Wells Fargo Preferred Shares: An Investment Yielding 5.7%

Earn a 5.7% Yield…From Wells Fargo?

Any of this sound familiar?

- Your “high” interest rate savings account pays only one percent.

- Longer-term bank certificates of deposit pay a bit better, but the yields hardly knock your socks off.

- The payouts on junk bonds and dividend stocks look okay, but the market ups and downs keep you up at night.

You’re not the only one struggling with low interest rates. One-quarter of retirees report having to offer less help to family members and local charities. Over half report having to cut spending on travel, recreation, and dinners out. (Source: “No B.S. Marketing Letter,” Dan Kennedy, July 2012.)

One solution? Preferred stocks.

This quite niche of the financial world combines the safety of bonds with the return potential of stocks. You can scoop up yields ranging from five to nine percent from some of the most profitable businesses on earth. Thousands of investors rely on them for reliable income.

One of them is the preferred shares of Wells Fargo & Co (NYSE:WFC). Specifically, I’m talking about Wells Fargo & Company Non-Cumulative Perpetual Preferred Series T (NYSE:WFC-T). Income investors should take a look for a couple of reasons.

Numero uno, you get safety. Wells Fargo is investment-grade. That means the company has ample buffer room in the event of a downturn, making it one of the most conservative big banks in the country. This Warren Buffett holding cruised through the financial crisis, never skipping a single payment to common shareholders.

These preferreds, though, have even more built-in security. This class of stockholders must get paid before the common shareholders see one penny in dividends. In the event of a bankruptcy, preferred shareholders get their money back before the common stockholders.

You can think of preferreds as a kind of hybrid between stocks and bonds. Like bonds, they get issued at a par value ($25.00). And like fixed-income investments, they usually come with fixed payments. This provides a lot more security than traditional dividend stocks.

Number two, you have to love the yields. Preferreds usually get issued with a fixed payout. This dividend won’t grow over time like typical dividend stocks. But for those looking for income today, this trade-off makes sense.

Preferreds also come with a big tax advantage. Bond interest, as any longtime investor knows, get taxed at your marginal tax rate. The IRS, however, considers preferreds a type of equity, so they get taxed at your lower dividend tax rate.

All of this means big payouts for owners. Today, the common shares of Wells Fargo stock yield only 2.7%. The “Series T” preferred shares, however, come with a fixed quarterly payment of $0.375 each, which comes out to an annual yield of 5.7%.

I often compare owning preferred stock to the VIP section of the club. As a common shareholder, you’re standing in line outside, just hoping to get past the bouncer. Preferred owners seem to have their own special entrance, with access to the private lounge and other perks.

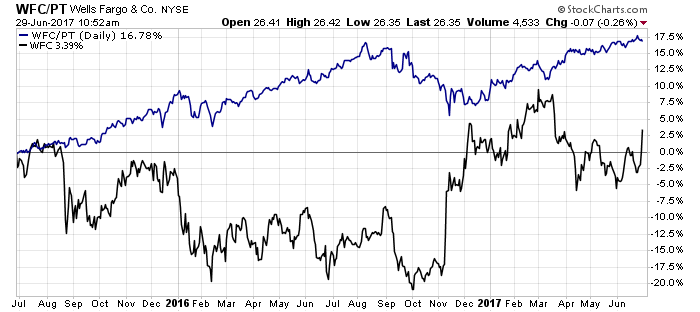

You can see this play out in the chart below. Over the past two years, the common Wells Fargo shares (black) suffered wild swings. Investors got rocked by scandals, election worries, and rising interest rates. The preferred shares (blue), in contrast, just kept chugging along, paying out dividends to owners.

Source: StockCharts.com

Of course, I wouldn’t call preferreds a slam dunk. You really have to dig into the prospectus when it comes to these investments. Small clauses buried in the fine print can trip up lazy investors.

Here’s what you need to know: Wells Fargo can buy back these preferreds at the par value ($25.00) anytime after September 15, 2019. If interest rates drop, management will call back the shares to save money. For owners, that would mean the end of our 5.7% yield and maybe a small capital loss.

I’m not too worried, though. Since Wells Fargo issued these shares, interest rates have shot up. We would need to see a big drop in yields before management would consider refinancing.

The Bottom Line: Low rates have hammered retirees. Preferred shares, however, represent a compelling alternative. Nowhere else can you find big, safe yields topping 10%.

Still, I want to stick to the best of breed names. You can’t get much better than Wells Fargo. And with a yield nearing six percent, income-hungry investors should take a second look at these issues.