Iron Mountain REIT (NYSE:IRM) Now Yields 6%

1 High-Dividend Stock to Retire On

Iron Mountain REIT (NYSE:IRM) is the ultimate high-dividend stock.

The firm gets little coverage in the press. Yet despite receiving almost no attention, shareholders have made a fortune.

Hedge funds love this cash cow. Billionaire David E. Shaw has been quietly building up a stake, and other money managers are buying up shares hand over fist. Let me explain.

Earn a 6% Yield from This Top Dividend Stock

As regular readers know, I’m a big fan of a group of stocks I like to call my “cash cows.”

These firms can be “milked” for ongoing income with little expense. Their entrenched position results in steady sales, thick margins, and robust profits. You tend to find them in mature, slow-growing industries with little need for new investment.

Growth stocks have to plow most of their profits back into their business. Cash cows, in contrast, have finished most of their big spending. For this reason, these firms can just pay out their profits to shareholders. Many crank out yields of five, seven, even nine percent.

And while the media focuses of hot gadgets, cash cows can be far more lucrative. Some of the stock markets biggest winners, like Hershey Co (NYSE:HSY), Altria Group Inc (NYSE:MO), and Procter & Gamble Co (NYSE:PG), fit into this group. One of my favorites, Iron Mountain REIT, meets the criteria of a cash cow for a couple of reasons.

First, the business gushes cash flow.

You don’t need a PhD to wrap your head around this one. Iron Mountain stores paper records, earning rent from customers in exchange for warehouse space. The firm serves some 230,000 businesses across 45 countries, accounting for 95% of Fortune 1,000 companies. (Source: “Durable Business Drives Cash Flow and Dividend Growth,” Iron Mountain REIT, March 2017.)

These facilities require little in the way of maintenance; after all, you just need to buy a big, grey warehouse in some industrial park. Iron Mountain spends only $0.02 in capital expenditures for every dollar earned in revenue each year. By comparison, industrial landlords spend $0.12 on average annually.

Better still, Iron Mountain doesn’t deal with the biggest problem facing most businesses: turnover. Self-storage units, for example, typically rent out on a month-to-month basis. Large industrial landlords usually sign tenants to a three- or four-year lease. The average item stored in an Iron Mountain facility, in contrast, has been there for 15 years. (Source: Ibid.)

As a result, the company cranks out oversized profits each year. You typically see net margins well over 80%. I can only think of a handful of other firms in the world this profitable.

| Metric |

Industrial |

Iron Mountain |

| Rent per square foot |

$5.50 |

$28.40 |

| Maintenance capex |

12% |

3% |

| Customer retention |

~75% |

98% |

| Net operating margin (storage) |

70% |

82% |

Source: “Durable Business Drives Cash Flow and Dividend Growth,” Iron Mountain REIT, March 2017

Second, the business looks like a kind of monopoly.

At first glance, it appears easy to break into this industry. A well-endowed investor could just buy up some cheap warehouses and a few trucks.

Iron Mountain, however, has built out a vast global network of facilities. Not to mention the back-end systems of security, logistics, and document tracking. You need this kind of infrastructure to handle the storage needs of big businesses across continents.

Any rival would have to spend billions to replicate Iron Mountain’s business, not to mention charging cut-rate prices while prodding customers to switch. The prospect of a huge investment and low returns should be enough to keep most people out of the business.

Even if you wanted to compete, Iron Mountain also benefits from high switching costs. For a large customer, it could take a year to move the mountains of physical documents, plus consider the cost of transit, break fees, and security risks.

Also Read:

Top 10 ETFs for Retirement Investors

5 High-Dividend-Yielding Stocks to Consider in 2017

The problem can be a lot like dealing with your bank. Moving your accounts can be a hassle. You wouldn’t switch to the rival down the street just to save a few bucks.

Big enterprises don’t spend that much on document storage, so there would be no windfall from switching. For this reason, Iron Mountain’s retention rate tops 98%. The average customer has been with the business for over 50 years. (Source: Ibid.)

This puts Iron Mountain in a powerful position. Just like your bank, the company can pass on small, regular price hikes each year. For shareholders, this translates into a growing, inflation-proof stream of income.

It has been a lucrative formula for investors.

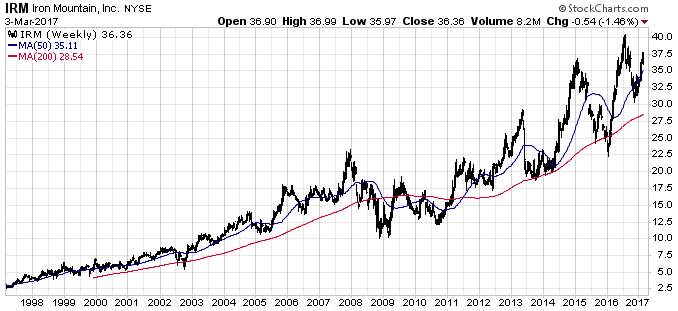

Say you had bought $10,000 of Iron Mountain stock back in 1996. Your stake would be worth $190,000 today, assuming reinvested dividends.

Source: StockCharts.com

Income investors have cashed in, too. Because of how the firm is legally structured, it pays no corporate income taxes. In exchange for this benefit, however, management must pay out most of their profits to shareholders.

Right now, Iron Mountain pays out a quarterly dividend of $0.55 per share. Based on the current stock price, this represents an annual yield of six percent.

The Bottom Line on This High-Dividend Stock

Document storage has the excitement of milk toast. But while most media outlets skip over it, owning a cash cow like Iron Mountain can be lucrative. If you’re looking for income, this high-dividend stock might be one to look into further.