This Monthly Dividend Stock Yields 7.8%

Monthly Dividend Stock Profits From the Economy’s “Sweet Spot”

If you want to earn more interest income, then you need to consider investing in the “sweet spot” of the U.S. economy.

As regular readers know, I’m a big fan of monthly dividend stocks. And Main Street Capital Corporation (NYSE:MAIN) is one of my favorites.

This business development company (BDC) is pretty straightforward to wrap your head around: management makes loans or takes equity stakes in private businesses across the country. Executives then pass these interest payments on to shareholders.

These BDCs have carved out a profitable niche in the financial market. Banks will lend to small business, but only if they provide considerable collateral. Wall Street provides another source of capital, but only for large operations. BDCs fill the gap by providing loans to businesses too risky for commercial banks and too small for Wall Street.

I often describe this as the “sweet spot” of the U.S. economy for two reasons. First, a lack of competition allows Main Street to charge higher interest rates on loans. Commercial banks, which face a lot of competition, typically lend money at rates between three and five percent. Main Street Capital Corporation, by comparison, earns between eight percent and 15% on new loans.

Second, these loans have a high degree of safety. Borrowers are typically profitable, established businesses with steady cash flow. And because Main Street Capital has senior status with most of its loans, the firm stands first in line to get paid if anything goes wrong.

But here’s what sets Main Street Capital apart from peers: management owns over six percent of outstanding shares, according to the latest numbers from Thomson Reuters Corp (NYSE:TRI).

That represents an enormous amount of stock held by insiders and keeps their interests aligned with their fellow shareholders. In other words, the executives have very good reason to care about the company’s performance; most of their wealth is tied up in the success of the business. (Source: “Main Street Capital Corporation (MAIN),” Yahoo! Finance, last accessed March 21, 2019.)

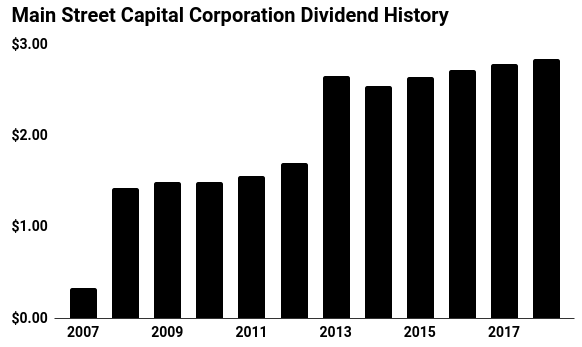

That formula has paid off for investors. Since 2010, Main Street Capital Corporation has generated $0.13 in profit on every dollar of equity invested in the business. Since 2007, the company’s total investment portfolio has increased 25-fold to $2.5 billion. On a per-share basis, distributable investment income topped $2.76 last year. That marks a nearly fourfold increase from what the business generated 10 years ago.

For shareholders, this performance has allowed Main Street to pay out buckets of cash. Today, the company pays a monthly dividend of $0.20 per share. That comes out to an annual dividend of 6.4% on an annual basis.

To supplement this income stream further, management also pays out special distributions twice per year. If you include these dividends in your yield calculator, the total payout on shares jumps to 7.8%.

(Source: “Dividends,” Main Street Capital Corporation, last accessed March 25, 2019.)

Of course, you can’t call any investment a surefire bet. If the economy slows down, BDCs could see an uptick in defaults. If interest rates rise, the market value of existing loans will decline.

That said, Main Street Capital has positioned itself better than its rivals. Almost half of the company’s deal flow is done on a floating rate basis. So if interest rates rise, Main Street Capital Corporation’s investment income automatically increases.

Moreover, 99% of debt investments have first-lien positions. That means, in the event of a default, the company gets its money back before any other creditors.

That’s the benefit of investing in the “sweet spot” of the U.S. economy. Income investors should take notice of this monthly dividend stock.