Why Southern Co Remains a Top Dividend Stock: A Juicy Yield of 4.5%

Utility stocks are usually known for their slow and stodgy nature, but once in a while, they can make some pretty exciting moves. Electricity giant Southern Co (NYSE:SO), for example, is a utility dividend stock that is up more than six percent over just the past five days, while the broader market has gained only slightly.

What’s the reason for the pop? Well, utility stocks, as a whole, have underperformed in recent months on concerns that President Trump’s planned infrastructure spending and tax rate cuts would fuel higher levels of inflation (and in turn, interest rates). But over the past week, sentiment has shifted a bit, with Wall Street starting to think that Trump’s growth-inducing plans will take much longer than expected.

Southern also posted strong Q4 results last Wednesday, which is giving investors both a top-down (economic outlook first) and bottom-up (company fundamentals first) reason to be bullish.

So is SO a top dividend stock worth following the crowd into?

Well, given the company’s wide competitive advantages, operating momentum, and strong dividend history, I’d definitely say so.

Electric Performance

In Q4, Southern earned $235.0 million, or $0.24 a share, as revenue spiked 45% to $5.18 billion, easily topping the consensus estimate by $760.0 million. On a full-year basis, the company earned $2.73 billion, compared to $2.64 billion in the year-ago period.

Southern benefited from relatively cool weather during the quarter, as well as continued revenue strength at its traditional regulated electric utilities. That’s not a huge surprise, considering that Southern boasts some of the healthiest and most stable regulatory relationships in the United States.

During the quarter, total electricity sales volume increased 6.2% year-over-year, driven by a 1.7% bump in retail sales and a 31% spike in wholesale sales.

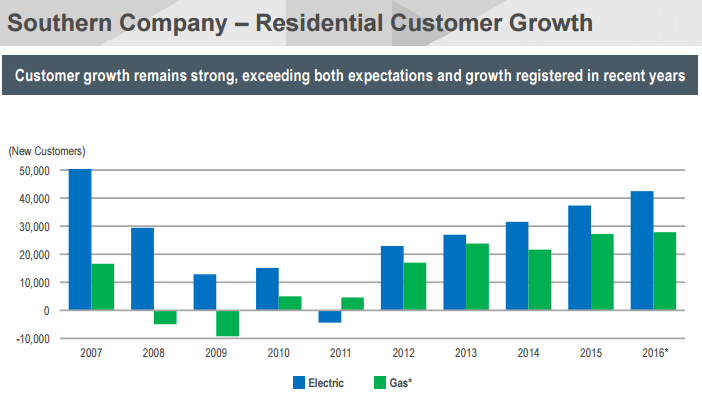

Thanks to its low power prices and sterling reputation in the southeast region, Southern’s regulatory environment is one of the friendliest among utility companies, translating into remarkably stable and consistent earnings. Moreover, with the southeastern part of the country having experienced relatively strong growth and business investment of late, Southern has certainly been in a sweet spot to capitalize.

Southern’s exposure to Georgia, where the company serves both gas and electric markets, should be particularly bullish for investors, given the region’s above-average population and employment growth in recent years.

Source: “Earnings Conference Call – Fourth Quarter and Full Year 2016,” Southern Co

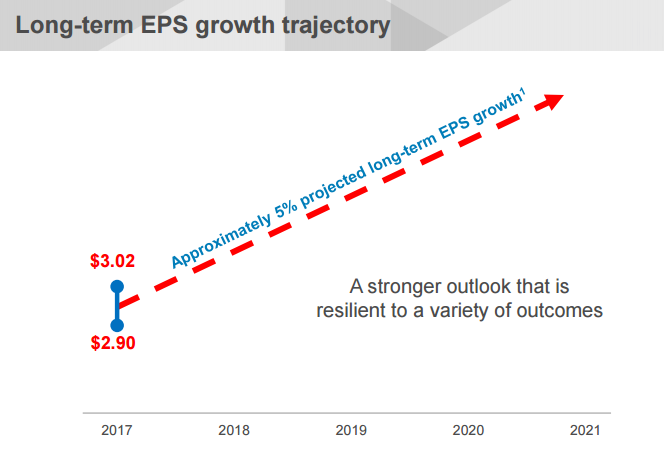

Due to a stable outlook for electric sales and solid customer growth prospects, Southern reiterated its earnings per share (EPS) guidance of $2.90–$3.02 for 2017, as well as an EPS growth rate of roughly five percent for the next five years.

“In 2016, by expanding our premier state-regulated utility portfolio, continuing to invest in energy infrastructure projects under long-term contract and financing our 2016 growth on very favorable terms,” said Chairman and CEO Thomas Fanning, “we were able to extend our EPS outlook to five years with an EPS growth rate of approximately 5%.” (Source: “The Southern (SO) Q4 2016 Results – Earnings Call Transcript,” Seeking Alpha, February 27, 2017.)

