Uniti Group Stock Is a 10.8%-Yielder for Contrarian Investors

Uniti Group Inc Is an Underperforming REIT Looking to Improve

Interest rates are likely to begin heading lower in June, and there could eventually be a total reduction of 100 basis points. The downward move will benefit companies with high amounts of debt, such as real estate investment trusts (REITs).

One REIT stock for contrarian investors to consider is Uniti Group Inc (NASDAQ:UNIT).

The company acquires and builds the infrastructure that the communications industry requires to move data. Uniti Group describes itself as “a leading provider of fiber and other wireless solutions.” (Source: “Corporate Profile,” Uniti Group Inc, last accessed February 22, 2024.)

As of the end of September 2023, the company’s network comprised about 139,000 fiber route miles, 8.4 million fiber strand miles, and other communications real estate across the U.S.

In terms of financials, Uniti Group is a work in progress that needs to strengthen its fundamentals. While investors wait for this to happen—and for its share price to rise—they can collect high-yield dividends from UNIT stock.

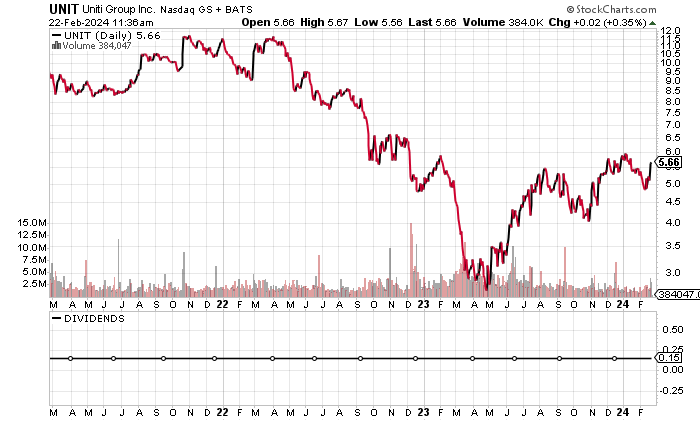

As of this writing, Uniti Group Inc’s share price has nearly doubled from its 52-week low of $2.94 and is currently just below its range high of $6.01, which was set in August 2023.

The potential for big gains from Uniti Group stock is intriguing, given that the stock hit a 10-year high of $34.63 in April 2015 and traded at $14.60 in November 2021.

Chart courtesy of StockCharts.com

My Rationale for Being Bullish on UNIT Stock

Uniti Group Inc has consistently generated more than $1.0 billion in annual revenues. The company’s revenues have grown for five straight years, but the growth rates were in the single digits for its last four reported years.

Analysts estimate that Uniti Group will report revenue growth of 2.8% to $1.16 billion for 2023, followed by growth of 3.0% to $1.2 billion for 2024. (Source: “Uniti Group Inc. (UNIT),” Yahoo! Finance, last accessed February 22, 2024.)

| Fiscal Year | Revenues (Billions) | Growth |

| 2018 | $1.02 | N/A |

| 2019 | $1.06 | 3.92% |

| 2020 | $1.07 | 0.89% |

| 2021 | $1.1 | 3.14% |

| 2022 | $1.13 | 2.57% |

(Source: “Uniti Group Inc.” MarketWatch, last accessed February 22, 2024.)

Uniti Group had gross margins in excess of 80% in four of its last five reported years. There was a slight drop in 2020, which was during the COVID-19 pandemic. The company’s gross margin hit a five-year high in 2022.

| Fiscal Year | Gross Margins |

| 2018 | 84.8% |

| 2019 | 80.7% |

| 2020 | 79.1% |

| 2021 | 86.0% |

| 2022 | 86.4% |

Although Uniti Group Inc’s revenues and gross margins have been consistent, that hasn’t been the case with the company’s generally accepted accounting principles (GAAP)-diluted earnings per share (EPS).

Analysts expect Uniti Group to report an adjusted loss of $0.18 per diluted share for 2023 (after reporting a profit of $0.98 per diluted share in 2022). There are encouraging signs for 2024, though. Analysts expect the company to report earnings of $0.41 per diluted share for this year. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2018 | $0.04 | N/A |

| 2019 | $0.04 | -5.91% |

| 2020 | -$3.47 | -7,855% |

| 2021 | $0.51 | 114.66% |

| 2022 | -$0.04 | -107.85% |

(Source: MarketWatch, op. cit.)

Meanwhile, Uniti Group Inc’s funds statements have shown consistent positive free cash flow (FCF), except for when it had an FCF loss in 2020. The company uses its FCF to pay dividends.

| Fiscal Year | FCF (Millions) | Growth |

| 2018 | $49.24 | N/A |

| 2019 | $259.61 | 427.2% |

| 2020 | -$161.65 | -162.27% |

| 2021 | $113.3 | 170.09% |

| 2022 | $32.55 | -71.27% |

(Source: MarketWatch, op. cit.)

The major risk for Uniti Group Inc is the $5.68 billion of debt and only $34.1 million in cash on its balance sheet. (Source: Yahoo! Finance, op. cit.)

Uniti Group will need to remedy its debt situation. The company only covered its interest expense with higher earnings before interest and taxes (EBIT) in one of its past three reported years.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2020 | -$236.99 | $497.13 |

| 2021 | $526.75 | $409.02 |

| 2022 | $341.58 | $369.44 |

(Source: Yahoo! Finance, op. cit.)

Uniti Group Inc’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a somewhat weak 4.0, which is below the midpoint of the Piotroski score’s range of 1.0 to 9.0. An improvement in the company’s debt and profitability would help boost its Piotroski score.

Uniti Group Stock’s Dividends Will Likely Remain Flat

UNIT stock has paid dividends for nine consecutive years. Uniti Group stock’s current quarterly dividend of $0.15 per share represents a forward yield of 10.77% (as of this writing).

From October 2015 through January 2019, Uniti Group Inc paid quarterly dividends of $0.60 per share. The company slashed its quarterly dividend to $0.05 per share in April 2019, prior to increasing it to $0.22 in January 2020 and then lowering it to the current $0.15 in April 2020. (Source: “UNIT Dividend History,” Nasdaq, last accessed February 22, 2024.)

Given Uniti Group Inc’s debt and inconsistent financial results, I don’t envision higher dividends anytime soon. I do, however, expect UNIT stock’s current dividend level to be maintained. The company’s dividend coverage ratio of 2.6 supports its current dividend level.

| Metric | Value |

| Dividend Streak | 9 Years |

| 7-Year Dividend Compound Annual Growth Rate | 0.0% |

| 10-Year Average Dividend Yield | 12.1% |

| Dividend Coverage Ratio | 2.6 |

The Lowdown on Uniti Group Inc

As I said earlier, Uniti Group is a work in progress, but in the meantime, income investors receive high-yield dividends for assuming risk.

Note that Uniti Group stock has strong institutional support, with 422 institutions holding 89.7% of the outstanding shares (as of this writing). About 32% of Uniti Group Inc’s outstanding shares are held by two companies: BlackRock Inc (NYSE: BLK), which has a 16.65% stake, and The Vanguard Group, Inc., which has a 15.88% stake. (Source: Yahoo! Finance, op. cit.)