ZIM Integrated Shipping Services Ltd’s Massive 26.8% Dividend Is Safe & Growing

ZIM Stock Is Up 35% in 2022

Every savvy investor knows there’s a risk/reward trade-off when it comes to dividend stocks. The higher the yield, the greater the risk. And no one would call you overcautious for questioning the reliability of a dividend stock with an extra-high yield.

It’s not difficult for investors to get sucked into a stock simply because it provides ultra-high dividends. But risking capital for an attractive dividend that might not be safe is the best way to wipe out an initial investment. That certainly isn’t the case with ZIM Integrated Shipping Services Ltd (NYSE:ZIM), though.

ZIM is a global container shipping company with more than 110 vessels serving more than 30,000 customers in more than 300 ports of call in more than 100 countries. From fruit, to pharmaceuticals, to airplanes, to ceramics, to dangerous goods, the company ships it all. (Source: “Investor Presentation: March 2022,” ZIM Integrated Shipping Services Ltd, last accessed April 5, 2022.)

The company’s local offices and representatives around the world also offer cargo handling, tariff management, schedule information, and other related services.

It wasn’t that long ago that I last wrote about ZIM Integrated Shipping Services Ltd. Back in January, the marine shipping stock was up by 24% over the previous month and 85% over the previous six months. It also had a dividend yield of 15.7% and an ultra-low payout ratio.

ZIM Integrated Shipping stock was a great stock back in January, and it’s even better now.

First, the global economy has been recovering from the COVID-19 pandemic, and the demand for products and services has been soaring. Many consumers can’t get what they need fast enough. Thanks to the ongoing supply chain crunch and the high consumer demand, marine shipping rates are at a premium.

Second, ZIM Integrated Shipping Services Ltd has been making money hand over fist. In 2019, its operating cash flow was a solid $370.6 million. In 2020, it soared to $880.8 million. That’s nothing, though, compared to the $5.9 billion of cash flow it reported for 2021.

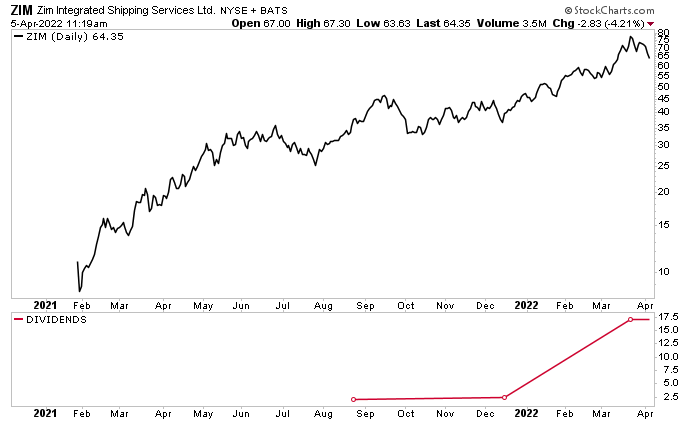

The company’s record financial results have been juicing ZIM stock to record levels. As of this writing, ZIM Integrated Shipping stock is up by:

- 10% over the last month

- 45% over the last three months

- 90% over the last six months

- 35% year-to-date

- 230% year-over-year

Chart courtesy of StockCharts.com

Can ZIM stock maintain its momentum? One would think that its trajectory would have to slow, but no one predicted this kind of pace in the first place.

The demand for shipping containers has been up, and it’s expected to keep going up for the foreseeable future. ZIM Integrated Shipping’s robust guidance for 2022 points to a year of significant gains from ZIM Integrated Shipping stock.

ZIM Integrated Shipping Services Ltd Reports Record 2021 & Declares Monster Dividend

Dishing out gigantic dividends is a good sign that a company continues to have confidence in its near- and long-term outlook.

As you can see in the ZIM stock chart above (the red line at the bottom), ZIM Integrated Shipping only began paying dividends in the second half of last year. ZIM Integrated Shipping stock’s first dividend of 2021 ($2.00) only ate up $237.0 million of the company’s cash. The second payment of the year ($2.50) represented just 20% of the company’s quarterly net income of $12.16 per share. (Source: “Dividend History,” ZIM Integrated Shipping Services Ltd, last accessed April 5, 2022.)

Then we get to the first dividend of 2022. In March, the company reported record financial results for both the fourth quarter and full year of 2021. (Source: “ZIM Reports Record Financial Results for the Fourth Quarter and Full Year 2021,” ZIM Integrated Shipping Services Ltd, March 9, 2022.)

ZIM Integrated Shipping’s fourth-quarter 2021 net income soared by 367% year-over-year to $1.7 billion, or $14.71 per share. Its operating income in the fourth quarter was $2.1 billion, a year-over-year increase of 382%.

The company’s full-year net income was $4.7 billion, or $39.02 per share, up by 787% year-over-year from $524.0 million, or $4.96 per share. Its operating income for the full year of 2021 went up by 706% year-over-year to $5.8 billion.

The outsized gains have allowed ZIM Integrated Shipping Services Ltd to declare a massive $17.00-per-share dividend, representing 50% of the company’s 2021 net income.

Including the special dividend paid in September 2021, ZIM stock has returned approximately $2.6 billion, or $21.50 per share, to its shareholders since going public in January 2021. This represents approximately 30% of the company’s current market cap and, incredibly, is 50% higher than its initial public offering (IPO) market cap.

Even with that $17.00 quarterly dividend, ZIM Integrated Shipping Services Ltd’s payout ratio is a measly 6.4%. The maximum payout ratio I can stomach is 90%. This ultra-low payout ratio gives the company more than enough room to increase its dividend again in the upcoming quarters.

ZIM Integrated Shipping Services Ltd’s management team is bullish about the future. They expect the company to generate adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) between $7.1 and $7.5 billion in 2022. That’s compared to $6.6 billion in 2021.

Management also expects the company to make adjusted earnings before interest and taxes (EBIT) between $5.6 and $6.0 billion in full-year 2022. The company’s adjusted EBIT in 2021 was $5.8 billion.

The Lowdown on ZIM Integrated Shipping Stock

There’s a lot to like about ZIM stock. The company reported another quarter of exceptional financials, and it generated record full-year revenue, adjusted EBITDA, net profit, and operating cash flow. The company also ended the year with a net-positive cash position, providing it with financial flexibility.

ZIM Integrated Shipping Services Ltd is commercially and operationally stronger than ever before, and management expects the company’s momentum to continue in 2022 and beyond. This bodes well for dividend and growth hogs.