Western Union Stock Pays Consistent Dividends & Could Rise in Value

WU Stock Has Been Outperforming the S&P 500

In the current age of digital commerce, the adoption of digital payment technologies has exploded and will continue to grow.

According to a recent report, the global digital remittance market was worth $19.65 billion in 2022 and could rise to $72.44 billion by 2031. This equates to a compound annual growth rate (CAGR) of 15.6% for the period of 2024 through 2031. (Source: “Global Digital Remittance Market Insights,” SkyQuest Technology Consulting Pvt. Ltd., last accessed April 25, 2024.)

This is significant and will provide opportunities to many companies.

Before the emergence of the Internet and digital transactions, Western Union Co (NYSE:WU) was providing money transfer services to individuals and businesses worldwide, dating back to 1871. Today, the company is trying to adapt to the extremely competitive money transfer business.

Western Union operates in more than 200 countries and territories. Its services are used by millions of retail and digital customers daily via its online platform and its hundreds of thousands of agent locations scattered globally. (Source: “About Us,” Western Union Co, last accessed April 25, 2024.)

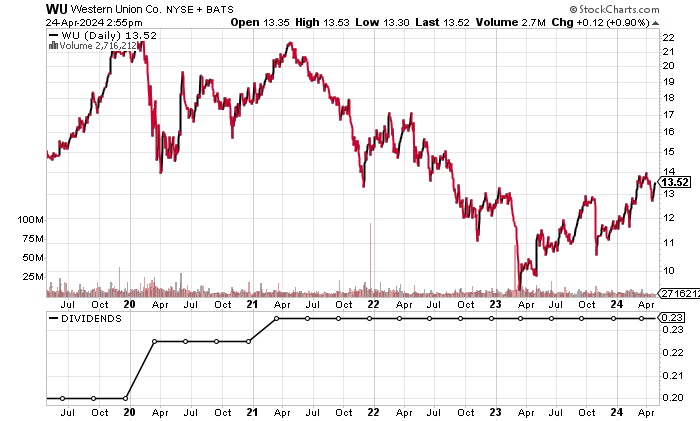

And while the company has work to do, the market appears to be favorable toward Western Union, pushing its stock price up by a market-beating 11.8% this year and 25.2% over the past year (as of this writing). That means Western Union stock has been outperforming the S&P 500.

The stock traded at a 52-week high of $14.19 on March 8, but it remains well below its record high of $28.45 in February 2020.

The following chart shows shares of Western Union Co trading in a golden cross pattern. That’s a bullish technical crossover formation that appears when a stock’s 50-day moving average (MA) goes above its 200-day MA. This could signal additional upside moves by WU stock.

Chart courtesy of StockCharts.com

Western Union Co Reports Profits & Positive Free Cash Flow

Western Union has clearly been negatively affected by the rise of much bigger digital payment companies. The company’s revenues declined in 2022 and 2023 to their lowest levels in 10 years.

The outlook for the company’s revenues is mixed. Analysts estimate that Western Union will report lower revenues of $4.14 billion for 2024, followed by a small rebound to $4.18 billion in 2025. (Source: “The Western Union Company (WU),” Yahoo! Finance, last accessed April 25, 2024.)

The company will need to look at strategies to address its lack of revenue growth.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $5.28 | N/A |

| 2020 | $4.82 | -8.6% |

| 2021 | $5.11 | 6.0% |

| 2022 | $4.47 | -12.6% |

| 2023 | $4.35 | -2.7% |

(Source: “Western Union Co.” MarketWatch, last accessed April 25, 2024.)

Western Union Co has consistently produced gross margins of at least 40%, prior to seeing a decline in 2023.

| Fiscal Year | Gross Margin |

| 2019 | 42.4% |

| 2020 | 41.6% |

| 2021 | 42.9% |

| 2022 | 41.4% |

| 2023 | 38.9% |

As far as its bottom line goes, Western Union Co has been consistently profitable based on generally accepted accounting principles (GAAP)-diluted earnings per share (EPS), but it will need to improve its consistency.

Analysts expect Western Union to report an adjusted $1.70 per diluted share in 2024 and $1.78 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $2.46 | N/A |

| 2020 | $1.79 | -27.0% |

| 2021 | $1.97 | 9.9% |

| 2022 | $2.34 | 19.0% |

| 2023 | $1.68 | -28.2% |

(Source: MarketWatch, op. cit.)

Moving on to Western Union Co’s funds statement, the company has consistently generated positive free cash flow (FCF). This included a 38.3% increase in 2023. The company uses its FCF to pay dividends, buy back its own shares, and reduce its debt.

| Fiscal Year | FCF | Growth |

| 2019 | $866.5 Million | N/A |

| 2020 | $841.0 Million | -2.9% |

| 2021 | $1.01 Billion | 19.8% |

| 2022 | $549.7 Million | -45.4% |

| 2023 | $760.2 Million | 38.3% |

(Source: MarketWatch, op. cit.)

Western Union Co’s balance sheet is manageable, with $1.77 billion in cash and $2.67 billion in total debt. (Source: Yahoo! Finance, op. cit.)

The company has managed to easily cover its annual interest expenses with higher earnings before interest and taxes (EBIT). Its interest coverage ratio of 8.1 times in 2023 was extremely strong and suggests that the company has no problems paying its interest expenses.

| Fiscal Year | EBIT | Interest Expense |

| 2020 | $973.6 Million | $118.5 Million |

| 2021 | $1.0 Billion | $105.5 Million |

| 2022 | $1.1 Billion | $101.0 Million |

| 2023 | $851.1 Million | $105.3 Million |

(Source: Yahoo! Finance, op. cit.)

Western Union Co’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a reasonable 5.0. This is just above the midpoint of the Piotroski score’s range of 1.0 to 9.0.

Western Union Stock’s Dividends Expected to Continue

Western Union has paid dividends for 19 consecutive years, but it hasn’t raised its dividend level since March 2021. Before that, the company raised its dividends for seven straight years. (Source: “Dividend History,” Western Union Co, last accessed April 25, 2024.)

WU stock’s forward dividend yield of 7.01% (as of this writing) is attractive and above its five-year average yield of 5.27%. The company’s payout ratio of 55.9% is reasonable. (Source: Yahoo! Finance, op. cit.)

| Metric | Value |

| Dividend Streak | 19 Years |

| 7-Year Dividend Compound Annual Growth Rate | 5.6% |

| 10-Year Average Dividend Yield | 5.2% |

| Dividend Coverage Ratio | 2.2 |

The Lowdown on Western Union Co

Western Union Co is a work in progress, but the company generates profits and positive FCF, which allows it to pay distributions. With Western Union stock, investors collect nice dividends while achieving some capital appreciation.

Note that WU stock has strong institutional ownership, with 664 institutions holding 96.3% of the outstanding shares. The top two institutional investors are The Vanguard Group, Inc., with a 12.01% stake, and BlackRock Inc (NYSE:BLK), with a 10.75% stake. (Source: Yahoo! Finance, op. cit.)