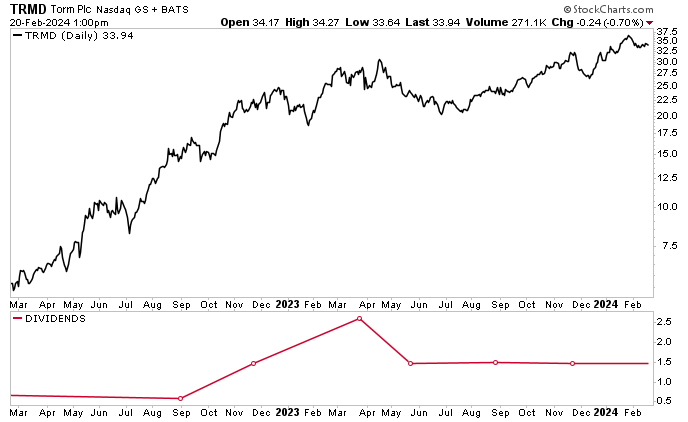

Torm Stock: 17%-Yielder Trading at Record-High Levels

Industry Tailwinds Bode Well for Torm PLC

Marine shipping companies, including Torm PLC (NASDAQ:TRMD), have recently taken center stage, with Houthi attacks in the Red Sea forcing cargo vessels to reroute around the southern tip of Africa.

An estimated 30% of global container trade passes through the Suez Canal. Since the attacks in the nearby Red Sea started, however, hundreds of container ships have been taking a 4,000-mile detour, which has been increasing shipping times by about 30%. (Source: “What Are the Impacts of the Red Sea Shipping Crisis?” JPMorgan Chase & Co, February 8, 2024.)

The longer the duration of the disruptions, the higher shipping rates will be. For example, since December 1, 2023, shipping costs from Shanghai to Genoa have increased by more than 350%, while shipping costs from Shanghai to Los Angeles have increased by about 150%.

The Red Sea crisis is a few months old, and there’s no end in sight. If anything, it appears that things are getting worse. Just recently, a missile attack by Yemen’s Houthi rebels damaged a Belize-flagged vessel, leading its crew to abandon ship.

If you’re a company that transports highly combustible products, like Torm PLC, you’ll most certainly want to avoid the Red Sea.

Torm is a leading pure-play tanker company with a fleet of more than 80 vessels that are configured to move gasoline, naphtha, diesel, and jet fuel from refiners to their customers. (Source: “About” and “Our Fleet,” Torm PLC, last accessed February 20, 2024.)

Ranging in capacity from 45,000 to 115,000 deadweight tonnage (DWT), the company’s ships include Long Range 1, Long Range 2, and Medium Range vessels.

Torm PLC’s Long Range 1 tankers typically carry diesel or jet fuel from the Middle East to Europe. Its Long Range 2 tankers are generally used on long trade routes, such as carrying diesel from the eastern hemisphere into the Atlantic or naphtha from the Middle East to the Far East.

A typical trade for the company’s Medium Range vessels would be gasoline from Europe to the U.S.

During the third quarter of 2023, Torm PLC entered an agreement to acquire eight Long Range 2 vessels for approximately $399.0 million. This will bring the company’s total fleet up to 93 vessels. The first of the ships was expected to be delivered in the fourth quarter of 2023, and the other seven are expected to be delivered in the first quarter of 2024.

Management Reported Historically High TCE Rates

Torm PLC continues to report outstanding financial results.

In the first three quarters of 2023, the company’s time charter equivalent (TCE) rates increased by 23% year-over-year to $36,837 per day. This resulted in TCE earnings growth of 26% to $817.4 million. (Source: “TORM PLC Q3 2023 Results, Dividend Distribution, and Financial Outlook 2023,” Torm PLC, November 9, 2023.)

Also in that period, the company’s earnings before interest, taxes, depreciation, and amortization (EBITDA) increased by 29% to $613.6 million.

The company’s CEO, Jacob Meldgaard, said the following: “The strong and sustained market for product tankers has resulted in [historically] high TCE earnings for the first nine months of 2023…We expect a strong ending to the year, driven by seasonal factors and continued favorable market conditions.” (Source: Ibid.)

As of November 6, 2023, Torm PLC had covered 791% of the 2023 full-year earning days at $36,452 per day. Moreover, the company’s coverage for the fourth quarter of 2023 was 64%, at $38,822 per day.

For full-year 2023, the company estimates that its TCE earnings were in the range of $1.07 billion to $1.12 billion and that its EBITDA were in the range of $825.0 million to $875.0 million.

TRMD Stock Has Returned $123.2 Million to Shareholders

Thanks to its high cash generation in the third quarter of 2023, Torm PLC was able to return $123.2 million, or $1.46 per share, to its shareholders as dividends in December 2023. (Source: Ibid.)

As of this writing, that translates to a yield of 17.09%.

Because the company’s dividend levels are tied to its profitability, they fluctuate from quarter to quarter. Torm PLC had the misfortune of announcing a dividend during the opening days of the COVID-19 pandemic. Suffice it to say, the financial windfall to investors didn’t last long, with the board suspending the company’s payouts for two years.

In September 2020, Torm stock paid quarterly dividends of $0.85 per share. In August 2022, the company resumed its dividend program with a payout of $0.58 per share. The payouts have been much higher since then, including $1.46 per share in June 2023 and $1.50 per share in September 2023. (Source: “Distribution,” Torm PLC, last accessed February 20, 2024.)

TRMD stock’s dividends are safe—as long as the company is making money, of course. Lately, the company has been making boatloads of cash, and its payout ratio is just 80%.

As for Torm stock’s price, an ultra-high dividend yield is typically tied to a lower share price. That’s because yield and share price move in opposite directions. That hasn’t been the case with Torm PLC, though; TRMD stock actually hit a new record high of $37.11 on January 29.

As of this writing, Torm stock has gone up by 40% over the last six months, almost 12% year-to-date, and 34% year-over-year.

Bigger gains are expected, with Wall Street analysts predicting that TRMD stock will hit $42.00 per share over the next 12 months. This points to potential gains of approximately 24%.

Chart courtesy of StockCharts.com

The Lowdown on Torm PLC

As discussed above, Torm PLC is a pure-play tanker shipping company that’s been reporting tremendous financial results (including big increases in profits) and recently resumed its ultra-high-yield dividends.

Thanks to increases in the company’s fleet size, freight rates, and cargo shipping business, the outlook for Torm stock’s share price and dividends is excellent.