Spok Holdings Inc: Ultra-High-Yielder Hits Record High on Strong Q1

Outlook for Spok Holdings Remains Robust

The stock market’s performance over the first five months of 2025 has left many investors scratching their heads. The S&P 500 may be up almost 12% over the last year, but it’s up less than one percent year to date. And, since the start of 2025, investors have had to deal with huge single-day surges and big drops.

One way investors can combat ongoing economic uncertainty is through reliable, ultra-high-dividend-yielding stocks with a history of outperforming the broader markets. One excellent technology stock bucking the trend is Spok Holdings Inc (NASDAQ:SPOK).

In many cases, it can be difficult to explain exactly what some tech companies do. That’s not the case for Spok Holdings Inc, though. Through its subsidiary Spok Inc., the company provides health-care communications services to hospitals in the U.S., Canada, Europe, Australia, and the Middle East. (Source: “Investor Presentation,” Spok Holdings Inc, May 5, 2025.)

And by communications services, it means pagers. Spok Inc is the largest wireless paging carrier in the U.S. with more than 700,000 units in service. It has an enormous customer base and a strong relationship with leading health-care providers.

This includes nine of U.S. News & World Report’s top 10 children’s hospitals and 18 of the top 20 adult hospitals, with an average customer tenure of 26 years. More broadly, more than 2,200 hospitals use Spok’s technology.

However, the company’s customer base includes more than just hospitals; health care accounts for 85% of its revenue. Government, blue-chip, and “other” account for the remaining 15%. Spok’s focus is on health care though. In 2012, health care accounted for 61% of the company’s revenue.

Speaking of which, Spok has stable recurring software maintenance and wireless segment revenue. More than 80% of its revenue is reccuring thanks to maintenance revenue from contact center and wireless paging revenue.

Now, in an age of smartphones and artificial intelligence, why does anyone still use pagers?

In fact, they are the safest, most reliable way for hospitals and doctors to communicate. Pagers don’t need to be charged all the time, like a cell phone; they only need to be charged once every week or two, which means they’re less likely to lose battery power.

Pagers are also more secure than cell phones. Confidential information sent over a text is much more likely to be compromised or stolen. Pagers only send numeric messages or basic text messages, so it’s impossible for confidential information to get in the wrong hands, unlike with cell phones.

Strong Q1 and a Rock-Solid Balance Sheet

For the first quarter ended March 31, Spok Holdings announced that total revenue increased by four percent to $36.29 million. Its net income jumped 22.7% to $5.19 million, or $0.25 per share. Wall Street was looking for earnings of $0.18 per share. (Source: “Spok Reports First Quarter 2025 Results,” Spok Holdings Inc, April 30, 2025.)

It reported adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $8.2 million, up 8.9% on an annual basis.

Spok ended the quarter with cash equivalents of $19.9 million and remains debt-free.

Commenting on the strong first-quarter results, Vincent D. Kelly, the company’s chief executive officer, said, “I am proud of the strong performance our team was able to deliver in the first quarter and believe these results provide solid momentum as we kick-off 2025. Spok continues to execute on generating cash flow and returning capital to stockholders, while responsibly investing for future growth.”

2025 Business Outlook

In light of tariffs and trade wars, what does the outlook for 2025 look like for Spok Holdings?

Pretty solid. Management said that neither its revenue nor its supply chain will be materially impacted. On top of that, Spok’s products and solutions are viewed as an essential utility by its hospital customers.

For those reasons, and coupled with its first quarter performance, the company reiterated its financial guidance for the year. This includes:

- Total 2025 revenue in the range of $134.0 million to $142.0 million

- Adjusted EBITDA in the range of $27.5 million to $32.5 million

Quarterly Dividend of $0.31 Per Share Declared

Spok has a rock solid balance sheet, which also includes significant cash flow. In 2023, it generated $22.7 million in cash flow, with that number rising to $25.7 million in 2024. This helps the company provide investors with a reliable, high-yield dividend.

Spok returned $25.6 million to shareholders in the form of dividends in 2023, following that up with $26.4 million in 2024. SPOK stock has returned over $700.0 million since 2004.

In the first quarter of 2025, Spok returned $7.9 million to shareholders. This resulted in a first-quarter dividend payout of $0.3125 per share, or $1.25 on an annual basis, for a current yield of 7.7%.

SPOK Stock Hits Record High

Frankly, an annual dividend yield of 7.7% is on the low end for us at Income Investors, unless, it’s tied to a stock that is doing exceptionally well. And SPOK stock is doing just that.

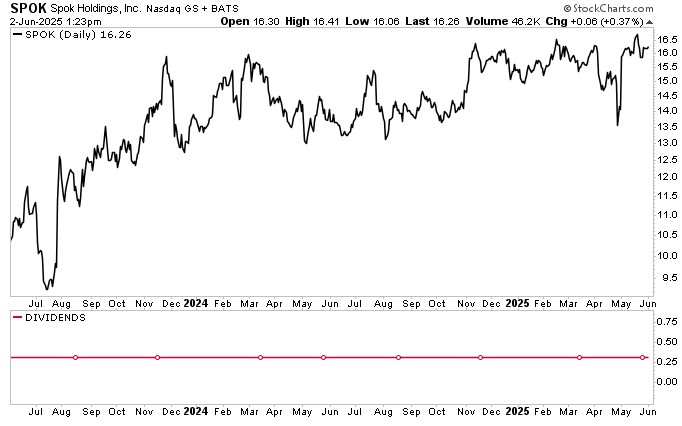

The stock popped in early May after Spok Holdings reported strong first-quarter results. It has held on to those gains since then, which suggests that investors remain bullish on SPOK.

It actually hit a new record high of $17.27 per share on June 27, and continues to hover near that level. As of June 2, SPOK is seriously outpacing the broader market, up:

- 5.7% year to date

- 16% year over year

The outlook for the stock remains solid, too, with Wall Street analysts providing a 12-month share price target of $20.00. This points to potential upside of approximately 22%.

Chart courtesy of StockCharts.com

The Lowdown on Spok Holdings Inc

Right now, you need to find a reason not to like Spok Holdings Inc. It has a strong foothold in the health information services industry, maintains a strong balance sheet, and continues to execute on generating cash flow and returning capital to stockholders, while responsibly investing for future growth.

In the first quarter, the company made excellent progress in several key performance areas, including software revenue growth, software operations bookings, and backlog levels. This allowed Spok to reiterate its full-year guidance.

Additional strong financial results should help juice SPOK and allow it to continue to provide investors with a reliable, high-yield distribution.