Source: “Earnings Conference Call – Fourth Quarter and Full Year 2016,” Southern Co

Kemper Tantrums

But just like all large companies, Southern has its fair share of problems. And as longtime shareholders know far too well, the company’s Kemper “clean coal” plant project in Mississippi has been one expensive setback.

For nearly seven years, Kemper has been marked by huge cost overruns and delays, with the project now likely to come in at around $7.0 billion (triple the company’s original cost estimate) and several years late. In Q4, Kemper-related delays cost the company $206.0 million, versus a loss of $183.0 million in the year prior. Year-to-date, Kemper delays have added up to a staggering $428.0 million in costs.

If those cost overruns weren’t frustrating enough for shareholders, a recent economic analysis by Southern suggests that Kemper may not even be cost-efficient. Specifically, the report concluded that Kemper is economically feasible only if gas prices are high, making the project all the more questionable in today’s market of depressed gas prices.

In other words, Kemper continues to be the sharpest thorn in Southern’s side, and needs to be very closely monitored by investors.

Southern Comforting Cash Flow

Still, I firmly believe that the risks associated with Kemper are largely manageable given Southern’s enviable regulatory environment in the southeast.

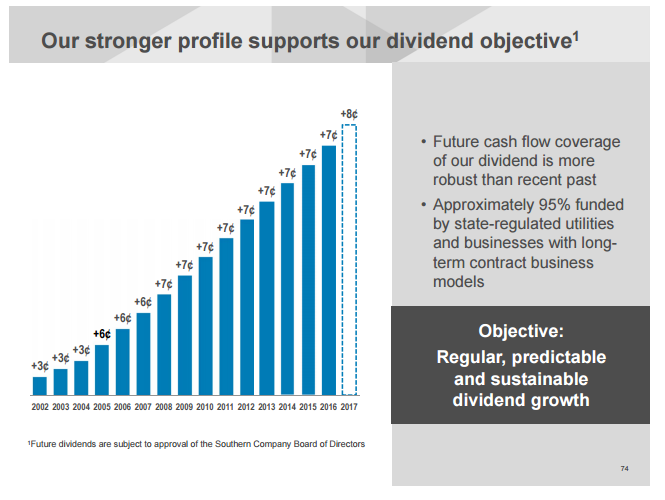

After all, even with the Kemper overruns, Southern’s monopoly-like position allowed it to generate whopping operating cash flow of $4.9 billion in 2016 vs. just $2.1 billion in dividends. In fact, the company has increased its annual dividend for 15 consecutive years at a rate of roughly four-percent, relatively in line with its earnings growth.

Source: “Analyst Day,” Southern Co

So although the Kemper project has been more boondoggle than boon up until this point, I wouldn’t expect it to have any permanent impact on Southern’s regulatory competitive advantages and, in turn, its long-term dividend trajectory. Cash flow is healthy, while the balance sheet remains strong.

With Southern’s earnings expected to grow at a healthy rate over the next several years and its payout ratio still at a relatively comforting 87%, I can only see the company’s dividend increasing over time.

“We continue to believe that focusing on the customer, operating premier state-regulated utilities and investing in energy infrastructure projects under long-term contracts will continue to support regular, predictable, sustainable, long-term earnings and dividend growth for our investors,” said Fanning. (Source: Ibid)

Powerful Yield

We can now turn our attention back on SO stock’s positive price momentum, which now seems largely justified, given the outlook for the company, as well as the economy.

Only time will tell, of course, when (or even if) President Trump’s spending plans will trigger inflationary pressures. But given the sluggish economic growth that we’re still seeing today and are likely to see over the next several months—the U.S. economy only grew 1.6% in 2016—bidding up for a top dividend stock like Southern makes a ton of sense.

But here’s the best part: even with the recent rally, Southern continues to boast a juicy dividend yield of 4.4%. That easily tops the S&P 500 (2.2%), as well as other large-cap utility plays like Duke Energy Corp (NYSE:DUK) (4.1%), NextEra Energy Inc (NYSE:NEE) (2.8%), and Dominion Resources, Inc. (NYSE:D) (3.9%).

While I’d like to see Southern’s price-to-earnings multiple of 20 fall back into the mid-teens, the dividend gap alone might be enough to hold the stock up at these slightly elevated levels.

The Bottom Line on Southern Company

Don’t let Southern’s rally over the past week scare you off the stock. While interest rates uncertainty and Kemper-related risks certainly need to be considered, Southern’s well-entrenched position in the growing southeast remains firm.

When you couple Southern’s predictable and safely growing dividend with an industry-topping yield, SO dividend stock looks like a particularly powerful income play.