Where to Find High-Yield Stocks Right Now

High-Yield Stocks Hidden Here

When I worked in a brokerage office, the branch president shared a great indicator with me. He would pitch a stock idea to 10 clients and then tally their reactions.

If five or more clients bought in, the stock would drop by half. If one or two clients bought in, the stock would do okay. But if he couldn’t sell a single client on the idea, the stock would double or triple in value.

And that makes sense when you think about it. The investing public represents the ultimate contrary indicator. If everyone at your cocktail party owns the same investment as you, it might be time to get nervous.

Which brings me to today’s topic: the United Kingdom. At the moment, it doesn’t look like the country will reach a deal to make an orderly exit from the European Union. Such fears have triggered a sell-off in both equities and the British pound.

Retail investors seem the most panicked. Since the Brexit referendum, savers have yanked more than $8.6 billion out of mutual funds investing in British firms. U.K.-focused mutual funds have ranked dead last in sales over the past two years, according to data from the nation’s trade body, the Investment Association. (Source: “Why British stocks are cheap and why you should snap them up today,” This Is Money, May 4, 2018.)

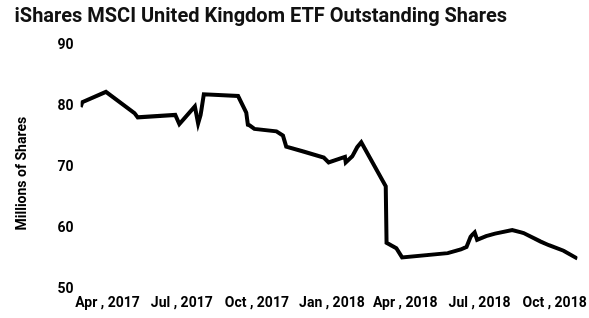

You can see this yourself by checking out the number of outstanding shares for the iShares MSCI United Kingdom ETF (NYSEARCA:EWU). The fund tracks the investment returns of the top 100 or so companies in the country. Its total share count has fallen sharply, being down by more than a third over the past year and a half.

Take a look:

(Source: “EWU Shares Outstanding History,” Shares Outstanding History.com, last accessed November 20, 2018.)

A plunging share count means investors hate U.K. stocks. They’re nervous, they want out, and they’re jumping ship.

The thing is, I love to see this kind of negative sentiment when searching for investments. Apathy starts to breed bargains. When you pitch an idea at parties and nobody likes it, you just might be on to something.

In the case of U.K. equities, investors will practically give stocks away. Shares trade at their lowest multiples since World War II. The country’s stock market now looks to be the cheapest in the world based on the forward price-to-earnings ratio.

For income investors, it also means we can lock in some real payouts. Wonderful businesses like beverage maker Diageo plc (NYSE:DEO), cigarette manufacturer British American Tobacco PLC (NYSE:BTI), and oil producer Royal Dutch Shell plc (NYSE:RDS.A, NYSE:RDS.B) now pay mid-single-digit yields. You’d have a hard time finding distributions that high stateside from blue-chip companies.

You can’t call the U.K. a surefire bet just yet. If the country doesn’t reach a clean Brexit deal, an unorderly exit from the European Union could spark economic chaos. A weaker pound sterling would also hurt American investors converting their shares to U.S. dollars.

That said, fear creates bargains. Nobody likes U.K. stocks right now. And if the president at my old brokerage firm taught me anything, that could mean an opportunity.