ZIM stock has been trending downward lately. As of this writing, ZIM Integrated Shipping stock is down by:

- 20% over the last month

- 38% over the last three months

- 13% year-to-date

On top of that, ZIM stock tumbled by 15% on August 26 after trading ex-dividend. The $7.21 drop far exceeds the $4.75 quarterly dividend.

ZIM Integrated Shipping stock has continued to fall since then. Currently trading at $35.51, it’s down by 17% from where it opened on August 26. This overreaction has sent ZIM stock into bargain territory.

Chart courtesy of StockCharts.com

That has more to do with softening spot prices and fears that global shipping demand will slide, should a recession take hold. Analysts have provided a 12-month share-price target for ZIM Integrated Shipping Services Ltd of $52.50 to $63.00. This represents upside potential in the range of 48% to 77%.

The Lowdown on ZIM Integrated Shipping Stock

ZIM Integrated Shipping Services Ltd is a great marine shipping company. It reported excellent second-quarter and first-half 2022 results and reaffirmed its full-year guidance, which includes record earnings and profitability. Management raised ZIM stock’s quarterly distribution to 30%–50% of the company’s annual net income.

ZIM Integrated Shipping’s unique position in its industry, which includes multiple chartering agreements, positions the company to be a top performer and allows it to deliver value to shareholders, including incredible, ultra-high-yield dividends.