Wendy’s Stock: High-Yielder Up 41% YOY & Has 30% Upside

Why WEN Stock Is Worth Watching

With more than 2,350 companies listed on the New York Stock Exchange (NYSE) and more than 3,625 on the Nasdaq, there are a lot of stocks to choose from. There are fewer to consider, however, if you follow Warren Buffett’s advice to “never invest in a business you cannot understand.”

One type of business that most people are familiar with is restaurants. A standout in that industry is Wendy’s Co (NASDAQ:WEN), a large global fast-food company that pays high-yield dividends.

While other fast-food companies like McDonald’s Corporation (NYSE:MCD) tend to hog the industry spotlight, investors might want to now focus their attention on Wendy’s Co.

The Dublin, Ohio-based company recently reported fabulous quarterly financial results, opened 39 restaurants, doubled its quarterly dividend, and announced a new share-repurchase program. Management said it expects that momentum to continue throughout 2023.

Wendy’s Co operates, develops, and franchises fast-food restaurants around the world. “Wendy’s” restaurants are best known for their made-to-order square hamburgers and the “Frosty” dessert. The company and its franchisees operate about 7,000 restaurants.

The company operates through three segments: Wendy’s U.S., Wendy’s International, and Global Real Estate & Development.

The Wendy’s U.S. segment involves the operation and franchising of Wendy’s restaurants in the U.S. The Wendy’s International segment involves the operation and franchising of Wendy’s restaurants outside the U.S. The Global Real Estate & Development segment involves leasing and/or subleasing sites (which the company either owns or leases from third parties) to franchisees.

Strong 2022 Financial Performance Carries Into 2023

Any company can have one good quarter. This isn’t the case with Wendy’s Co, though; it has a long history of reporting wonderful financial results.

In 2022, the company’s total revenue increased by 10.5% to $2.1 billion and its adjusted revenues increased by 12.1% to $1.7 billion. Its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) climbed by 6.6% to $467.8 million. (Source: “The Wendy’s Company Reports Fourth Quarter and Full Year 2022 Results,” Wendy’s Co, March 1, 2023.)

Its full-year 2022 operating profit slipped slightly to $353.3 million, while its net income fell by 11.5% to $177.4 million, or $0.82 per share. Its full-year free cash flow (FCF) fell by 19.0% to $213.1 million.

For 2022, Wendy’s Co also reported:

- Its 12th consecutive year of global same restaurant store (SRS) growth

- Its second consecutive year of double-digit two-year global SRS growth

- Its global digital business climbing to record highs

- Opening more than 275 restaurants

- Having more than 300 potential franchise candidates in its recruiting pipeline

“Our strong 2022 results and the progress we made against our strategic growth pillars have laid the foundation for continued growth for years to come,” said Todd Penegor, Wendy’s Co’s president and CEO. (Source: Ibid.)

True to Penegor’s word, the company reported superb first-quarter 2023 results, which included its sixth consecutive quarter of double-digit global SRS sales growth on a two-year basis. That represents an over-250-basis-point year-over-year expansion of its company-operated restaurant margin. (Source: “The Wendy’s Company Reports First Quarter 2023 Results,” Wendy’s Co, May 10, 2023.)

The company’s first-quarter revenue went up by 8.2% year-over-year to $528.8 million, while its adjusted revenue climbed by 7.9% to $427.4 million. Its operating profit improved in the first quarter by 12.8% year-over-year to $84.5 million. Meanwhile, its net income increased by 6.4% to $39.8 million, or $0.19 per share. Its adjusted earnings per share (EPS) grew by 23.5% to $0.21.

Wendy’s Co’s adjusted EBITDA advanced in the first quarter by 17.5% year-over-year to $125.6 million, while its cash flow from operations jumped by 152.4% to $53.0 million, and its FCF jumped by 43.5% to $63.7 million.

Penegor noted, “Our strong first quarter results build on the momentum we created in 2022. Our successful start to the year and clear alignment behind our strategic pillars give us confidence that we will deliver meaningful global growth for the remainder of 2023 and beyond.” (Source: Ibid.)

Management Reaffirmed 2023 Guidance

Wendy’s Co has reaffirmed that, for 2023, it expects:

- Global systemwide sales growth in the range of six to eight percent

- Adjusted EBITDA in the range of $530.0 to $540.0 million

- Adjusted EPS in the range of $0.95 to $1.00

- Cash flow from operations in the range of $340.0 to $360.0 million

- Capital expenditures in the range of $75.0 to $85.0 million

- FCF in the range of $265.0 to $275.0 million

(Source: Ibid.)

For 2024–2025, the company expects systemwide sales growth in the mid-single digits and FCF growth in the range of high single digits to low double digits.

Wendy’s Co Hiked Dividend 100% & Repurchased Shares

In January, Wendy’s announced that it was raising its quarterly dividend by 100% to $0.25 per share. It maintained that payout in the second quarter, for a current yield of 4.5%.

The company also creates value for investors through share repurchases.

In 2022, the company repurchased 3.5 million shares of Wendy’s stock for $51.9 million. In the first quarter of 2023, it repurchased 1.8 million shares for $38.8 million. In the second quarter, as of May 3, Wendy’s Co repurchased 1.1 million shares of WEN stock for $23.6 million. The company has approximately $437.6 million available under its $500.0-million share repurchase authorization that expires in February 2027.

Wendy’s Stock Beating S&P 500 & Restaurant Industry

What’s better than a growing, high-yield dividend stock? One that thumps the broader market and its peers in terms of share price.

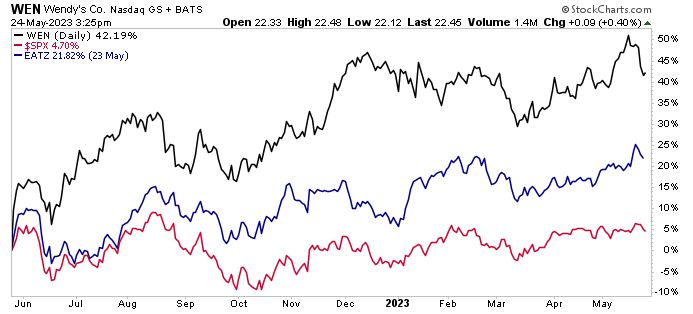

Over the last year, WEN stock has rallied by 41%. Over the same time frame, the S&P 500 has gone up by just 4.7% and the AdvisorShares Restaurant ETF (NYSEARCA:EATZ) has climbed by 21.8%.

Those are big gains from Wendy’s Co, and Wall Street analysts expect Wendy’s stock to climb considerably over the next 12 months. They have an average target of $25.19 per share and a high target of $29.00. This points to potential gains in the range of about 12% to 30%.

Chart courtesy of StockCharts.com

The Lowdown on Wendy’s Co

Wendy’s is one of the most recognized fast-food restaurant companies in the world. It has a long history of reporting solid financial results; paying reliable, high-yield dividends; and providing robust share-price gains.

The company reported excellent 2022 financial results and impressive first-quarter 2023 results. Management reaffirmed their full-year guidance, which includes SRS growth in the mid-single digits. They also maintained their outlook for 2024–2025.

For yield hogs, Wendy’s Co’s momentum and strong liquidity have allowed the company to hike its quarterly dividend by 100% and authorize a new $500.0-million share-repurchase plan. This big outlay is a testament to management’s belief that the company has the financial flexibility to continue investing in growing its business and delivering significant long-term value to WEN stockholders.