This Top Dividend Stock Yields 10.3%

This Stock Now Pays 10.3%

Today’s chart highlights one of the best sectors of the economy to find safe, growing dividend yields: healthcare.

Longtime readers have heard our thesis on this industry before. As baby boomers get older, they’ll need more tests, more prescriptions, and more doctor visits.

For investors, that has resulted in a big opportunity. We’ve seen booming profits on everything from pharmaceuticals and biotechnology to medical equipment and healthcare supplies. And that has driven the share prices of related businesses higher, like Abbott Laboratories (NYSE:ABT), Johnson & Johnson (NYSE:JNJ), and Eli Lilly And Co (NYSE:LLY).

Another example is Senior Housing Properties Trust (NASDAQ:SNH). The partnership owns a sprawling real estate empire, totaling some 440 properties across 42 states. For investors looking for a safe, growing income stream, it’s an interesting business to investigate further.

It helps that owning senior housing properties can be quite profitable. To be clear, SNH doesn’t actually manage any facilities itself: instead, the firm only leases out real estate to operators in exchange for ongoing rent checks.

The model adheres to the 80/20 rule of doing business. SNH can make 80% of the profits while doing 20% of the work. It leaves the hard, low-margin work of dealing with residents to someone else.

Furthermore, operators, not Senior Housing Properties Trust, have to front most of the costs. Tenants have to pay for maintenance, insurance, and property taxes in most of these lease agreements. As a result, almost all of the company’s rental income goes straight to shareholders in the form of distributions.

And that income stream keeps growing.

The number of people who are 65 or older in America topped 49.2 million, according to the latest numbers from the United States Census Bureau. To put that number into perspective, it’s larger than the population of Spain, with a few million extra people thrown in for good measure. (Source: “The Nation’s Older Population Is Still Growing, Census Bureau Reports,” United States Census Bureau, June 22, 2017.)

The size of that business pie will likely keep growing. Each day, more than 10,000 baby boomers hit their 65th birthday. By 2060, analysts estimate that the country’s senior population will more than double in size. (Source: “Fact Sheet: Aging in the United States,” PRB, January 13, 2016.)

All of which means great news for senior property landlords. A graying of the U.S. population has pushed up demand for care facilities, lowering vacancy rates and driving up rents.

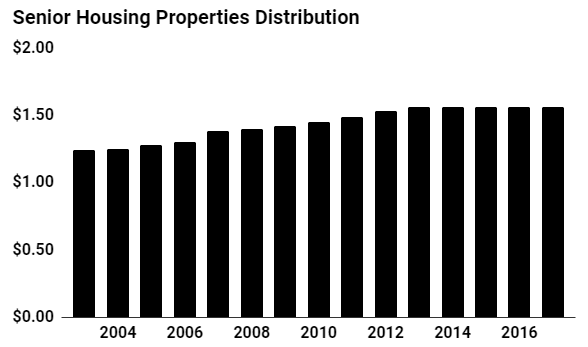

As you can see in the chart below, this demographic tailwind has paid off for stockholders. The development has allowed SNH to increase its distribution on a mid-single-digit clip over the past few years.

(Source: “Senior Housing Properties Trust (SNH),” Yahoo! Finance, last accessed April 17, 2018.)

Those small distribution hikes can add up over time. Today, SNH pays out a quarterly distribution of $0.39 per unit. That comes out to an annual yield of 10.3%.

Of course, you can’t call that payout risk-free. Investors still have to stomach a number of risks, including regulations, tenant defaults, and higher interest rates. But by maintaining a light debt load and a diverse renter base, management has done a good job of preparing the business for the inevitable ups and downs.

In other words, income hunters should give this high-yield healthcare stock a second look.