Texas Instruments Incorporated: Insiders Buying This Top Dividend Stock

Insiders Are Buying Texas Instruments Stock: Here’s Why

In business, I like managers that put their money where their mouth is.

Executives always talk up a big game. After spending more than a decade in the research business, you start taking these tales with a grain of salt.

But you know what always catches my attention? When management teams buy up big chunks of stock. Because there’s only one reason why executives would pull off such a maneuver: they see a lot of upside ahead.

Take analog-chipmaker Texas Instruments Incorporated (NASDAQ:TXN). Late last year, Director Martin Craighead bought 10,900 shares of TXN stock. Based on the share price at the time of the filing, that represents a purchase of almost $1.0 million. What could have him so excited about this top dividend stock? (Source: “Texas Instruments S-1 Filing,” United States Securities and Exchange Commission, October 25, 2018.)

What’s the Appeal of Texas Instruments Incorporated?

Shares have gotten cheap, for starters.

Texas Instruments stock has traded sideways for two years now. That’s bad news for shareholders, but this consolidation has allowed the company’s earnings to catch up to the share price.

Today, Texas Instruments stock trades at only 14-times forward earnings. Over the next five years, Wall Street projects the business will grow profits at a 12% annual clip. The mean TXN stock looks reasonably valued on a price/earnings-to-growth basis.

You can’t call these shares cheap, mind you. Investors will always have to pay a premium for a wonderful, blue-chip business. But 14-times forward earnings represents one of the lowest multiples investors have had to pay in many years.

Moreover, several catalysts could put a bid underneath shares.

Earlier this week, reports suggested China could make unprecedented concessions to end a possible trade war. If business conditions return to normal, Texas Instruments Corporation would once again see booming demand for its chip products. (Source: “China makes unprecedented proposals on tech transfer, trade challenges: US officials,” CNBC, March 28, 2019.)

Longer term, the company remains a key player in the Internet of Things. Gadget makers need Texas Instruments sensors to build everything from Internet-connected light bulbs to Wi-Fi-enabled refrigerators. Given more than 50 billion devices will get connected to the Internet over the next few years, the company could make a fortune.

In the meantime, investors can lock in a tidy income stream.

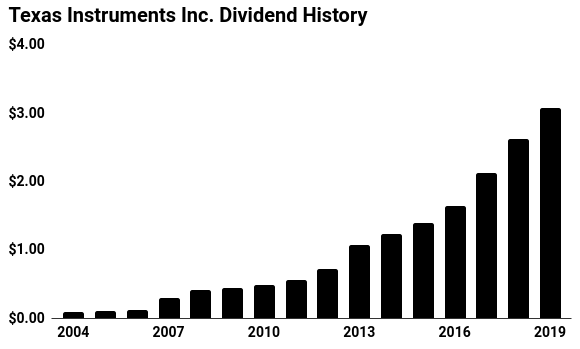

Over the past 15 years, management has boosted the company’s distribution at a 26% compounded annual clip. Today, Texas Instruments stock pays a quarterly dividend of $0.77 per share, which comes out to an annual yield of almost three percent.

(Source: “Dividends,” Texas Instruments Incorporated, last accessed March 28, 2019.)

“Our objective with dividends is to appeal to a broader set of investors;” the company says on their investor relations page. “Our focus is on both growth and sustainability.” (Source: Ibid.)

The Bottom Line on Texas Instruments Incorporated

Of course, you can’t call future dividend hikes a sure thing. That said, it’s not often that companies come out and outright say they will boost their distribution. That signals an enormous amount of confidence on the part of executives.

And when insiders start buying up big chunks of stock, like with Texas Instruments Incorporated, income investors should take notice.