United Parcel Service, Inc.: This Wonderful Business Looks Like a Bargain

Time to Scoop Up UPS Stock?

The market got clobbered last week, but the media missed the real story.

On Monday, the Dow posted its biggest one-day point drop ever. Investors endured round-the-clock news coverage of the market plunge, with the index off 11% at one point from its all-time highs.

But you could find some good news buried among all of the headlines. Last week, United Parcel Service, Inc. (NYSE:UPS) announced a quarterly dividend hike for shareholders. The board set the new payout at $0.91 per share, representing a 10% increase from the previous distribution.

I zero in on stories like these during a market selloff. The media gets focused on 1,000-point selloffs and portfolios bathed in red ink. Reports on solid earnings, growing dividend payments, and improving business prospects get pushed to the sidelines.

And in the case of UPS, you have a lot of good things to report. Here you have an irreplaceable asset making money hand over fist from the e-commerce boom, all while paying out growing dividends to boot. And following last week’s market plunge, shares look like an interesting prospect for a couple of reasons.

The dividend looks rock solid, for starters. UPS enjoys a low-cost advantage. Running a delivery business comes with a lot of fixed costs, so a low-volume competitor would have a tough time breaking into the business.

Even for those with deep pockets, you would have a tough time replicating UPS’s business. The company’s delivery networks demand requires a large number of trucks, labor, terminals, and equipment. You’d have to cough up billions to replicate these assets, and few firms could endure the decade or more of financial losses during the necessary building phase.

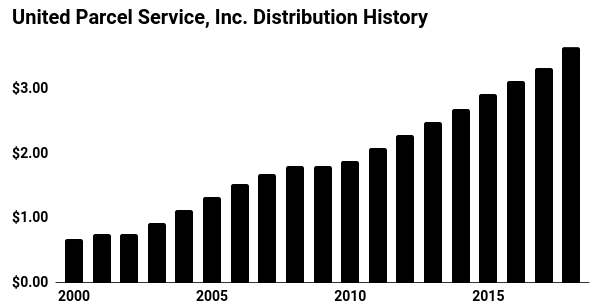

For proof, you only need to check out the company’s financial results. UPS produces returns on invested capital about double its cost of capital (usually above 25% per year) and margins well above its competitors. This entrenched market position has allowed management to deliver 15 dividend hikes since 2000.

That payout will likely keep growing too. UPS represents a big winner from the current economic expansion and surging e-commerce volumes. UPS increased U.S. average daily ground packages 5.7% year over year last quarter, while international shipments increased 8.3%.

In addition to volume growth, the firm benefits from steadily increasing prices for deliveries. In the U.S., UPS increased prices 3.4% year-over-year on each delivery last quarter. And in addition to handling greater parcel density, UPS exploits many of its assets to handle both higher-margin express and ground shipments.

Good news for shareholders: over the next five years, “the street” expects UPS to grow earnings per share at a 10% annual clip. Given the company’s long-term track record, investors can expect the distribution to grow more or less in line.

Source: “Investor Relations,” United Parcel Service, Inc., last accessed February 14, 2018.

For owners, this combination should result in good returns. Following the sell-off, UPS shares now may a total yield of 3.4%. If we plug in our dividend growth rate, our total return potential hits the low teens. That more than exceeds my hurdle rate and leaves some wiggle room in our projections.

Of course, you can’t say those returns are set in stone. UPS has struggled to keep up with the boom in e-commerce, as evidenced in the unexpected overload of packages in its system last Christmas. New investments could clip margins, hence the massive selloff following the last quarterly report.

I don’t think investors should lose too much sleep, though. Traders watching numbers quarter to quarter will stress out over every basis point or two on gross margins. Long-term investors, however, can expect these investments to result in a rising stream of cash flow and, most probably, a growing stream of dividends.

Bottom line, traders got clobbered last week, but most businesses will keep chugging along just fine. The selloff creates an opportunity to put fresh money to work. And with a yield approaching three percent (and growing), UPS looks like a bargain.