Sitio Royalties Stock: 6.6%-Yielding Energy Play Up 23% YOY

Why STR Stock Has High Potential

The price of oil has staged an incredible comeback in 2023. Rising interest rates and fears of a recession saw crude oil hit a low of $63.57 per barrel in April, but a lot has changed since then.

Record-high demand, production cuts from Organization of the Petroleum Exporting Countries Plus (OPEC+), and the chance of avoiding a recession have helped juice crude oil prices to more than $90.00 per barrel. Analysts are now predicting that West Texas Intermediate (WTI) crude oil will hit $100.00 per barrel in the fourth quarter. Analysts at JPMorgan Chase & Co (NYSE:JPM) see oil hitting $150.00 per barrel by 2026.

That’s music to the ears of oil and natural gas companies like Sitio Royalties Corp (NYSE:STR).

Sitio Royalties is a mineral and royalty company that acquires, owns, and manages oil and gas mineral and royalty interests that are operated by a diverse set of exploration and production companies. (Source: “Corporate Overview,” Sitio Royalties Corp, last accessed September 25, 2023.)

The company focuses on investing in mineral and royalty interests in the Permian Basin and other productive U.S. oil basins. The Permian Basin is the largest unconventional resource play in the U.S. The company buys mineral and royalty interests and then collects royalty revenue from exploration and production companies that drill wells and sell the oil and gas that comes from them.

Sitio Royalties Corp currently owns more than 275,000 net royalty acres, over 190,000 of which are in the Permian Basin. The company’s asset base is diversified across more than 22,000 wells and more than 240 operators.

Some of the operators it deals with are Exxon Mobil Corp (NYSE:XOM), Chevron Corporation (NYSE:CVX), ConocoPhillips (NYSE:COP), and Pioneer Natural Resources Co (NYSE:PXD).

Recent Mergers & Acquisitions

Since March 31, Sitio Royalties Corp has closed numerous accretive acquisitions, for an aggregate of $247.9 million. They were funded with approximately 27% equity and 73% cash. Those acquisitions added up to 13,705 net royalty acres, or seven percent of the company’s Permian Basin footprint.

Those were big acquisitions, but they pale in comparison to the company’s agreement to acquire all of the stock of Brigham Minerals, Inc. in 2022.

This merger formed the largest (by enterprise value) publicly traded mineral and royalty company in the U.S. The combined company has an aggregate enterprise value of about $4.8 billion (based on the closing share prices of both companies on September 2, 2022). (Source: “Sitio Royalties and Brigham Minerals to Combine in $4.8 Billion All-Stock, At-Market Merger,” Sitio Royalties Corp, September 6, 2022.)

According to Sitio Royalties, the transaction, which closed in the fourth quarter of 2022, “[brought] together two of the largest public companies in the oil and gas mineral and royalty sector with complementary high-quality assets in the Permian Basin and other oil-focused regions.” (Source: Ibid.)

The move added more than 85,000 net royalty acres, half of which are in the Permian Basin, to the company’s portfolio. (Source: “Sitio Royalties Reports Third Quarter 2022 Operational and Financial Results,” November 8, 2022.)

Before that merger, Brigham Minerals had also been busy on the acquisition front. In August 2022, it announced its $132.5-million acquisition of mineral and royalty interests in the Permian Basin from royalty funds managed by Avant Natural Resources, LLC and its affiliates. (Source: “Brigham Minerals, Inc. Announces Core Midland Basin Acquisition,” Business Wire, August 22, 2022.)

Record-High Quarterly Production Volume

For the second quarter ended June 30, Sitio Royalties reported an average daily production volume of 34,681 barrels of oil equivalent per day (Boe/d)—50% of which was oil—which was comparable to its daily production volume in the first quarter. The company also declared a record-high average quarterly production volume of 34,681 Boe/d. (Source: “Sitio Royalties Reports Second Quarter 2023 Operational and Financial Results,” Sitio Royalties Corp, August 8, 2023.)

The company reported a second-quarter net loss of $3.0 million. That loss was “primarily driven by a $25.6 million non-cash impairment charge related to Appalachian Basin proved properties and lower realized commodity prices commodity prices.” (Source: Ibid.)

Sitio Royalties Corp reported second-quarter adjusted earnings before income, taxes, depreciation and amortization (EBITDA) of $127.2 million and pro forma adjusted EBITDA of $129.4 million.

The company’s high cash flow of $94.8 million in the second quarter allowed its board to declare a quarterly cash dividend of $0.40 per share, for a yield of 6.6%.

Because the company’s cash flow fluctuates from quarter to quarter, so too does its payout. Sitio Royalties Corp’s goal is to pay dividends of at least 65% of its discretionary cash flow. This leaves the company with 35% of its discretionary cash flow to protect its balance sheet and make opportunistic cash acquisitions.

Sitio Royalties Stock Has 39% Upside Potential

High oil and gas prices have spurred Wall Street to take a bullish stance on STR stock.

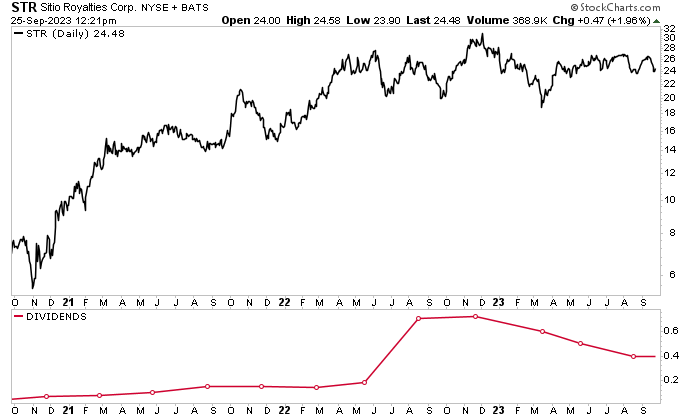

As of this writing, its share price is up by 19.7% over the last six months and 23% year-over-year—and its outlook remains bright.

Wall Street analysts have provided a 12-month share-price target for Sitio Royalties stock in the range of $31.00 to $34.00 per share. This points to potential gains in the range of approximately 26% to 39%.

Chart courtesy of StockCharts.com

The Lowdown on Sitio Royalties Corp

Sitio Royalties is an oil and natural gas mineral and royalty company with a growing position in the oil-rich Permian Basin.

In 2023, the company has closed on a number of accretive acquisitions. In late 2022, it closed on a big merger with Brigham Minerals. These deals will not only help energize Sitio Royalties Corp’s production volume, but—according to the company’s management—they should also result in substantial increases to STR stock’s already high-yield dividends.