Why VF Corp’s Dividend Will Double Again Soon

The best dividend stocks are often the most obscure ones. VF Corp (NYSE:VFC) is an apparel company that many investors don’t even know exists, but given its decades-long history of dividend increases, income hunters should at least keep an eye on it. Moreover, with VFC stock having slipped sharply over the past several months, now seems like the perfect time to do so.

It’s very easy to get caught up in the hype surrounding high-flying momentum stocks on the cusp of the next technological “breakthrough,” but as I always tell our Income Investors readers, boring stories often translate into the market’s biggest returns.

Considering its wide competitive advantages, stable dividends, and cheap-ish valuation, VF Corp represents one of those big-return opportunities.

Let’s take a closer look.

Wholesale Headaches

While the name VF Corp is relatively unknown, the brands that drive its business—including North Face, Vans, Timberland, and Lee Jeans—are some of the most recognized in the world. This has given the company tremendous pricing power over the years, allowing it to consistently generate industry-topping returns on capital.

More recently, however, strong currency headwinds and general retail weakness have weighed heavily on VF Corp’s revenue and margins, dragging down the stock price along with it.

In the company’s Q4 results released a couple of weeks ago, adjusted EPS edged up only three percent to $0.97, while revenue of $3.3 billion was flat over the year-ago period. The primary source of pain continues come from VF Corp’s North American wholesale business, where a mid-teen decline easily offset low-single digit growth internationally. Overall wholesale revenue decreased at a high single-digit rate.

Additionally, the adjusted operating margin declined 90 basis points to 15.3%.

So given the strong headwinds that the company seems to be facing, why would we even consider biting into VFC stock?

Well, it’s simple: VF Corp’s brands remain stronger than the recent results would lead you to believe.

Brand Power Priorities

For the full year 2016, VF Corp’s revenue actually increased one percent on a currency-neutral basis, driven by solid six-percent growth in the company’s international business. That isn’t exactly awe-inspiring performance, of course, but given the fact that management has been actively reducing sales to the off-price channel, any top-line increase is pretty darn encouraging.

Although we’d love to see our businesses grow year-in and year-out, the reality is that all industries go through ups and downs. But what we never want to see is a company sacrificing brand integrity in the name of a short-term spike in sales.

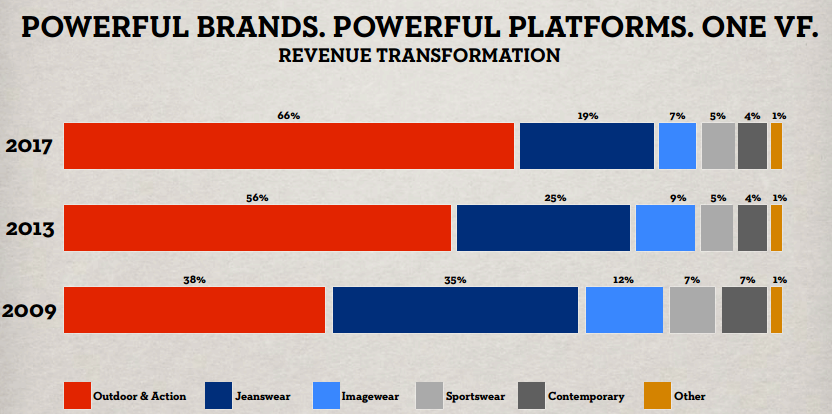

The truth is that VF Corp could’ve easily posted significantly higher revenue and earnings last year with more distribution to the discount channel, but the company determined (correctly) that it would only end up hurting brand strength over the long run. Furthermore, VF Corp continues to strategically tilt its portfolio towards the higher-margin outdoor and action sports segment, which should also set up revenues for much more robust long-term growth.

The company expects the Outdoor and Action segment to account for roughly 65% of business in 2017.

Source: “Powerful Brands. Powerful Platforms. One VF.,” VF Corp

In other words, management remains laser-focused on the quality and sustainability of sales, not on how quickly it can grow from quarter to quarter. Needless to say, that’s a rare thing to find.

