5.8%-Yield WP Carey Stock on 27-Year Dividend Streak

Why WPC Stock Is Attractive Right Now

Income investors continue to reap the rewards from high-yield treasury bonds, but the reality is that interest rates are heading lower, and that will result in lower bond yields.

Investors who seek a proven dividend payer might want to take a look at WP Carey Inc (NYSE:WPC), a $13.0-billion market-cap real estate investment trust (REIT) that’s loved by institutional investors and company insiders.

The company is one of the biggest net lease REITs. It has a diverse portfolio of high-quality, operationally critical commercial real estate. (Source: “Corporate Overview,” WP Carey Inc, last accessed May 16, 2024.)

Its holdings include 1,282 net lease properties representing about 168 million square feet. The REIT focuses on single-tenant, industrial, warehouse, and retail properties. Its portfolio includes 89 self-storage facilities.

High interest rates have been negatively affecting REITs due to the high debts that REITs typically have on their balance sheets. Investors’ concern about that has led WP Carey stock to struggle, but its share price has been showing signs of holding.

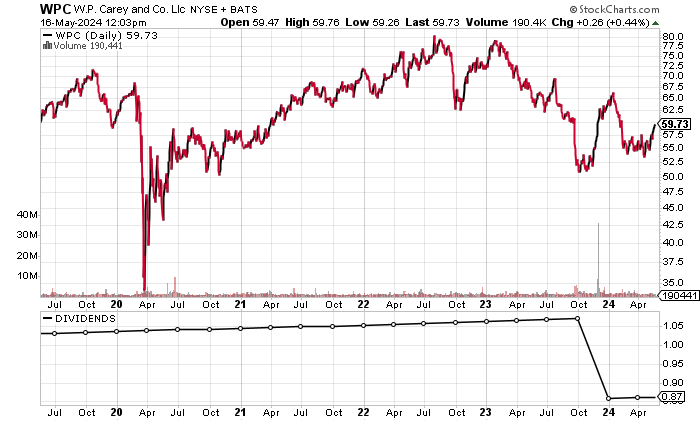

WPC stock traded at a 52-week low of $50.28 on October 6, 2023. As of May 16, it had edged up by 11.5% month-over-month but remained well below its 52-week high of $71.84 and its record high of $91.65 in October 2019, prior to the COVID-19 pandemic.

As WP Carey Inc tries to turn things around, its shareholders get to collect regular dividend income.

Chart courtesy of StockCharts.com

Record-High Revenues & Rising Free Cash Flow

WP Carey Inc’s revenues advanced in the last three straight years, including by double-digit percentages in 2022 and 2023.

The REIT generated record-high revenues of $1.74 billion in 2023, up by 41.5% from $1.23 billion in 2019, before the pandemic. The company’s revenue compound annual growth rate (CAGR) for the 2019–2023 period was a decent 9.1%.

Analysts estimate that the REIT’s revenues will decline by 6.5% to $1.63 billion in 2024, prior to rebounding by 5.0% to $1.71 billion in 2025. (Source: “W. P. Carey Inc. (WPC),” Yahoo! Finance, last accessed May 16, 2024.)

| Fiscal Year | Revenues (Billions) | Growth |

| 2019 | $1.23 | N/A |

| 2020 | $1.21 | -1.9% |

| 2021 | $1.33 | 10.1% |

| 2022 | $1.48 | 11.1% |

| 2023 | $1.74 | 17.7% |

(Source: “W. P. Carey Inc.” MarketWatch, last accessed May 16, 2024.)

WP Carey produced gross margins of more than 90% for 10 straight years.

| Fiscal Year | Gross Margin |

| 2019 | 93.6% |

| 2020 | 95.4% |

| 2021 | 95.4% |

| 2022 | 94.7% |

| 2023 | 92.0% |

On the bottom line, WP Carey has been consistently profitable on a generally accepted accounting principles (GAAP) basis. Its GAAP-diluted earnings per share (EPS) of $3.28 in 2023 share was its second-highest in 10 years.

Expect some bumps over the next two years. As of this writing, analysts forecast that WP Carey Inc will report an earnings decline to $2.45 per diluted share for 2024, followed by $2.53 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.78 | N/A |

| 2020 | $2.60 | 46.2% |

| 2021 | $2.24 | -14.0% |

| 2022 | $2.99 | 33.5% |

| 2023 | $3.28 | 9.8% |

(Source: MarketWatch, op. cit.)

Moving to WP Carey Inc’s funds statement, the REIT has consistently generated positive free cash flow (FCF).

A big plus was the company’s FCF growth over the last three straight years to a five-year best in 2023. This will help the REIT continue paying dividends near their current level.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $646.6 | N/A |

| 2020 | $594.3 | -8.1% |

| 2021 | $812.9 | 36.8% |

| 2022 | $899.1 | 10.6% |

| 2023 | $951.8 | 5.9% |

(Source: MarketWatch, op. cit.)

WP Carey Inc held total debt of $7.9 billion on its balance sheet at the end of March. (Source: Yahoo! Finance, op. cit.)

I don’t see any problem, given the company’s profitability, positive FCF, and healthy amount of cash. Moreover, as mentioned earlier, high debt levels are typical for REITs.

The following table shows that WP Carey can easily cover its interest expenses via its earnings before interest and taxes (EBIT). In 2023, the REIT had a decent interest coverage ratio of 3.6 times. So, for now, the company’s financial situation is manageable.

| Fiscal Year | EBIT | Interest Expense |

| 2020 | $655.3 Million | $210.1 Million |

| 2021 | $635.4 Million | $196.8 Million |

| 2022 | $845.4 Million | $219.2 Million |

| 2023 | $1.0 Billion | $291.9 Million |

(Source: Yahoo! Finance, op. cit.)

WP Carey Inc’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is 4.0, which is just below the midpoint of the Piotroski score’s range of 1.0 to 9.0.

WP Carey Stockholders Can Collect Dividends & Wait

WPC stock has paid dividends for 27 straight years. Furthermore, the stock had been on a 12-year dividend growth streak prior to WP Carey Inc cutting its annualized dividend from $3.87 to $3.46 per share.

WP Carey stock stock’s quarterly dividend in April was $0.865 per share. (Source: “Dividend Information,” WP Carey Inc, last accessed May 16, 2024.)

As of this writing, that represents a forward yield of 5.82%, which is near WPC stock’s five-year average dividend yield of 5.77%. (Source: Yahoo! Finance, op. cit.)

WP Carey stock’s current payout ratio of 148.1% is high, but high payout ratios are common for REIT stocks.

Until the REIT’s earnings improve, I doubt we’ll see a dividend increase from WPC stock.

| Metric | Value |

| Dividend Streak | 27 Years |

| 7-Year Dividend CAGR | -2.0% |

| 10-Year Average Dividend Yield | 7.6% |

| Dividend Coverage Ratio | 2.1 |

The Lowdown on WP Carey Inc

For contrarian income investors, patience could be rewarded with large share-price gains from WP Carey stock. While shareholders wait for the stock’s price to rise, they can collect high-yield dividends.

Note that WP Carey Inc has broad institutional ownership, with 1,034 institutional investors holding 72.0% of the company’s outstanding shares (as of this writing). Company insiders only hold a 1.2% stake of WPC stock, but they purchased a net 301,383 shares over the last six months. (Source: Yahoo! Finance, op. cit.)