9%-Yield Starwood Property Stock Has High Potential

STWD Stock Offers Steady Income & Opportunity for Price Appreciation

One of the hardest-hit segments of the real estate investment trust (REIT) sector during the recent period of rising interest rates was commercial mortgage REITs. Investors had concerns about the possibility of commercial mortgage defaults, but so far, the impact of defaults has been immaterial.

High interest rates drive up the cost of borrowing capital and erode margins, thereby leading to reductions in profits and free cash flow (FCF).

Recently, however, REIT stocks have been rallying on expectations that the Federal Reserve will begin cutting interest rates by midyear. And while the majority of REIT stocks have already made some big upward moves, there are still opportunities for investors to make gains.

For instance, there’s Starwood Property Trust Inc (NYSE:STWD), a high-yield, mid-cap real estate finance company that’s the biggest commercial mortgage REIT in the U.S.

With Starwood Property stock, investors get the opportunity to make capital gains while collecting steady, high-yield dividends.

Starwood Property, which is an affiliate of the global private investment firm Starwood Capital Group, manages a diverse portfolio that’s worth more than $27.0 billion. Those investments are spread across the REIT’s Commercial and Residential Lending, Infrastructure Lending, Investing & Servicing, and Property business segments. (Source: “At a Glance,” Starwood Property Trust Inc, last accessed April 12, 2024.)

As of April 10, Starwood Property stock was down by nine percent year-to-date but up by 9.25% year-over-year. The stock traded as high as $27.01 in June 2021 before interest rates began to climb. As of April 10, STWD stock was down by 29.6% from its record high, despite the company driving its revenues 32.1% higher in 2023, versus its revenues in 2022.

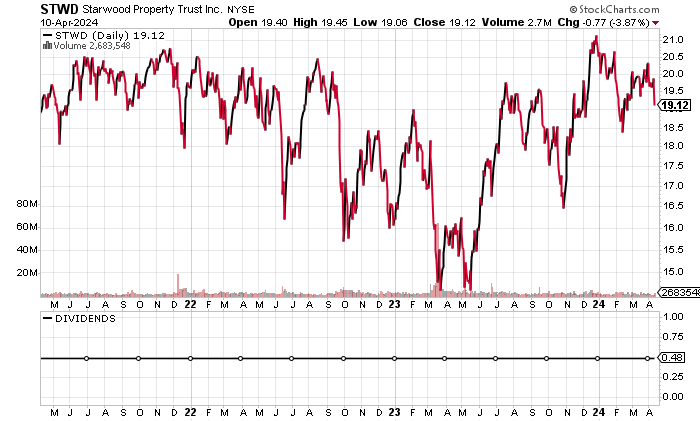

The following chart shows STWD stock hovering around the midpoint of its 52-week range and potentially taking a run at overtaking its 50-day and 200-day moving averages. A break above those levels could see Starwood Property Trust Inc’s share price rebound to its record high.

Chart courtesy of StockCharts.com

Starwood Property Trust Inc Is Profitable & Generates Positive FCF

Starwood Property Trust’s revenues have risen for three consecutive years, establishing a record high of $2.05 billion in 2023. That was well above the company’s pre-pandemic revenue high.

Analysts estimate that Starwood Property Trust Inc will grow its revenues by 4.5% to $2.14 billion in 2024 before contracting its revenues by 5.9% to $2.05 billion in 2025. (Source: “Starwood Property Trust, Inc. (STWD),” Yahoo! Finance, last accessed April 12, 2024.)

| Fiscal Year | Revenues (Billions) | Growth |

| 2019 | $1.32 | N/A |

| 2020 | $1.14 | -13.8% |

| 2021 | $1.19 | 4.5% |

| 2022 | $1.55 | 30.7% |

| 2023 | $2.05 | 32.1% |

(Source: “Starwood Property Trust, Inc,” MarketWatch, last accessed April 12, 2024.)

Starwood Property Trust Inc has consistently generated gross margins of 80% and higher, as the following table shows.

| Fiscal Year | Gross Margin |

| 2019 | 81.7% |

| 2020 | 82.0% |

| 2021 | 84.3% |

| 2022 | 92.4% |

| 2023 | 87.6% |

On the bottom line, Starwood Property Trust Inc has consistently generated generally accepted accounting principles (GAAP)-diluted earnings-per-share (EPS) profitability, but it needs to generate more consistent growth following a drop in 2023.

Analysts expect Starwood Property to report lower adjusted earnings of $1.94 per diluted share for 2024, compared to $2.05 per diluted share in 2023. This is expected to be followed by $1.94 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.79 | N/A |

| 2020 | $1.16 | -35.4% |

| 2021 | $1.52 | 31.9% |

| 2022 | $2.74 | 80.0% |

| 2023 | $1.07 | -60.9% |

(Source: MarketWatch, op. cit.)

Starwood Property Trust Inc’s funds statement shows consistent positive FCF, with growth in two of the last four years.

Positive FCF allows the REIT to pay dividends and reduce its total debt of $19.66 billion. Moreover, the expected lower interest rates will help reduce the company’s borrowing costs. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $370.8 | N/A |

| 2020 | $321.5 | -13.3% |

| 2021 | $381.5 | 18.7% |

| 2022 | $501.6 | 31.5% |

| 2023 | $339.9 | -32.2% |

(Source: MarketWatch, op. cit.)

Starwood Property Trust Inc’s’ Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, is 4.0. That’s just below the midpoint of the Piotroski score’s range of 1.0 to 9.0, which suggests that improvements are needed.

Starwood Property Stock’s Dividends Should Be Safe

STWD stock’s forward dividend yield of 9.44% (as of this writing) is attractive and in line with its five-year average dividend yield of 9.49%.

I’m not convinced that Starwood Property Trust Inc will increase its dividends anytime soon, given the company’s debt load, but I expect that its dividend streak will continue.

| Metric | Value |

| Dividend Streak | 16 Years |

| 7-Year Dividend Compound Annual Growth Rate | 0.0% |

| 10-Year Average Dividend Yield | 14.0% |

| Dividend Coverage Ratio | 0.9 |

The Lowdown on Starwood Property Trust Inc

Starwood Property stock provides investors with reliable income and the potential for capital appreciation.

STWD stock has a moderate amount of institutional ownership, with 591 institutions holding 52.2% of its outstanding shares (as of this writing). Moreover, company insiders have been buying shares of Starwood Property Trust Inc to the tune of a net 1.2 million shares over the last six months. (Source: Yahoo! Finance, op. cit.)

I view this as a signal of confidence by institutional investors and Starwood Property’s insiders.