In fact, the company’s Q4 adjusted gross margins expanded 160 basis points to 49.8%, largely driven by management’s pricing discipline. So while currency headwinds continue to wreak havoc with operating margins, VF Corp’s still-formidable brand power is fueling record gross margins.

Source: “VF Q4 2016 Results,” VF Corp

“VF’s global business model, diverse brand portfolio and focused operational discipline helped the company deliver solid results in 2016 despite an inconsistent U.S. marketplace,” said Eric Wiseman, chairman of VF Corp. “Looking forward, I expect the strategic and operational actions we are taking to generate even stronger long-term value for our shareholders.” (Source: “VF Reports 2016 Fourth Quarter And Full Year Results; Provides Outlook For 2017,” VF Corp, January 31, 2017.)

Decades-Long Dividends

Of course, what’s really important to us Income Investors is how VF Corp’s cash flow is holding up. Here, the news also isn’t as bad as the stock’s plunge would imply.

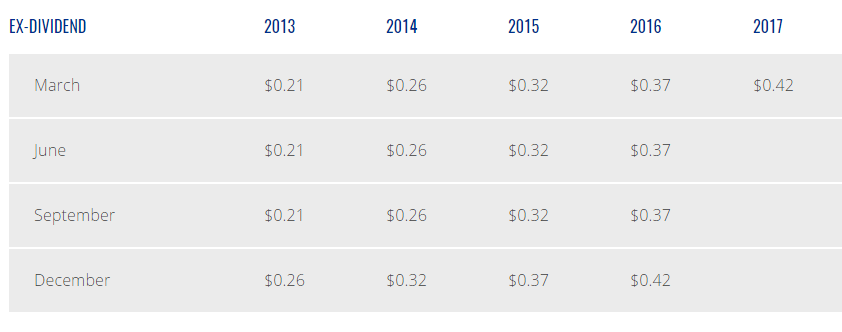

In 2016, the company generated $1.5 billion in operating cash flow, returning more than $1.6 billion to shareholders through hefty repurchases and higher dividend payments. In fact, the company raised its quarterly dividend by 13.5% in Q4 to $0.42, which is already double that of VF Corp’s $0.21 payout in 2013. The increase also marks the company’s 44th consecutive year of annual dividend growth. Talk about consistency.

Source: “Stock Information,” VF Corp

Over the past 10 years, VF Corp has managed to grow its dividend at a solid rate of 12.2% per year. Given the company’s still-modest payout ratio of roughly 50%, as well management’s goal of returning yet another $1.6 billion in 2017, I’d only expect more double-digit dividend growth going forward.

“Gross margin is up. Cash flow is strong. Inventory is under control, up less than 1% versus last year,” said CFO Scott Roe in a conference call with analysts. “These facts give us confidence that the actions we’re taking to improve and protect the long-term health of our brands, our channel, and our business model are beginning to show progress.” (Source: “VF (VFC) Q4 2016 Results – Earnings Call Transcript,” Seeking Alpha, February 17, 2017.)

VF Value Play?

That brings us back to VF Corp’s slumping stock price, which is down nearly 20% over just the past six months. But given how well VF Corp’s fundamentals are holding up amid the retail downturn, you’d think that investors would give it a bit more credit.

Specifically, VF Corp’s forward dividend yield of 3.2% is particularly appealing, considering the healthy cash flow and brand power that support it. Moreover, VF Corp’s yield is higher than of industry peers such as Nike Inc (NYSE:NKE) (1.3%), Ralph Lauren Corp (NYSE:RL) (2.5%), and Gildan Activewear Inc (NYSE:GIL) (1.5%), as well as the S&P 500 (2.2%).

With as many high-margin, globally recognized brands that VF Corp boasts in its portfolio, I can only see that yield gap narrowing over the long run.

The Bottom Line on VF Corp

VF Corp currently represents an attractive income opportunity. While currency headaches and general retail malaise continue to weigh on growth, management is doing a solid job in maintaining VF Corp’s brand power while keeping its impressive 40-plus-year streak of annual dividend increases alive.

Most importantly, with VF Corp shares well off their 52-week highs and boasting an above-average yield, the downside now seems limited enough to jump in.