Where Retirees Can Find 7% to 12% Yields Right Now

If You Were Born Before 1967, Read This

How do I make decent yield on my savings?

For thousands of Americans approaching retirement, this question keeps them wide awake at night.

And you can’t blame people for worrying.

After all, many folks over 50 have spent decades scraping together a nest egg. During those years, all of the financial experts promised that you could earn plenty of income from your investments.

But thanks to rock-bottom interest rates, it’s now far harder to find safe, sizable yields from normal investments like stocks and bonds.

Bank CDs pay out almost zero. Government bonds yield only one or two percent. You can still earn decent money in junk bonds, but these coupons will likely dry up in the next recession.

In other words, many retirees have to choose between living on beans and rice or gut-wrenching market volatility.

Fortunately, one little-known investment niche could provide an answer: preferred shares.

Preferred shares represent a kind of hybrid investment between a stock and a bond, so they share some characteristics of both.

Also Read:

5 Best Dividend Stocks for Retirement Income

Preferreds pay a fixed interest rate, like a bond. Preferred share owners must also receive their dividend checks before common shareholders see one red cent.

Preferred shares also have a higher claim to any assets than do common stockholders. This means, in plain English, if the business goes bust, you’re ahead of the line to get your money back. So, preferred stocks tend to be much less volatile than regular shares.

Finally, they also pay some of the highest yields around. Thousands of preferred stocks trade publicly in America today, issued by around 200 large companies. Typical payouts range between four and nine percent, with riskier issues yielding up to 12%.

No matter how you look at it, preferred shares belong in every income investor’s portfolio.

The best way to invest? I like owning a “basket” of these issues through closed-end funds. These investments allow you to buy a diversified portfolio of high-quality preferred issues in only a few clicks.

Take the Nuveen Preferred & Income Securities Fund (NYSE:JPS), for example. It’s a fund we tout frequently here on Income Investors.

NIO holds a basket of over 200 preferred issues. Most of these positions are in Grade-A businesses that I’m sure you’ve heard of, including UBS Group AG (USA) (NYSE:UBS), HSBC Holdings plc (ADR) (NYSE:HSBC), and JPMorgan Chase & Co. (NYSE:JPM).

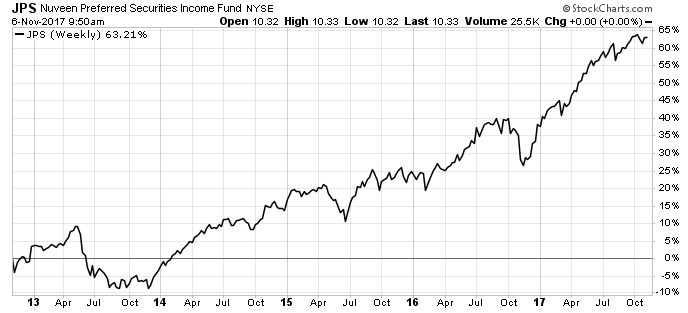

Chart courtesy of StockCharts.com

JPS has delivered high-single-digit returns over the last decade. And, at the current price, JPS yields nearly seven percent.

Better still, shares often trade at a discount to their net asset value. Over the past decade, JPS has traded at five percent below the value of its investment holdings. So, if you’re willing to wait for a market pullback, it’s like buying up dollar bills for $0.95 or less.

For retirees looking for safe retirement income in a low-rate world, consider preferred share funds like JPS.