Universal Health Realty Stock: Under-the-Radar 5.8%-Yielder Has Raised Payout for 38 Years

How UHT Stock Can Pay Big, Growing Dividends

Universal Health Realty Income Trust (NYSE:UHT) is an overlooked real estate investment trust (REIT) that has become an institution for income hogs who want reliable, growing, high-yield dividends. In fact, Universal Health Realty stock has paid dividends for more than 150 consecutive quarters and has raised its dividends for the last 38 straight years.

Before the COVID-19 pandemic, Universal Health Realty Income Trust’s units (a REIT’s shares are called “units”) were trading at record levels. As expected, UHT stock took a hit in the opening weeks of the pandemic. And while the company continues to do well financially, its unit price hasn’t recovered from the pandemic.

As of this writing, Universal Health Realty Income Trust’s units are up by 7.5% over the last month and three percent since the start of 2023, but they still need to climb by more than 120% to get to their pre-pandemic level.

There’s every reason to believe the units will recover over the long run.

Why?

Universal Health Realty is a REIT that focuses on health-care facilities. The trust has 76 investments in dense urban areas of 21 states. Its real estate portfolio includes acute care hospitals, medical office buildings, rehabilitation hospitals, sub-acute care facilities, freestanding emergency departments, and childcare centers. (Source: “Corporate Information,” Universal Health Realty Income Trust, last accessed June 14, 2023.)

In a nutshell, the company provides a necessary service in a lucrative field. Medical office buildings and clinics account for 68% of its portfolio, followed by acute care hospitals (17%), behavioral health centers (eight percent), specialty facilities (three percent), ambulatory care facilities (three percent), and childcare centers (one percent).

Health care is a very profitable business. As of 2018, 10,000 baby boomers in the U.S. were turning 65 each day. By 2030, all baby boomers in the U.S. will be older than 65. There’s an even bigger wave of seniors coming later. By 2050, the number of people in the U.S. turning 65 each day will hit 12,000. (Source: “Americans Are Retiring at An Increasing Pace,” Yahoo! Finance, November 21, 2018.)

That means more tests, more prescriptions, and more doctor visits. That has created a boom for health-care companies, service providers, and life science businesses. This will translate to higher spending on health care.

In 2021, U.S. health-care spending grew by 2.7%, hitting $4.3 trillion, or $12,914 per person. This accounted for $0.183 out of every dollar spent in the country’s entire economy. (Source: “Historical,” Centers for Medicare & Medicaid Services, last accessed June 14, 2023.)

Universal Health Realty Income Trust’s Revenues Jumped 25%+ Since 2017

For companies like Universal Health Realty, the aging of the population translates to rising rental income. With more money being spent on health care, companies like this have a reliably growing revenue and earnings stream.

Since 2017, Universal Health Realty Income Trust has increased its revenues by more than 25% to $90.6 million. That big increase comes on the heels of an expanding real estate portfolio and rising rents (with rent escalators built into its leases).

Even a modest one-percent hike in rent will result in millions of dollars in extra income each year. And when rental agreements come to an end, tenants that renew will likely face steep rental increases—especially in this high-inflation environment.

That doesn’t even factor in new opportunities for business growth. In March, Universal Health Realty Income Trust opened a new $34.6-million medical plaza in Reno, Nevada. It’s also evaluating suitable uses for vacant specialty lots in Chicago, Illinois; Evansville, Indiana; and Corpus Christi, Texas.

Universal Health Realty Stock’s Dividends Have Been Rising for Decades

Universal Health Realty Income Trust’s rising revenues and earnings have resulted in reliably growing high-yield dividends.

As noted above, the company has raised its dividends for 38 consecutive years. This puts the company in an elite group of companies called “Dividend Champions,” a designation for businesses that have raised their dividends for at least 25 consecutive years.

Universal Health Realty Income Trust actually has a history of raising its payouts twice in any given year. This year, it paid $0.715 per unit in the first quarter and raised the dividend to $0.72 in the second quarter. This works out to a current yield of 5.8%. That’s more than twice the average payout of about 1.6% from stocks in the S&P 500.

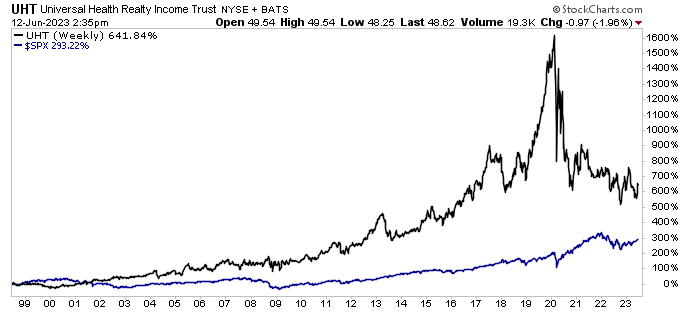

Chart courtesy of StockCharts.com

If history is any indicator, Universal Health Realty Income Trust will raise its payout again in the fourth quarter of this year.

Those incremental increases really add up. Over the last 25 years, the REIT has hiked its quarterly distributions by 69%. Over the last 25 years, with dividends reinvested, UHT stock has provided total returns of 641%. That’s more than double the 293% from the S&P 500 during the same period.

As you can see in the above chart, before the COVID-19 pandemic, Universal Health Realty stock had provided total returns in excess of 1,600%. Meanwhile, the S&P 500 had returned slightly more than 200%.

It’s not tough to see why investors love high-yield dividend stocks like UHT stock.

The Lowdown on Universal Health Realty Income Trust

Despite its big, growing dividends and capital appreciation, Universal Health Realty stock continues to fly under the radar of most investors.

It’s difficult to understand why. Universal Health Realty Income Trust has raised its dividends for 38 consecutive years, and it consistently provides investors with total returns that are well in excess of those from the S&P 500.

And by all accounts, UHT stock’s distribution hikes and stock market gains should continue over the coming years and decades.